What are the 4 Inventory Valuation Methods? Examples & Comparison

Oct 15, 2025

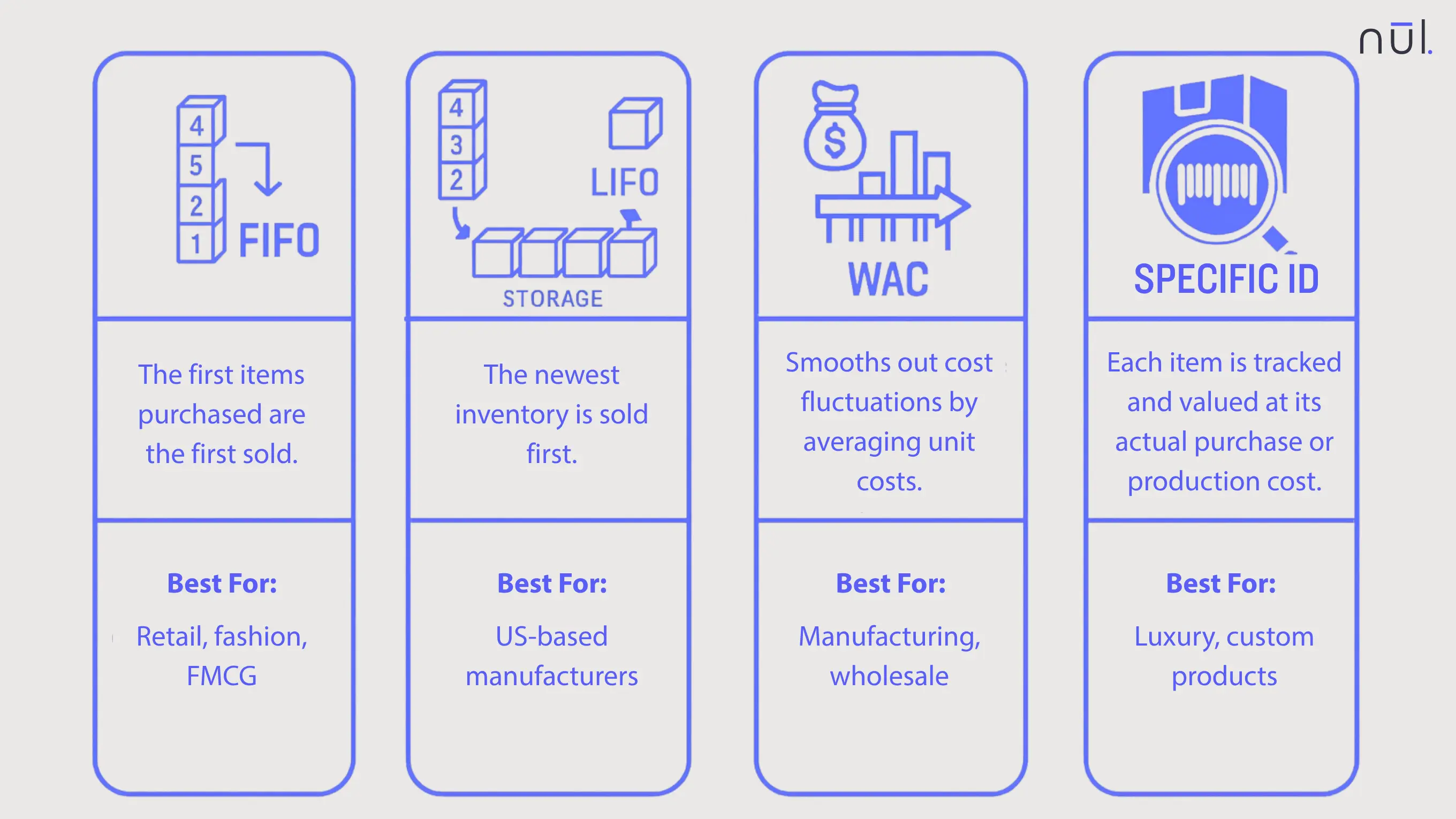

FIFO (First-In, First-Out), LIFO (Last-In, First-Out), Weighted Average Cost (WAC), and Specific Identification are the four inventory valuation methods.

Behind every “sold-out” or “slow-moving” product sits a deeper question: how much is your inventory actually worth? Inventory valuation isn’t just an accounting formality — it shapes your profit, taxes, and cash flow. The same pile of stock can appear more or less profitable depending on the method you use.

In this guide, we’ll break down what inventory valuation means, the four main methods, how they affect your financials, and how to choose the right one for your brand.

What Is Inventory Valuation?

Inventory valuation is how businesses assign a financial value to the products they hold — whether on shelves, in warehouses, or in production. This valuation directly affects your Cost of Goods Sold (COGS), which in turn determines gross profit and taxable income.

Good valuation practices balance these key accounting principles:

Consistency: Use the same method across periods for comparability.

Conservatism: Avoid overstating profits or assets, especially in uncertain markets.

Relevance and Reliability: The method should reflect your real cost trends and be verifiable.

Inventory valuation rules differ depending on the accounting standards your business follows:

IFRS (used globally) allows FIFO and Weighted Average Cost. The LIFO (Last-In, First-Out) approach is not permitted because it can distort profitability and asset values during inflation.

US GAAP (Used mainly in the United States) allows FIFO, LIFO, Weighted Average, and Specific Identification methods

Valuation is also subject to rules like Lower of Cost or Market (LCM) or Net Realizable Value (NRV) — ensuring inventory isn’t valued higher than what it can actually sell for.

What Is Inventory Valuation?

Why Inventory Valuation Matters?

Your choice of method impacts more than your balance sheet. It shapes the way your business operates day-to-day.

Profit & Tax: A higher COGS means lower profit — and lower taxable income. A lower COGS inflates profits (and potentially taxes). In inflation, FIFO may show strong profits but raise tax liabilities.

Cash Flow: Valuation affects working capital, stock replenishment planning, and how investors view liquidity. A method that overstates inventory can make liquidity appear stronger than it is.

Compliance & Comparability: Auditors, regulators, and potential investors look for consistency and transparency in valuation. Frequent or unexplained changes in valuation methods may trigger scrutiny or restatements.

Decision-Making: True visibility into margins and stock health helps your team decide when to replenish, discount, or discontinue a product. Accurate valuation also improves budgeting and demand planning.

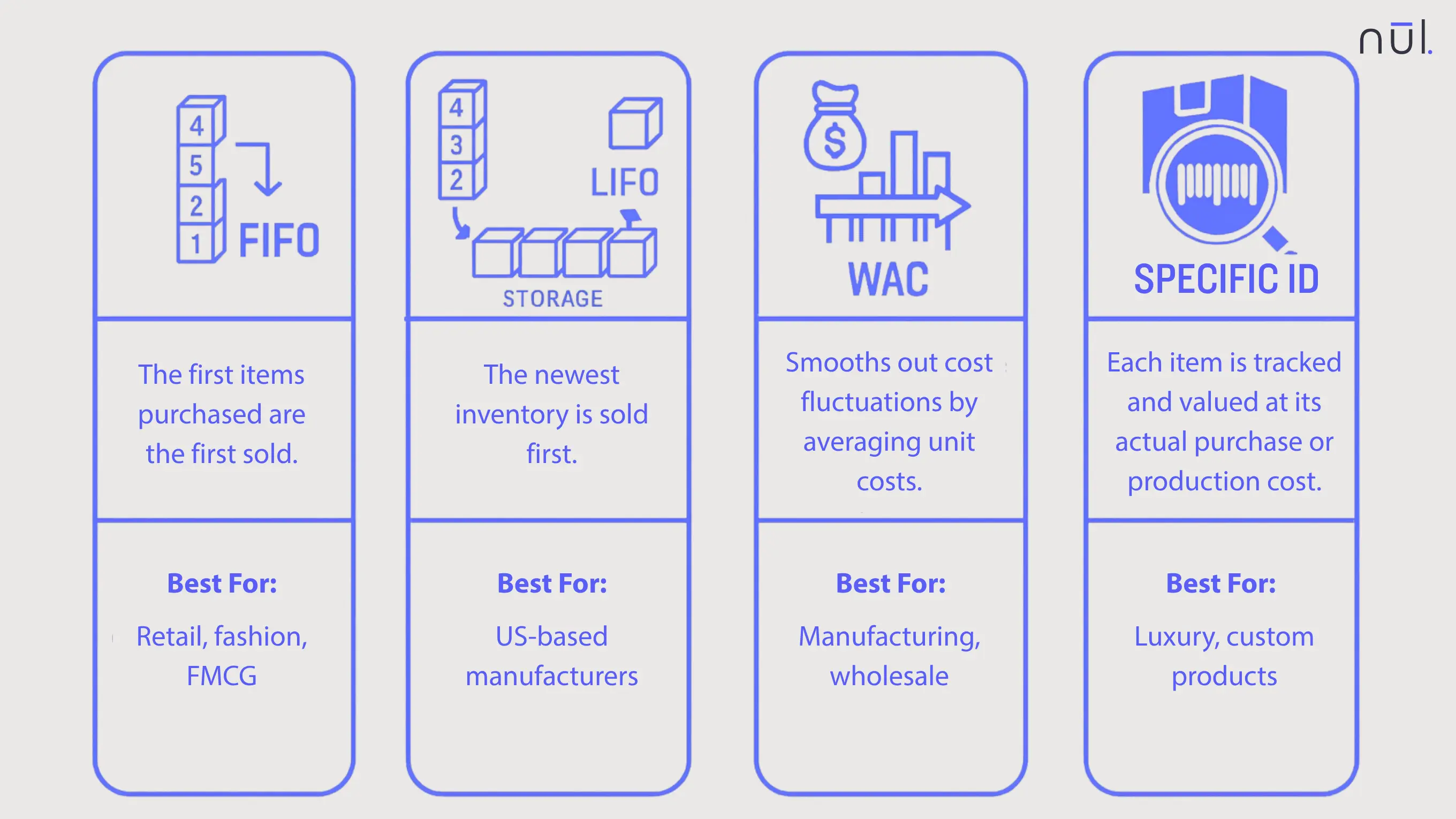

What are the Four Methods of Inventory Valuation?

FIFO (First-In, First-Out)

Concept: The first items purchased are the first sold. In other words, older inventory costs are used to calculate COGS, while newer purchases remain in ending inventory.

Formula: COGS = Cost of oldest inventory items

Example: If you bought 100 shirts at $20 and 100 more at $25, FIFO assumes the $20 shirts sell first. When prices rise, this means your COGS is based on older, cheaper costs, making profits look higher.

Impact:

In inflation: lower COGS → higher profit, higher taxes.

In deflation: opposite effect.

Best for: Retail, fashion, FMCG — industries where older stock sells first.

Pros: Matches physical flow of goods; simple; aligns with IFRS.

Cons: Overstates profit during inflation.

Pro Tip: FIFO works best when paired with an automated inventory system that tracks purchase dates and cost batches, minimizing manual errors.

LIFO (Last-In, First-Out)

Concept: The newest inventory is sold first. This means COGS reflects the latest prices, while older costs remain in inventory.

Formula: COGS = Cost of latest purchases

Example: Using the same case, LIFO assumes the $25 shirts sell first.

Impact:

In inflation: higher COGS → lower profit, lower tax.

Best for: Businesses facing inflationary cost environments (e.g., raw materials).

Pros: Tax savings in inflation.

Cons: Not allowed under IFRS; can distort balance sheet (older inventory may stay undervalued).

Pro Tip: LIFO can be strategically useful under US GAAP but should be managed carefully with strong audit documentation due to potential scrutiny.

3. Weighted Average Cost (WAC)

Concept: Smooths out cost fluctuations by averaging unit costs. It’s widely used when inventory items are indistinguishable or interchangeable (e.g., grains, liquids, bulk materials).

Formula: WAC = Total Cost of Goods Available / Total Units Available

Example: (100×$20 + 100×$25) / 200 = $22.50 per unit. Each sale and ending stock unit is valued at this averaged rate.

Impact: Balances volatility; provides a middle ground between FIFO and LIFO.

Best for: Manufacturers, brands with bulk materials or blended batches.

Pros: Stable margins, simple for ERP systems.

Cons: Less responsive to rapid cost changes.

Pro Tip: Combine WAC with AI-based forecasting tools to predict how average costs may evolve under changing supply conditions.

4. Specific Identification

Concept: Each item is individually tracked and valued at its actual purchase or production cost. It’s the most precise method but also the most labor-intensive.

Example: Luxury handbags or limited-edition sneakers — every SKU has a unique cost and tag. For instance, a jewelry retailer can trace the cost of a specific diamond ring sold to a customer.

Best for: High-value, low-volume products.

Pros: Exact matching of cost and revenue.

Cons: Impractical for large or fast-moving inventories.

Pro Tip: Specific Identification works best when inventory is digitally tagged (barcode or RFID) so real-time tracking automatically updates valuation and sales data.

Inventory Valuation Methods Comparison:

Method | COGS (Inflation) | Ending Inventory Value | Tax Burden | Profit Volatility | Best For |

FIFO | Lower | Higher | Higher | Moderate | Retail, fashion, FMCG |

LIFO | Higher | Lower | Lower | High | US-based manufacturers |

WAC | Medium | Medium | Medium | Low | Manufacturing, wholesale |

Specific ID | Actual | Actual | Actual | Low | Luxury, custom products |

Key Insight: The same inventory can tell four different stories. Using the same cost data, your financials could look vastly different depending on the chosen method — which is why CFOs and founders must choose wisely.

What are the Four Methods of Inventory Valuation?

How to Choose the Right Inventory Valuation Method?

Step 1: Understand your business model

Are you fast fashion (high SKU turnover) or bespoke (low volume, high value)? Consider:

Fast-moving consumer goods (FMCG) or fashion retailers often benefit from FIFO, since older items sell first and it aligns naturally with product lifecycles.

Manufacturers or wholesalers dealing with bulk materials may prefer Weighted Average Cost (WAC) to simplify cost tracking.

Luxury or custom-product sellers (like jewelry or furniture brands) should use Specific Identification to maintain precision and traceability.

Step 2: Consider your market environment.

Economic environments affect which method performs best.

In inflationary markets, LIFO (under US GAAP) can help reduce taxable income by matching recent, higher costs with current sales.

In deflationary or stable periods, FIFO provides a clearer and often fairer reflection of actual profitability.

WAC smooths out volatility and is ideal if your input costs fluctuate unpredictably.

Regularly reassess your environment.

Step 3: Align with regulations.

Check if your jurisdiction follows IFRS (no LIFO) or GAAP (LIFO allowed).

Always disclose your method in financial statements, and get professional approval if you plan to switch.

Changes between methods (e.g., from LIFO to FIFO) require retrospective restatement of financials to preserve comparability.

Step 4: Sync with your systems.

The valuation method you choose should integrate smoothly with your ERP, accounting software, or inventory platforms. Modern solutions like Nūl help track real-time cost data, forecast demand, and identify slow-moving items before they affect your valuation.

If your system supports perpetual inventory tracking, choose a method that updates automatically with each transaction. Automation minimizes errors and ensures your COGS and ending inventory values always reflect reality.

>> Read more: Perpetual vs Periodic Inventory System: Which to Choose?

Step 5: Keep your investors and auditors in mind.

Consistency builds trust and comparability. Your valuation method sends signals to your investors, lenders, and auditors.

If you want transparency and easier audits → FIFO or WAC

If you want short-term tax relief (under GAAP) → LIFO

If you sell one-of-a-kind items → Specific ID

Why Businesses Change Their Inventory Valuation Method?

Sometimes, the numbers stop telling the real story. Businesses switch methods when:

Costs or markets change: Economic shifts often drive companies to re-evaluate how they value inventory. Like Inflation or deflation alters cost structures. The goal is not to manipulate earnings, but to ensure that the method reflects current market realities.

Business models evolve: Moving from bespoke to scale production. For example, a fast-fashion brand shifting toward limited-edition, premium collections may adopt FIFO or Specific Identification for better traceability. Changing methods helps align accounting logic with real operations as product types, scale, and production flow shift.

Compliance shifts: Regulatory changes are one of the most common reasons for method changes to adapt to IFRS or GAAP transitions. Sometimes, national tax laws or new audit guidelines require companies to adopt standardized methods. In all cases, the switch must be justified, approved, and clearly disclosed in financial statements to maintain transparency.

Mergers or acquisitions: When two companies merge, they often bring different accounting practices. So switching is to align group accounting policies. This is especially important for multinational or multi-brand portfolios operating under shared ERP systems.

New ERP systems: Modern ERP and AI-powered inventory platforms have changed how businesses handle valuation. They require compatible valuation modules.

Strategic financial planning: To manage profit presentation or cash flow. In tougher economic times, for instance, switching to a cost-heavy method like LIFO (under GAAP) can reduce tax liability and preserve cash flow.

Audit corrections: When older policies no longer reflect operations. If inventory tracking systems improve or audit reviews reveal inconsistencies, a switch can restore accuracy.

Best Practices in Inventory Valuation

Stay consistent, but review annually: Changes must be justified and disclosed.

Integrate tech: Modern ERPs and AI systems (like Nūl) automate valuation and COGS tracking in real time.

Use analytics: AI-driven insights can forecast how valuation shifts will impact your margins, helping you plan tax and working capital more intelligently.

Document everything: Maintain clear audit trails and disclosures.

Think beyond profit: Choose valuation methods that reflect sustainability and inventory transparency — not just numbers.

Conclusion

Inventory valuation is more than accounting. It’s storytelling — the story of how efficiently your brand turns stock into value.

The right method helps you:

Reflect true profitability

Build trust with investors

Plan better for tax and cash flow

Make smarter, sustainable inventory decisions

In fashion, where every piece counts, knowing how you value what you hold can redefine how you grow.

Article by

Nūl Content Team

An Experienced Research & Knowledge Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile

More From Blog

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

More From Blog

What are the 4 Inventory Valuation Methods? Examples & Comparison

Oct 15, 2025

FIFO (First-In, First-Out), LIFO (Last-In, First-Out), Weighted Average Cost (WAC), and Specific Identification are the four inventory valuation methods.

Behind every “sold-out” or “slow-moving” product sits a deeper question: how much is your inventory actually worth? Inventory valuation isn’t just an accounting formality — it shapes your profit, taxes, and cash flow. The same pile of stock can appear more or less profitable depending on the method you use.

In this guide, we’ll break down what inventory valuation means, the four main methods, how they affect your financials, and how to choose the right one for your brand.

What Is Inventory Valuation?

Inventory valuation is how businesses assign a financial value to the products they hold — whether on shelves, in warehouses, or in production. This valuation directly affects your Cost of Goods Sold (COGS), which in turn determines gross profit and taxable income.

Good valuation practices balance these key accounting principles:

Consistency: Use the same method across periods for comparability.

Conservatism: Avoid overstating profits or assets, especially in uncertain markets.

Relevance and Reliability: The method should reflect your real cost trends and be verifiable.

Inventory valuation rules differ depending on the accounting standards your business follows:

IFRS (used globally) allows FIFO and Weighted Average Cost. The LIFO (Last-In, First-Out) approach is not permitted because it can distort profitability and asset values during inflation.

US GAAP (Used mainly in the United States) allows FIFO, LIFO, Weighted Average, and Specific Identification methods

Valuation is also subject to rules like Lower of Cost or Market (LCM) or Net Realizable Value (NRV) — ensuring inventory isn’t valued higher than what it can actually sell for.

What Is Inventory Valuation?

Why Inventory Valuation Matters?

Your choice of method impacts more than your balance sheet. It shapes the way your business operates day-to-day.

Profit & Tax: A higher COGS means lower profit — and lower taxable income. A lower COGS inflates profits (and potentially taxes). In inflation, FIFO may show strong profits but raise tax liabilities.

Cash Flow: Valuation affects working capital, stock replenishment planning, and how investors view liquidity. A method that overstates inventory can make liquidity appear stronger than it is.

Compliance & Comparability: Auditors, regulators, and potential investors look for consistency and transparency in valuation. Frequent or unexplained changes in valuation methods may trigger scrutiny or restatements.

Decision-Making: True visibility into margins and stock health helps your team decide when to replenish, discount, or discontinue a product. Accurate valuation also improves budgeting and demand planning.

What are the Four Methods of Inventory Valuation?

FIFO (First-In, First-Out)

Concept: The first items purchased are the first sold. In other words, older inventory costs are used to calculate COGS, while newer purchases remain in ending inventory.

Formula: COGS = Cost of oldest inventory items

Example: If you bought 100 shirts at $20 and 100 more at $25, FIFO assumes the $20 shirts sell first. When prices rise, this means your COGS is based on older, cheaper costs, making profits look higher.

Impact:

In inflation: lower COGS → higher profit, higher taxes.

In deflation: opposite effect.

Best for: Retail, fashion, FMCG — industries where older stock sells first.

Pros: Matches physical flow of goods; simple; aligns with IFRS.

Cons: Overstates profit during inflation.

Pro Tip: FIFO works best when paired with an automated inventory system that tracks purchase dates and cost batches, minimizing manual errors.

LIFO (Last-In, First-Out)

Concept: The newest inventory is sold first. This means COGS reflects the latest prices, while older costs remain in inventory.

Formula: COGS = Cost of latest purchases

Example: Using the same case, LIFO assumes the $25 shirts sell first.

Impact:

In inflation: higher COGS → lower profit, lower tax.

Best for: Businesses facing inflationary cost environments (e.g., raw materials).

Pros: Tax savings in inflation.

Cons: Not allowed under IFRS; can distort balance sheet (older inventory may stay undervalued).

Pro Tip: LIFO can be strategically useful under US GAAP but should be managed carefully with strong audit documentation due to potential scrutiny.

3. Weighted Average Cost (WAC)

Concept: Smooths out cost fluctuations by averaging unit costs. It’s widely used when inventory items are indistinguishable or interchangeable (e.g., grains, liquids, bulk materials).

Formula: WAC = Total Cost of Goods Available / Total Units Available

Example: (100×$20 + 100×$25) / 200 = $22.50 per unit. Each sale and ending stock unit is valued at this averaged rate.

Impact: Balances volatility; provides a middle ground between FIFO and LIFO.

Best for: Manufacturers, brands with bulk materials or blended batches.

Pros: Stable margins, simple for ERP systems.

Cons: Less responsive to rapid cost changes.

Pro Tip: Combine WAC with AI-based forecasting tools to predict how average costs may evolve under changing supply conditions.

4. Specific Identification

Concept: Each item is individually tracked and valued at its actual purchase or production cost. It’s the most precise method but also the most labor-intensive.

Example: Luxury handbags or limited-edition sneakers — every SKU has a unique cost and tag. For instance, a jewelry retailer can trace the cost of a specific diamond ring sold to a customer.

Best for: High-value, low-volume products.

Pros: Exact matching of cost and revenue.

Cons: Impractical for large or fast-moving inventories.

Pro Tip: Specific Identification works best when inventory is digitally tagged (barcode or RFID) so real-time tracking automatically updates valuation and sales data.

Inventory Valuation Methods Comparison:

Method | COGS (Inflation) | Ending Inventory Value | Tax Burden | Profit Volatility | Best For |

FIFO | Lower | Higher | Higher | Moderate | Retail, fashion, FMCG |

LIFO | Higher | Lower | Lower | High | US-based manufacturers |

WAC | Medium | Medium | Medium | Low | Manufacturing, wholesale |

Specific ID | Actual | Actual | Actual | Low | Luxury, custom products |

Key Insight: The same inventory can tell four different stories. Using the same cost data, your financials could look vastly different depending on the chosen method — which is why CFOs and founders must choose wisely.

What are the Four Methods of Inventory Valuation?

How to Choose the Right Inventory Valuation Method?

Step 1: Understand your business model

Are you fast fashion (high SKU turnover) or bespoke (low volume, high value)? Consider:

Fast-moving consumer goods (FMCG) or fashion retailers often benefit from FIFO, since older items sell first and it aligns naturally with product lifecycles.

Manufacturers or wholesalers dealing with bulk materials may prefer Weighted Average Cost (WAC) to simplify cost tracking.

Luxury or custom-product sellers (like jewelry or furniture brands) should use Specific Identification to maintain precision and traceability.

Step 2: Consider your market environment.

Economic environments affect which method performs best.

In inflationary markets, LIFO (under US GAAP) can help reduce taxable income by matching recent, higher costs with current sales.

In deflationary or stable periods, FIFO provides a clearer and often fairer reflection of actual profitability.

WAC smooths out volatility and is ideal if your input costs fluctuate unpredictably.

Regularly reassess your environment.

Step 3: Align with regulations.

Check if your jurisdiction follows IFRS (no LIFO) or GAAP (LIFO allowed).

Always disclose your method in financial statements, and get professional approval if you plan to switch.

Changes between methods (e.g., from LIFO to FIFO) require retrospective restatement of financials to preserve comparability.

Step 4: Sync with your systems.

The valuation method you choose should integrate smoothly with your ERP, accounting software, or inventory platforms. Modern solutions like Nūl help track real-time cost data, forecast demand, and identify slow-moving items before they affect your valuation.

If your system supports perpetual inventory tracking, choose a method that updates automatically with each transaction. Automation minimizes errors and ensures your COGS and ending inventory values always reflect reality.

>> Read more: Perpetual vs Periodic Inventory System: Which to Choose?

Step 5: Keep your investors and auditors in mind.

Consistency builds trust and comparability. Your valuation method sends signals to your investors, lenders, and auditors.

If you want transparency and easier audits → FIFO or WAC

If you want short-term tax relief (under GAAP) → LIFO

If you sell one-of-a-kind items → Specific ID

Why Businesses Change Their Inventory Valuation Method?

Sometimes, the numbers stop telling the real story. Businesses switch methods when:

Costs or markets change: Economic shifts often drive companies to re-evaluate how they value inventory. Like Inflation or deflation alters cost structures. The goal is not to manipulate earnings, but to ensure that the method reflects current market realities.

Business models evolve: Moving from bespoke to scale production. For example, a fast-fashion brand shifting toward limited-edition, premium collections may adopt FIFO or Specific Identification for better traceability. Changing methods helps align accounting logic with real operations as product types, scale, and production flow shift.

Compliance shifts: Regulatory changes are one of the most common reasons for method changes to adapt to IFRS or GAAP transitions. Sometimes, national tax laws or new audit guidelines require companies to adopt standardized methods. In all cases, the switch must be justified, approved, and clearly disclosed in financial statements to maintain transparency.

Mergers or acquisitions: When two companies merge, they often bring different accounting practices. So switching is to align group accounting policies. This is especially important for multinational or multi-brand portfolios operating under shared ERP systems.

New ERP systems: Modern ERP and AI-powered inventory platforms have changed how businesses handle valuation. They require compatible valuation modules.

Strategic financial planning: To manage profit presentation or cash flow. In tougher economic times, for instance, switching to a cost-heavy method like LIFO (under GAAP) can reduce tax liability and preserve cash flow.

Audit corrections: When older policies no longer reflect operations. If inventory tracking systems improve or audit reviews reveal inconsistencies, a switch can restore accuracy.

Best Practices in Inventory Valuation

Stay consistent, but review annually: Changes must be justified and disclosed.

Integrate tech: Modern ERPs and AI systems (like Nūl) automate valuation and COGS tracking in real time.

Use analytics: AI-driven insights can forecast how valuation shifts will impact your margins, helping you plan tax and working capital more intelligently.

Document everything: Maintain clear audit trails and disclosures.

Think beyond profit: Choose valuation methods that reflect sustainability and inventory transparency — not just numbers.

Conclusion

Inventory valuation is more than accounting. It’s storytelling — the story of how efficiently your brand turns stock into value.

The right method helps you:

Reflect true profitability

Build trust with investors

Plan better for tax and cash flow

Make smarter, sustainable inventory decisions

In fashion, where every piece counts, knowing how you value what you hold can redefine how you grow.

Article by

Nūl Content Team

An Experienced Research & Knowledge Team

An Experienced Research & Knowledge Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile