What is Assortment Planning in Fashion? Process, Best Practices

Oct 8, 2025

Assortment planning means selecting the right product mix for each season, channel, or location and deciding what to sell, when, where, and in what quantity.

Every season, fashion teams face the same puzzle: deciding which products, sizes, and colors to carry, and in what quantity. This process, known as assortment planning, sits at the heart of retail success.

In fashion, assortment planning is especially complex. Unlike everyday retail, apparel and footwear assortments must account for seasonality, rapid trend cycles, and high SKU variability (sizes, fits, colorways). Get it right, and you increase sell-through, build brand loyalty, and reduce waste. Get it wrong, and you risk overstock, markdown dependency, and broken size runs.

At Nūl, we see fashion assortment planning not only as a profitability lever, but as a sustainability opportunity: making smarter decisions upstream to prevent waste before it happens.

What is Assortment Planning in Fashion?

Assortment planning is the process of selecting the right mix of products to offer customers in a given season, channel, or location. It determines what to sell, in what quantity, at what time, and where.

In fashion, this means balancing:

Categories (outerwear, dresses, activewear)

Subcategories (hoodies vs. jackets, midi vs. maxi dresses)

Attributes (size, color, fabric, fit)

Unlike grocery or electronics, fashion assortments must reflect both core staples and trend-driven items. A denim retailer, for example, may plan depth in classic skinny jeans (predictable demand) while experimenting with breadth across trending flares, cargos, and wide-legs.

Different business models approach assortment differently:

Fast fashion focuses on high variety, frequent drops, and speed to market.

Luxury brands emphasize curation and depth with limited seasonal lines.

Direct-to-consumer (DTC) brands rely on data-driven micro-collections that adapt rapidly to customer feedback.

Why is Assortment Planning Important?

Fashion assortment planning directly shapes business outcomes:

Balancing Demand and Financial Goals: Ensure enough depth to meet sales goals without locking capital in excess inventory.

Reducing Markdowns and Stock Issues: Minimize the cost of over-ordering and size stockouts by predicting sell-through and adjusting purchase orders dynamically.

Smarter Decisions for Merchandisers and Buyers: Modern planners rely on analytics, not gut feeling. Data-backed decisions help buyers identify which categories deserve deeper investment and which trends are fading.

Stronger Alignment Across Teams: Connect design, merchandising, and supply chain under one strategy, ensuring what’s designed can actually be produced, delivered, and sold profitably.

Building Brand Identity and Sustainability: Curate assortments that reflect brand values while cutting waste, reinforcing a brand’s sustainability commitments.

Core Elements of Assortment Planning

Product Hierarch: This organizes items from category → subcategory → SKU. For xample: Women’s → Dresses → Evening → Maxi → SKU1234. A clear hierarchy enables precise reporting and smoother allocation across channels.

Depth vs. Breadth: Whether to go deep (many variations in few categories) or wide (broad categories with fewer variations). Brands must balance these dimensions—too broad and inventory becomes fragmented, too deep and capital is tied up in slow movers.

Location & Channel Factors: Not all stores or platforms perform equally. Flagship stores may carry full collections, while eCommerce may emphasize size inclusivity or limited editions. Tailoring assortments by location, store size, and channel improves relevance and profitability.

Seasonal & Trend Alignment: Fashion operates on multiple calendars: spring/summer, fall/winter, and special capsules. Successful planners align timing and quantities with climate cycles, holidays, and cultural events. They also predict trends through early data signals.

Assortment Planning Models

Different retailers adopt different models depending on strategy and customer base:

Wide Model: Large variety across categories. Ideal for fast-fashion and lifestyle brands that rely on trend exploration and quick turnover.

Deep Model: Focus on a few categories but with many SKUs/variations per item. Common for specialists like denim or sneaker brands that build expertise and customer loyalty within a niche.

Scrambled Model: Add products outside core line to encourage cross-sales (e.g., activewear brands selling accessories). Effective for lifestyle positioning but risky if it dilutes focus.

Localized Model: Customizes assortments by geography (e.g., warmer fabrics in northern markets, resort wear in tropical ones). Often combined with store clustering or regional merchandising.

Mass Market Model: Wide + deep; typical of big-box retailers balancing volume and choice for broad audiences. Used by department stores and global chains to maintain high volume and choice diversity.

Model | Focus | Best For | Example Brands |

|---|---|---|---|

Wide | High variety, trend responsiveness | Fast-fashion, lifestyle retailers | Zara, H&M, SHEIN, ASOS |

Deep | Product specialization, quality | Niche or category-focused brands | Levi’s, The North Face, Timberland, New Balance, Crocs |

Scrambled | Adjacent category expansion | Lifestyle and sportswear brands | Nike, Adidas, Uniqlo, Calvin Klein, Lacoste |

Localized | Regional customization | Global retailers adapting to climates | MUJI, Marks & Spencer, Decathlon, Uniqlo |

Mass-Market | Scale + diversity | Department stores and marketplaces | Walmart, Target, Macy’s, Amazon Fashion |

Assortment Planning Models

The Assortment Planning Process in the Fashion Industry

Analyze Market & Trend: Start with a mix of qualitative and quantitative inputs: runway reports, competitor scans, social media trends, sales history, and influencer signals. The goal is to identify themes and customer moods early.

Forecast Demand: Blend historical sales, external data, and predictive AI models. AI-powered demand models can simulate how external factors like weather or economic shifts impact demand at SKU or store level.

Define Assortment Strategy: Determine breadth and depth ratios, choose the appropriate planning model (wide, deep, localized, etc.), and align price ranges and sustainability goals.

Integrate Merchandise & Financial Planning: Connect assortment decisions with Open-to-Buy (OTB) budgets, margin objectives, and vendor capacities. This ensures every product slot supports both creative vision and profitability.

Execute & Allocate: Translate plans into buy sheets and push assortments to the right stores, clusters, or online channels. Allocation must account for store size, local demand, and digital performance.

Review & Adjust: Use in-season data for reforecasting, inventory replenishment, and markdown optimization. Weekly reviews allow teams to respond to trend shifts before they affect revenue.

The Assortment Planning Process in the Fashion Industry

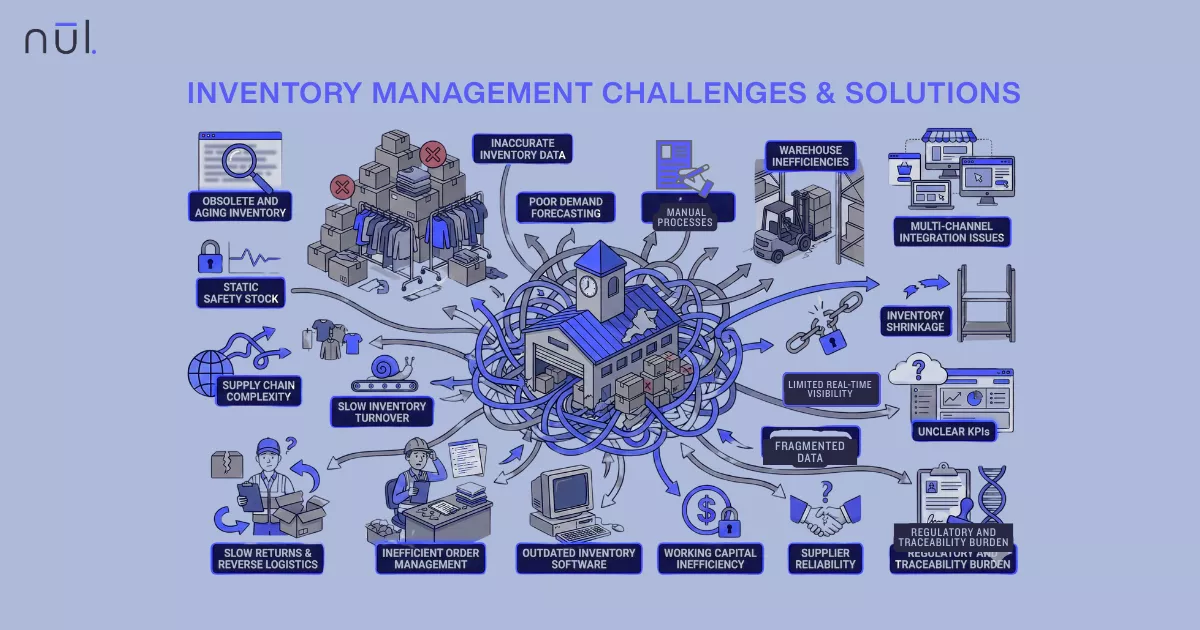

Challenges in Fashion Assortment Planning

Short Trend Cycles: Viral fashion trends can rise and fall within weeks, leaving unsold inventory before collections even hit the floor. This volatility leads to excess stock, frequent markdowns, and lost revenue as products quickly feel outdated.

Size Run Breaks: Core issue in apparel where one size sells out while others pile up. This creates both lost sales opportunities and surplus inventory in less-demanded sizes.

Overstock & Markdown Dependency: Overbuying or inaccurate forecasting ties up cash flow and storage capacity. As unsold items pile up, brands rely heavily on discounts, eroding profit margins and damaging perceived product value over time.

Cross-Team Misalignment: Designers, merchandisers, and planners working in silos. These result in mismatched inventory, slower product launches, and missed commercial opportunities.

Assortment Planning Best Practices

Understand Your Customers Deeply:

Great assortments start with knowing who you’re designing for. Go beyond age or gender, look at lifestyles, habits, and what inspires your audience to buy. When planners understand both the data and the emotion behind purchases, they can curate collections that feel personal and purposeful.

Let Data Guide Every Decision:

Past sales, current trends, and key metrics like sell-through or GMROI tell the real story of what works. Use data as your compass—not your cage—to balance creative instinct with evidence. Tracking these numbers regularly helps brands spot what’s performing and what’s quietly draining profit.

Find Balance in Your Product Mix: Core vs. Trendy, Breadth vs. Depth

Every strong assortment balances core staples with fresh, trend-driven pieces. Too many basics can make collections feel flat, while too much novelty leads to markdowns. Keep enough variety to stay relevant but enough focus to stay profitable. Leading brands often follow a 70/20/10 rule—70% core, 20% seasonal, 10% experimental—to stabilize revenue while testing innovation.

Adopt Predictive Forecasting and AI Tools:

Modern planning isn’t guesswork anymore. AI and machine learning can detect early shifts in demand, helping planners adjust before trends peak or fade. These tools make it easier to manage uncertainty, reduce excess stock, and react quickly when customer interest changes.

>> Read more: Top 10 Best Assortment Planning Software for Fashion

Connect Systems and Teams:

Design, merchandising, and supply chain decisions shouldn’t happen in isolation. Linking PLM, ERP, and retail planning systems keeps everyone aligned and working from the same data. When teams share visibility, they can move faster and make better, unified decisions.

Localize and Adapt for Each Market:

What sells in one place may not work in another. Adjust assortments for region, climate, and culture. You know, seasonal variation adds another layer: winter assortments in Canada differ from tropical edits in Singapore. Also, local relevance helps brands connect more naturally with customers everywhere.

Manage Inventory and Promotions Wisely:

Healthy inventory drives profit. Reorder fast-selling products early and plan markdowns before they become necessary. You can use auto-replenishment tools for fast movers and pre-planned markdown strategies for slow sellers keeps cash flow healthy. When promotions are proactive, not reactive, brands can protect their margins and maintain customer trust.

Keep Your Brand Consistent:

Every product should reflect your brand’s story. Whether it’s sustainability, innovation, or inclusivity, your assortment should express that identity clearly. When customers recognize your values through your collections, loyalty follows naturally.

Measure and Adjust Constantly:

Assortment planning doesn’t end at launch. Review performance weekly, analyze what sells full price, and spot slow movers early. The best planners see each season as a lesson for the next—learning, adapting, and getting sharper over time.

Assortment Planning Best Practices

Optimize Fashion Assortment Planning with Nūl

At Nūl, we’ve seen how traditional assortment planning—often done in Excel—leads to decision lag and missed opportunities. Our agentic AI platform transforms how brands plan:

Forecasting with Ranges, Not Just Numbers – Anticipate uncertainty and make safer buy calls.

Real-Time Rebalancing – Adjust assortments across stores and channels when demand shifts.

Zero-Waste Lens – Balance profitability with emissions reduction, cutting overproduction before it happens.

Cross-Team Visibility – Designers, merchandisers, and planners share one live source of truth.

For brands, this means faster planning cycles, fewer stockouts, and a measurable cut in waste.

Conclusion

Fashion assortment planning is no longer just about filling racks—it’s about making smarter, faster, and more sustainable decisions. The right assortment strengthens margins, builds customer loyalty, and prevents overproduction.

For modern fashion brands, the key lies in data-driven planning powered by AI. Platforms like Nūl help teams move beyond spreadsheets to make assortment planning adaptive, collaborative, and zero-waste.

Article by

Nūl Content Team

An Experienced Research & Knowledge Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile

More From Blog

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

More From Blog

What is Assortment Planning in Fashion? Process, Best Practices

Oct 8, 2025

Assortment planning means selecting the right product mix for each season, channel, or location and deciding what to sell, when, where, and in what quantity.

Every season, fashion teams face the same puzzle: deciding which products, sizes, and colors to carry, and in what quantity. This process, known as assortment planning, sits at the heart of retail success.

In fashion, assortment planning is especially complex. Unlike everyday retail, apparel and footwear assortments must account for seasonality, rapid trend cycles, and high SKU variability (sizes, fits, colorways). Get it right, and you increase sell-through, build brand loyalty, and reduce waste. Get it wrong, and you risk overstock, markdown dependency, and broken size runs.

At Nūl, we see fashion assortment planning not only as a profitability lever, but as a sustainability opportunity: making smarter decisions upstream to prevent waste before it happens.

What is Assortment Planning in Fashion?

Assortment planning is the process of selecting the right mix of products to offer customers in a given season, channel, or location. It determines what to sell, in what quantity, at what time, and where.

In fashion, this means balancing:

Categories (outerwear, dresses, activewear)

Subcategories (hoodies vs. jackets, midi vs. maxi dresses)

Attributes (size, color, fabric, fit)

Unlike grocery or electronics, fashion assortments must reflect both core staples and trend-driven items. A denim retailer, for example, may plan depth in classic skinny jeans (predictable demand) while experimenting with breadth across trending flares, cargos, and wide-legs.

Different business models approach assortment differently:

Fast fashion focuses on high variety, frequent drops, and speed to market.

Luxury brands emphasize curation and depth with limited seasonal lines.

Direct-to-consumer (DTC) brands rely on data-driven micro-collections that adapt rapidly to customer feedback.

Why is Assortment Planning Important?

Fashion assortment planning directly shapes business outcomes:

Balancing Demand and Financial Goals: Ensure enough depth to meet sales goals without locking capital in excess inventory.

Reducing Markdowns and Stock Issues: Minimize the cost of over-ordering and size stockouts by predicting sell-through and adjusting purchase orders dynamically.

Smarter Decisions for Merchandisers and Buyers: Modern planners rely on analytics, not gut feeling. Data-backed decisions help buyers identify which categories deserve deeper investment and which trends are fading.

Stronger Alignment Across Teams: Connect design, merchandising, and supply chain under one strategy, ensuring what’s designed can actually be produced, delivered, and sold profitably.

Building Brand Identity and Sustainability: Curate assortments that reflect brand values while cutting waste, reinforcing a brand’s sustainability commitments.

Core Elements of Assortment Planning

Product Hierarch: This organizes items from category → subcategory → SKU. For xample: Women’s → Dresses → Evening → Maxi → SKU1234. A clear hierarchy enables precise reporting and smoother allocation across channels.

Depth vs. Breadth: Whether to go deep (many variations in few categories) or wide (broad categories with fewer variations). Brands must balance these dimensions—too broad and inventory becomes fragmented, too deep and capital is tied up in slow movers.

Location & Channel Factors: Not all stores or platforms perform equally. Flagship stores may carry full collections, while eCommerce may emphasize size inclusivity or limited editions. Tailoring assortments by location, store size, and channel improves relevance and profitability.

Seasonal & Trend Alignment: Fashion operates on multiple calendars: spring/summer, fall/winter, and special capsules. Successful planners align timing and quantities with climate cycles, holidays, and cultural events. They also predict trends through early data signals.

Assortment Planning Models

Different retailers adopt different models depending on strategy and customer base:

Wide Model: Large variety across categories. Ideal for fast-fashion and lifestyle brands that rely on trend exploration and quick turnover.

Deep Model: Focus on a few categories but with many SKUs/variations per item. Common for specialists like denim or sneaker brands that build expertise and customer loyalty within a niche.

Scrambled Model: Add products outside core line to encourage cross-sales (e.g., activewear brands selling accessories). Effective for lifestyle positioning but risky if it dilutes focus.

Localized Model: Customizes assortments by geography (e.g., warmer fabrics in northern markets, resort wear in tropical ones). Often combined with store clustering or regional merchandising.

Mass Market Model: Wide + deep; typical of big-box retailers balancing volume and choice for broad audiences. Used by department stores and global chains to maintain high volume and choice diversity.

Model | Focus | Best For | Example Brands |

|---|---|---|---|

Wide | High variety, trend responsiveness | Fast-fashion, lifestyle retailers | Zara, H&M, SHEIN, ASOS |

Deep | Product specialization, quality | Niche or category-focused brands | Levi’s, The North Face, Timberland, New Balance, Crocs |

Scrambled | Adjacent category expansion | Lifestyle and sportswear brands | Nike, Adidas, Uniqlo, Calvin Klein, Lacoste |

Localized | Regional customization | Global retailers adapting to climates | MUJI, Marks & Spencer, Decathlon, Uniqlo |

Mass-Market | Scale + diversity | Department stores and marketplaces | Walmart, Target, Macy’s, Amazon Fashion |

Assortment Planning Models

The Assortment Planning Process in the Fashion Industry

Analyze Market & Trend: Start with a mix of qualitative and quantitative inputs: runway reports, competitor scans, social media trends, sales history, and influencer signals. The goal is to identify themes and customer moods early.

Forecast Demand: Blend historical sales, external data, and predictive AI models. AI-powered demand models can simulate how external factors like weather or economic shifts impact demand at SKU or store level.

Define Assortment Strategy: Determine breadth and depth ratios, choose the appropriate planning model (wide, deep, localized, etc.), and align price ranges and sustainability goals.

Integrate Merchandise & Financial Planning: Connect assortment decisions with Open-to-Buy (OTB) budgets, margin objectives, and vendor capacities. This ensures every product slot supports both creative vision and profitability.

Execute & Allocate: Translate plans into buy sheets and push assortments to the right stores, clusters, or online channels. Allocation must account for store size, local demand, and digital performance.

Review & Adjust: Use in-season data for reforecasting, inventory replenishment, and markdown optimization. Weekly reviews allow teams to respond to trend shifts before they affect revenue.

The Assortment Planning Process in the Fashion Industry

Challenges in Fashion Assortment Planning

Short Trend Cycles: Viral fashion trends can rise and fall within weeks, leaving unsold inventory before collections even hit the floor. This volatility leads to excess stock, frequent markdowns, and lost revenue as products quickly feel outdated.

Size Run Breaks: Core issue in apparel where one size sells out while others pile up. This creates both lost sales opportunities and surplus inventory in less-demanded sizes.

Overstock & Markdown Dependency: Overbuying or inaccurate forecasting ties up cash flow and storage capacity. As unsold items pile up, brands rely heavily on discounts, eroding profit margins and damaging perceived product value over time.

Cross-Team Misalignment: Designers, merchandisers, and planners working in silos. These result in mismatched inventory, slower product launches, and missed commercial opportunities.

Assortment Planning Best Practices

Understand Your Customers Deeply:

Great assortments start with knowing who you’re designing for. Go beyond age or gender, look at lifestyles, habits, and what inspires your audience to buy. When planners understand both the data and the emotion behind purchases, they can curate collections that feel personal and purposeful.

Let Data Guide Every Decision:

Past sales, current trends, and key metrics like sell-through or GMROI tell the real story of what works. Use data as your compass—not your cage—to balance creative instinct with evidence. Tracking these numbers regularly helps brands spot what’s performing and what’s quietly draining profit.

Find Balance in Your Product Mix: Core vs. Trendy, Breadth vs. Depth

Every strong assortment balances core staples with fresh, trend-driven pieces. Too many basics can make collections feel flat, while too much novelty leads to markdowns. Keep enough variety to stay relevant but enough focus to stay profitable. Leading brands often follow a 70/20/10 rule—70% core, 20% seasonal, 10% experimental—to stabilize revenue while testing innovation.

Adopt Predictive Forecasting and AI Tools:

Modern planning isn’t guesswork anymore. AI and machine learning can detect early shifts in demand, helping planners adjust before trends peak or fade. These tools make it easier to manage uncertainty, reduce excess stock, and react quickly when customer interest changes.

>> Read more: Top 10 Best Assortment Planning Software for Fashion

Connect Systems and Teams:

Design, merchandising, and supply chain decisions shouldn’t happen in isolation. Linking PLM, ERP, and retail planning systems keeps everyone aligned and working from the same data. When teams share visibility, they can move faster and make better, unified decisions.

Localize and Adapt for Each Market:

What sells in one place may not work in another. Adjust assortments for region, climate, and culture. You know, seasonal variation adds another layer: winter assortments in Canada differ from tropical edits in Singapore. Also, local relevance helps brands connect more naturally with customers everywhere.

Manage Inventory and Promotions Wisely:

Healthy inventory drives profit. Reorder fast-selling products early and plan markdowns before they become necessary. You can use auto-replenishment tools for fast movers and pre-planned markdown strategies for slow sellers keeps cash flow healthy. When promotions are proactive, not reactive, brands can protect their margins and maintain customer trust.

Keep Your Brand Consistent:

Every product should reflect your brand’s story. Whether it’s sustainability, innovation, or inclusivity, your assortment should express that identity clearly. When customers recognize your values through your collections, loyalty follows naturally.

Measure and Adjust Constantly:

Assortment planning doesn’t end at launch. Review performance weekly, analyze what sells full price, and spot slow movers early. The best planners see each season as a lesson for the next—learning, adapting, and getting sharper over time.

Assortment Planning Best Practices

Optimize Fashion Assortment Planning with Nūl

At Nūl, we’ve seen how traditional assortment planning—often done in Excel—leads to decision lag and missed opportunities. Our agentic AI platform transforms how brands plan:

Forecasting with Ranges, Not Just Numbers – Anticipate uncertainty and make safer buy calls.

Real-Time Rebalancing – Adjust assortments across stores and channels when demand shifts.

Zero-Waste Lens – Balance profitability with emissions reduction, cutting overproduction before it happens.

Cross-Team Visibility – Designers, merchandisers, and planners share one live source of truth.

For brands, this means faster planning cycles, fewer stockouts, and a measurable cut in waste.

Conclusion

Fashion assortment planning is no longer just about filling racks—it’s about making smarter, faster, and more sustainable decisions. The right assortment strengthens margins, builds customer loyalty, and prevents overproduction.

For modern fashion brands, the key lies in data-driven planning powered by AI. Platforms like Nūl help teams move beyond spreadsheets to make assortment planning adaptive, collaborative, and zero-waste.

Article by

Nūl Content Team

An Experienced Research & Knowledge Team

An Experienced Research & Knowledge Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile