Excess Inventory: Causes, Impacts, Measure, and Solutions

Oct 29, 2025

Excess inventory is stock a business holds beyond forecasted demand, tying up cash and storage space when products don’t sell as expected or move too slowly.

Too much inventory on hand is one of the most hidden profit killers in the retail and supply chain world. Having too much inventory holds up money, makes warehouses messy, and lowers profits.

Fashion and consumer brands feel this acutely — where trends shift fast, and overstock can turn into dead stock almost overnight. Post-pandemic supply disruptions, rising material costs, and slower consumer spending have made excess inventory a boardroom concern.

In this article, we’ll walk through what excess inventory means, its root causes, how to measure it, and how brands can prevent. Or you can even capitalize on it through smarter, data-driven inventory management.

What is Excess Inventory?

Excess inventory refers to stock that a business holds beyond the level needed to meet forecasted demand. In other words, it’s the inventory that isn’t selling fast enough and occupies valuable cash and space.

Depending on how long the items remain unsold, excess inventory may also be called:

Overstock – products ordered or produced in excess of demand.

Slow-moving stock – items that sell, but too slowly to justify holding costs.

Dead stock – unsellable products due to damage, expiration, or obsolescence.

Obsolete inventory – outdated items no longer relevant to the market or current product line.

For example, a brand might manufacture 1,000 pieces of a dress, but sell only 600 — leaving 400 units as sunk cost and storage burden.

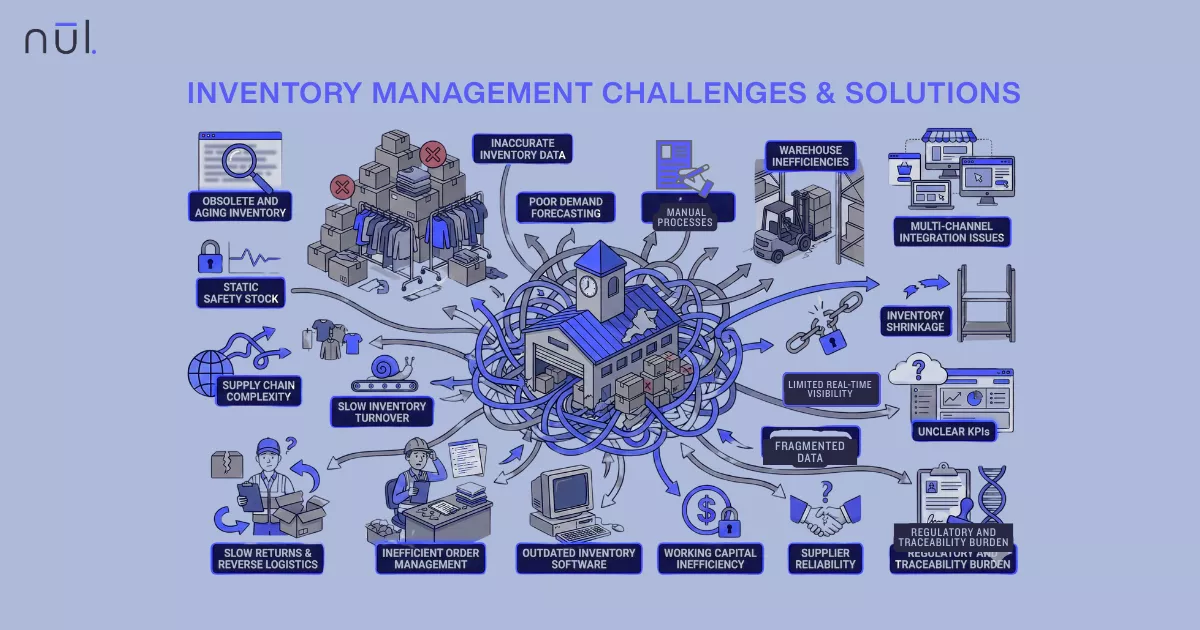

Root Causes of Excess Inventory

Inaccurate Demand Forecasting: Overestimating customer demand can lead to surplus inventory that may never sell, especially in sectors that are subject to trends, like fashion or electronics. Demand plans can be wrong if using old forecasting models, not having enough historical data, or ignoring things like weather and social media trends.

Long or Unreliable Lead Times: Delays in production or shipping can cause inventory to arrive late, often after the optimal selling period. To avoid stockouts, many businesses place early or oversized orders, but when delays occur, customer demand has shifted. This turns what was meant to be safety stock into surplus inventory that’s difficult to move.

Large Order Quantities & Supplier Minimums: Suppliers often impose minimum order quantities (MOQs) or offer bulk discounts that push brands to buy more than needed. While this reduces unit costs upfront, it often creates excess stock when demand falls short.

Product Life Cycle Mismanagement: Every item has its time to shine, and after that, it loses value quickly. If production time runs beyond peak demand or markdown timing is missed, profitable items can tủn into dead stock within weeks.

Poor Internal Communication Between Teams: Sales teams may adjust targets, marketing may cancel campaigns, or procurement may reorder based on outdated information. Misalignment between sales, merchandising, and procurement leads to over-ordering and duplicated stock.

Lack of Real-Time Inventory Visibility: Businesses that manage multiple sales channels or warehouses often struggle to see where stock is actually sitting. Without a unified view across warehouses, e-commerce, and retail, stock can accumulate unnoticed in certain locations.

Sudden Market or Economic Shifts: Recessions, weather changes, or viral trends can drastically change purchasing behavior overnight. Businesses that can’t adapt quickly to these shifts often end up with large volumes of unsellable goods.

Product Quality and Design Issues: Poorly received designs or inconsistent quality can result in unsellable inventory. Once consumer trust is lost, these items often linger in warehouses until they’re discounted or written off completely

Root Causes of Excess Inventory

What Happens to Excess Inventory?

The consequences of holding too much inventory go far beyond a cluttered warehouse.

Higher Carrying Costs: Storage, insurance, and depreciation eat into margins (often 20–30% of inventory value annually).

Cash Flow Strain: Capital tied up in unsold stock can’t be reinvested in marketing or new product lines.

Product Obsolescence: Styles or SKUs lose relevance, leading to write-offs.

Operational Clutter: Overstock crowds warehouse space, making picking and fulfillment inefficient.

Price Markdowns: To clear stock, brands resort to discounts that erode profit margins.

Waste and Disposal Issues: Unsold items often end up discarded, creating environmental and reputational costs.

For fashion brands, excess inventory isn’t just a financial problem — it’s a sustainability one. Every unsold garment represents wasted materials, energy, and emissions.

What Happens to Excess Inventory?

How to Measure Your Excess Inventory?

The first step in controlling excess inventory is achieving clear visibility into what you have, how fast it moves, and where it sits. Tracking the right metrics helps you spot problems early

Define “Excess” for Your Business

Every company’s definition of excess depends on its sales cycle. Most brands consider inventory excessive when stock levels exceed one to three months of forecasted demand. Setting this threshold helps you separate healthy safety stock from capital-draining surplus.

Use ABC/XYZ Analysis

ABC ranks products by revenue impact:

A-items: high-value, high-impact products

B-items: moderate value or sales frequency

C-items: low-value or slow movers

XYZ categorizes by demand predictability. This helps identify which SKUs require closer monitoring.

X: stable and predictable demand

Y: fluctuating demand

Z: irregular or unpredictable demand

Combining these views helps pinpoint which SKUs need tighter control — for example, AZ items (valuable but erratic sellers) that can easily turn into excess.

Calculate Carrying Costs

Inventory isn’t free to hold. Storage fees, insurance, depreciation, and the risk of obsolescence often add up to 20–30% of total inventory value per year. Knowing this figure lets you quantify how much excess stock is truly costing your business.

Monitor Key Dashboard Indicators

Use data dashboards or ERP reports to track early warning signs of excess, such as:

% of SKUs with zero movement in the last 60 or 90 days

% of inventory value older than a defined age threshold (e.g., 6 months)

Days Inventory Outstanding (DIO) trend month over month

Tracking these metrics in real time can flag excess before it becomes unmanageable.

What to Do When You Identify Excess Inventory?

Once you’ve spotted surplus stock, act fast and strategically.

Quick Actions

Identify and isolate slow-moving or overstocked items.

Pause any new purchase orders or production for those SKUs.

Update forecasts and purchase plans accordingly.

Disposal or Clearance Options

When reduction becomes necessary, choose the most practical way to sell excess inventory and recover value.

Method | Description | Pros | Cons |

Bundling | Combine slow-moving with fast-selling items. | Clears inventory faster | May reduce profit margin |

Repackaging | Rebrand or refresh packaging to renew appeal. | Adds perceived value | Adds rework cost |

Discounting | Offer limited-time sales or outlet pricing. | Quick turnover | Brand dilution risk |

Donation / Liquidation | Donate or sell through resellers. | Ethical disposal | Little to no financial recovery |

Treat It as an Opportunity

Creative use like for marketing or community engagement can rebuild value. For example, archive or sample sales, giveaways for brand awareness, or sustainability campaigns that showcase commitment to waste reduction. Turning excess into engagement can improve both reputation and retention.

Checklist Before Taking Action

Approval from finance and inventory teams

Cost vs. salvage value assessment

Timing around peak sales periods

Proper documentation and SKU tagging

How to Reduce Excess Inventory?

Re-Evaluate Demand Forecasts: Combine historical data with real-time sales and market signals for more accurate predictions. Regularly updating forecasts with AI helps prevent over-ordering and keeps production in sync with actual customer demand.

Improve Inventory Visibility: Adopt centralized dashboards for warehouse, store, and e-commerce data — ensuring no hidden overstock. You can consider using AI-driven inventory management systems which can simplify your workflows.

Review Purchasing & Production Policies: Negotiate smaller batch sizes or flexible MOQs (minimum order quantities) with suppliers. This reduces the risk of overproduction and lets you react quickly to changing sales trends instead of being locked into large, inflexible orders.

>> Read more: Batch Production: Examples, Advantages, Disadvantages, & More

Reposition or Repackage Stock: Sometimes, products aren’t selling because they’ve lost appeal, not really because there’s no demand. Refresh presentation or target new customer segments to revive stagnant SKUs.

Strengthen Collaboration Between Departments: Create integrated planning calendars linking design, merchandising, and procurement. When everyone plans from the same data, ordering becomes more accurate.

Implement Automated Replenishment Rules: Use software to set reorder thresholds, ensuring you don’t restock items that are already over-held. Currently, there are so many inventory replenishment software solutions out there, which can help you a lot.

Liquidate, Donate, or Recycle Unsellable Stock: Build sustainable exit strategies to clear obsolete goods responsibly, minimizing environmental impacts. This protects both margins and brand reputation.

How Nūl Helps Reduce Excess and Obsolete Inventory?

At Nūl, we help fashion and retail brands identify, forecast, and prevent excess inventory using AI-driven demand and allocation systems.

Our platform:

Detects early signals of excess through sales velocity and inventory aging analysis.

Optimizes allocation to balance stock between stores, warehouses, and channels.

Recommends markdown, replenishment, or recycling actions automatically.

Quantifies both profit and emission losses, so teams can make data-backed decisions that are financially and environmentally sound.

Through continuous learning, Nūl helps brands transform excess into efficiency — cutting waste while improving working capital and sustainability outcomes.

Conclusion

Excess inventory is not just an accounting issue, it’s a reflection of how well a brand anticipates and adapts to change. From forecasting errors to rigid supply chains, the causes are many, but so are the solutions.

By combining better visibility, cross-team coordination, and AI-powered optimization, brands can minimize excess, free up capital, and reduce waste. turning what once was a cost center into a competitive advantage.

Article by

Nūl Content Team

Nūl Content Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile

More From Blog

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

More From Blog

Excess Inventory: Causes, Impacts, Measure, and Solutions

Oct 29, 2025

Excess inventory is stock a business holds beyond forecasted demand, tying up cash and storage space when products don’t sell as expected or move too slowly.

Too much inventory on hand is one of the most hidden profit killers in the retail and supply chain world. Having too much inventory holds up money, makes warehouses messy, and lowers profits.

Fashion and consumer brands feel this acutely — where trends shift fast, and overstock can turn into dead stock almost overnight. Post-pandemic supply disruptions, rising material costs, and slower consumer spending have made excess inventory a boardroom concern.

In this article, we’ll walk through what excess inventory means, its root causes, how to measure it, and how brands can prevent. Or you can even capitalize on it through smarter, data-driven inventory management.

What is Excess Inventory?

Excess inventory refers to stock that a business holds beyond the level needed to meet forecasted demand. In other words, it’s the inventory that isn’t selling fast enough and occupies valuable cash and space.

Depending on how long the items remain unsold, excess inventory may also be called:

Overstock – products ordered or produced in excess of demand.

Slow-moving stock – items that sell, but too slowly to justify holding costs.

Dead stock – unsellable products due to damage, expiration, or obsolescence.

Obsolete inventory – outdated items no longer relevant to the market or current product line.

For example, a brand might manufacture 1,000 pieces of a dress, but sell only 600 — leaving 400 units as sunk cost and storage burden.

Root Causes of Excess Inventory

Inaccurate Demand Forecasting: Overestimating customer demand can lead to surplus inventory that may never sell, especially in sectors that are subject to trends, like fashion or electronics. Demand plans can be wrong if using old forecasting models, not having enough historical data, or ignoring things like weather and social media trends.

Long or Unreliable Lead Times: Delays in production or shipping can cause inventory to arrive late, often after the optimal selling period. To avoid stockouts, many businesses place early or oversized orders, but when delays occur, customer demand has shifted. This turns what was meant to be safety stock into surplus inventory that’s difficult to move.

Large Order Quantities & Supplier Minimums: Suppliers often impose minimum order quantities (MOQs) or offer bulk discounts that push brands to buy more than needed. While this reduces unit costs upfront, it often creates excess stock when demand falls short.

Product Life Cycle Mismanagement: Every item has its time to shine, and after that, it loses value quickly. If production time runs beyond peak demand or markdown timing is missed, profitable items can tủn into dead stock within weeks.

Poor Internal Communication Between Teams: Sales teams may adjust targets, marketing may cancel campaigns, or procurement may reorder based on outdated information. Misalignment between sales, merchandising, and procurement leads to over-ordering and duplicated stock.

Lack of Real-Time Inventory Visibility: Businesses that manage multiple sales channels or warehouses often struggle to see where stock is actually sitting. Without a unified view across warehouses, e-commerce, and retail, stock can accumulate unnoticed in certain locations.

Sudden Market or Economic Shifts: Recessions, weather changes, or viral trends can drastically change purchasing behavior overnight. Businesses that can’t adapt quickly to these shifts often end up with large volumes of unsellable goods.

Product Quality and Design Issues: Poorly received designs or inconsistent quality can result in unsellable inventory. Once consumer trust is lost, these items often linger in warehouses until they’re discounted or written off completely

Root Causes of Excess Inventory

What Happens to Excess Inventory?

The consequences of holding too much inventory go far beyond a cluttered warehouse.

Higher Carrying Costs: Storage, insurance, and depreciation eat into margins (often 20–30% of inventory value annually).

Cash Flow Strain: Capital tied up in unsold stock can’t be reinvested in marketing or new product lines.

Product Obsolescence: Styles or SKUs lose relevance, leading to write-offs.

Operational Clutter: Overstock crowds warehouse space, making picking and fulfillment inefficient.

Price Markdowns: To clear stock, brands resort to discounts that erode profit margins.

Waste and Disposal Issues: Unsold items often end up discarded, creating environmental and reputational costs.

For fashion brands, excess inventory isn’t just a financial problem — it’s a sustainability one. Every unsold garment represents wasted materials, energy, and emissions.

What Happens to Excess Inventory?

How to Measure Your Excess Inventory?

The first step in controlling excess inventory is achieving clear visibility into what you have, how fast it moves, and where it sits. Tracking the right metrics helps you spot problems early

Define “Excess” for Your Business

Every company’s definition of excess depends on its sales cycle. Most brands consider inventory excessive when stock levels exceed one to three months of forecasted demand. Setting this threshold helps you separate healthy safety stock from capital-draining surplus.

Use ABC/XYZ Analysis

ABC ranks products by revenue impact:

A-items: high-value, high-impact products

B-items: moderate value or sales frequency

C-items: low-value or slow movers

XYZ categorizes by demand predictability. This helps identify which SKUs require closer monitoring.

X: stable and predictable demand

Y: fluctuating demand

Z: irregular or unpredictable demand

Combining these views helps pinpoint which SKUs need tighter control — for example, AZ items (valuable but erratic sellers) that can easily turn into excess.

Calculate Carrying Costs

Inventory isn’t free to hold. Storage fees, insurance, depreciation, and the risk of obsolescence often add up to 20–30% of total inventory value per year. Knowing this figure lets you quantify how much excess stock is truly costing your business.

Monitor Key Dashboard Indicators

Use data dashboards or ERP reports to track early warning signs of excess, such as:

% of SKUs with zero movement in the last 60 or 90 days

% of inventory value older than a defined age threshold (e.g., 6 months)

Days Inventory Outstanding (DIO) trend month over month

Tracking these metrics in real time can flag excess before it becomes unmanageable.

What to Do When You Identify Excess Inventory?

Once you’ve spotted surplus stock, act fast and strategically.

Quick Actions

Identify and isolate slow-moving or overstocked items.

Pause any new purchase orders or production for those SKUs.

Update forecasts and purchase plans accordingly.

Disposal or Clearance Options

When reduction becomes necessary, choose the most practical way to sell excess inventory and recover value.

Method | Description | Pros | Cons |

Bundling | Combine slow-moving with fast-selling items. | Clears inventory faster | May reduce profit margin |

Repackaging | Rebrand or refresh packaging to renew appeal. | Adds perceived value | Adds rework cost |

Discounting | Offer limited-time sales or outlet pricing. | Quick turnover | Brand dilution risk |

Donation / Liquidation | Donate or sell through resellers. | Ethical disposal | Little to no financial recovery |

Treat It as an Opportunity

Creative use like for marketing or community engagement can rebuild value. For example, archive or sample sales, giveaways for brand awareness, or sustainability campaigns that showcase commitment to waste reduction. Turning excess into engagement can improve both reputation and retention.

Checklist Before Taking Action

Approval from finance and inventory teams

Cost vs. salvage value assessment

Timing around peak sales periods

Proper documentation and SKU tagging

How to Reduce Excess Inventory?

Re-Evaluate Demand Forecasts: Combine historical data with real-time sales and market signals for more accurate predictions. Regularly updating forecasts with AI helps prevent over-ordering and keeps production in sync with actual customer demand.

Improve Inventory Visibility: Adopt centralized dashboards for warehouse, store, and e-commerce data — ensuring no hidden overstock. You can consider using AI-driven inventory management systems which can simplify your workflows.

Review Purchasing & Production Policies: Negotiate smaller batch sizes or flexible MOQs (minimum order quantities) with suppliers. This reduces the risk of overproduction and lets you react quickly to changing sales trends instead of being locked into large, inflexible orders.

>> Read more: Batch Production: Examples, Advantages, Disadvantages, & More

Reposition or Repackage Stock: Sometimes, products aren’t selling because they’ve lost appeal, not really because there’s no demand. Refresh presentation or target new customer segments to revive stagnant SKUs.

Strengthen Collaboration Between Departments: Create integrated planning calendars linking design, merchandising, and procurement. When everyone plans from the same data, ordering becomes more accurate.

Implement Automated Replenishment Rules: Use software to set reorder thresholds, ensuring you don’t restock items that are already over-held. Currently, there are so many inventory replenishment software solutions out there, which can help you a lot.

Liquidate, Donate, or Recycle Unsellable Stock: Build sustainable exit strategies to clear obsolete goods responsibly, minimizing environmental impacts. This protects both margins and brand reputation.

How Nūl Helps Reduce Excess and Obsolete Inventory?

At Nūl, we help fashion and retail brands identify, forecast, and prevent excess inventory using AI-driven demand and allocation systems.

Our platform:

Detects early signals of excess through sales velocity and inventory aging analysis.

Optimizes allocation to balance stock between stores, warehouses, and channels.

Recommends markdown, replenishment, or recycling actions automatically.

Quantifies both profit and emission losses, so teams can make data-backed decisions that are financially and environmentally sound.

Through continuous learning, Nūl helps brands transform excess into efficiency — cutting waste while improving working capital and sustainability outcomes.

Conclusion

Excess inventory is not just an accounting issue, it’s a reflection of how well a brand anticipates and adapts to change. From forecasting errors to rigid supply chains, the causes are many, but so are the solutions.

By combining better visibility, cross-team coordination, and AI-powered optimization, brands can minimize excess, free up capital, and reduce waste. turning what once was a cost center into a competitive advantage.

Article by

Nūl Content Team

Nūl Content Team

Nūl Content Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile