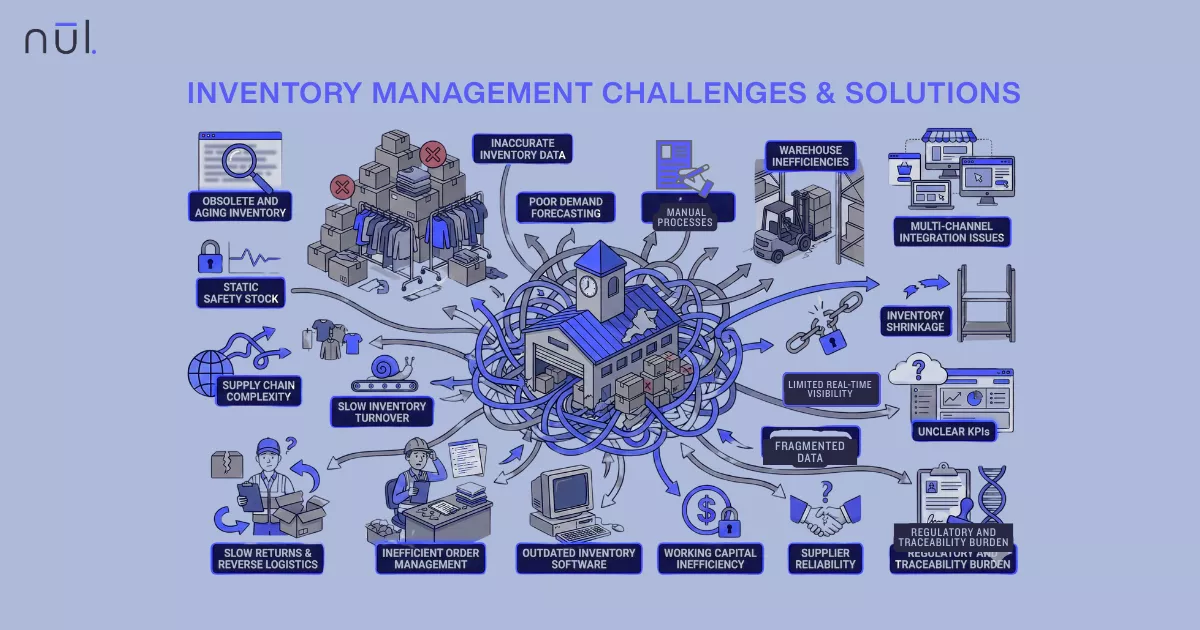

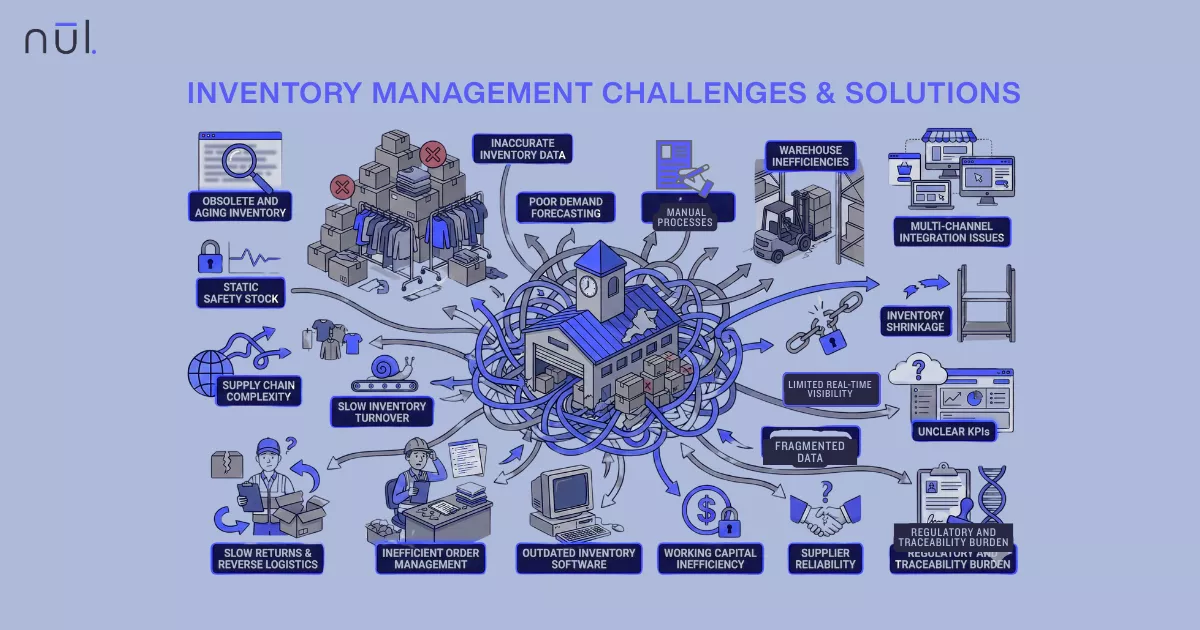

19 Inventory Management Challenges and Their Solutions

Dec 30, 2025

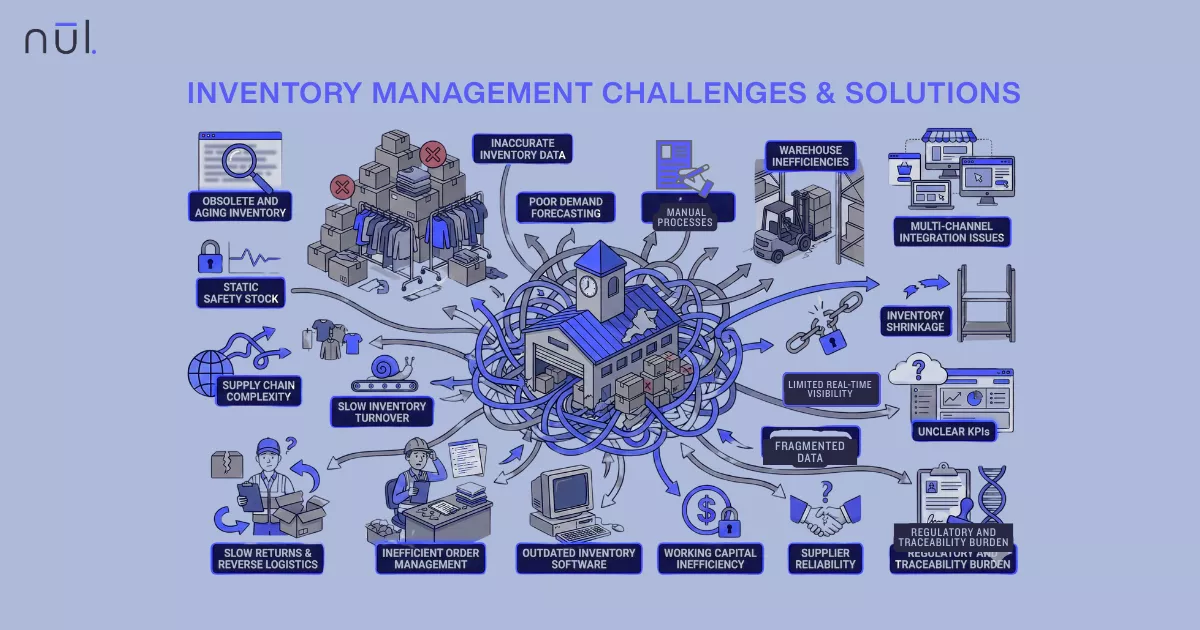

Inaccurate inventory data, poor demand forecasting, limited real-time visibility, fragmented data, manual processes,... are common inventory management challenges.

Inventory is one of the most valuable and difficult to manage assets in retail and fashion. With shorter trend cycles, omnichannel fulfillment, and increasingly complex supply chains, brands face constant pressure to keep the right amount of stock, in the right place, at the right time.

Yet many retailers still struggle with inaccurate data, manual workflows, fragmented systems, and costly inefficiencies that lead to stockouts, overstocks, poor cash flow, and lost sales.

This guide breaks down the 19 biggest inventory management challenges, their real impacts, examples, and the practical solutions your brand can implement today.

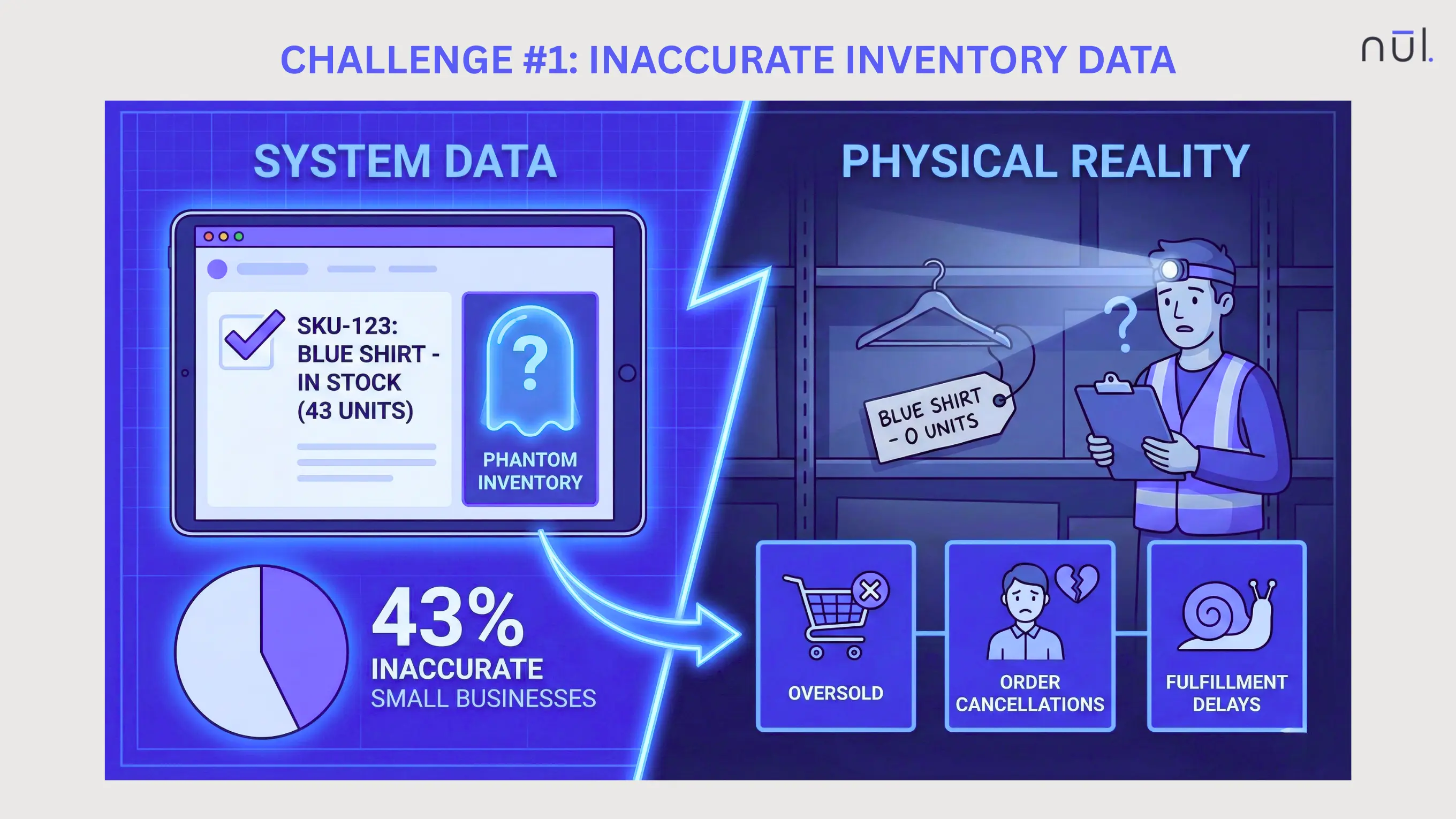

Inaccurate Inventory Data

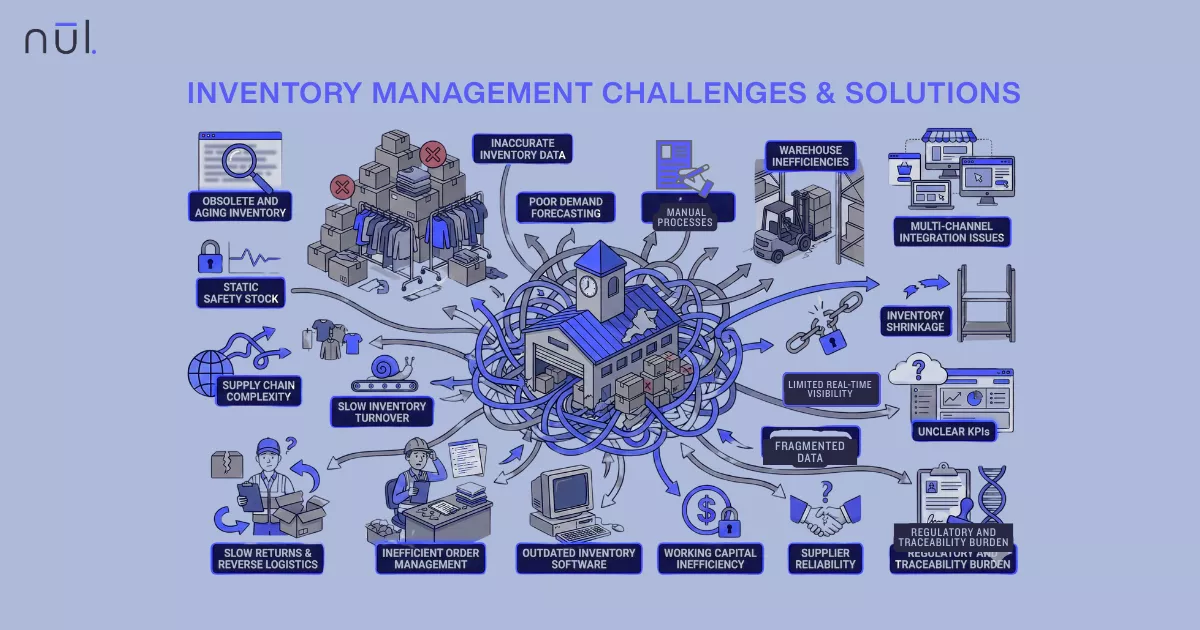

Inaccurate inventory data (or inventory discrepancy) happens when the numbers in your system don’t match what is physically on the shelf. A common case is phantom inventory where the system says an item is in stock, but it cannot be found in warehouse. Retail reports show up to 43% of small businesses don’t track inventory accurately.

When this gap grows, every decision needing stock data like procurement or customer fulfillment becomes less reliable. As a result, overselling, order cancellations, and significant fulfillment delays happen and damage customer trust.

Causes:

Manual Entry Errors: Paper forms and spreadsheet typing cause frequent mistakes and missed adjustments.

Disconnected Systems: POS, e-commerce, and warehouses don’t sync in real time, creating data blind spots.

No Scanning at Touchpoints: Items aren’t scanned at receiving, picking, or shipping, so movements aren’t recorded.

Rare Audits: Only doing one big annual count lets errors accumulate for months.

Mismatched SKUs: Inconsistent product codes and naming across channels confuse both systems and staff.

Solutions:

|

|---|

>> Read more: Perpetual vs Periodic Inventory System: What's the Difference?

Inaccurate Inventory Data

Poor Demand Forecasting

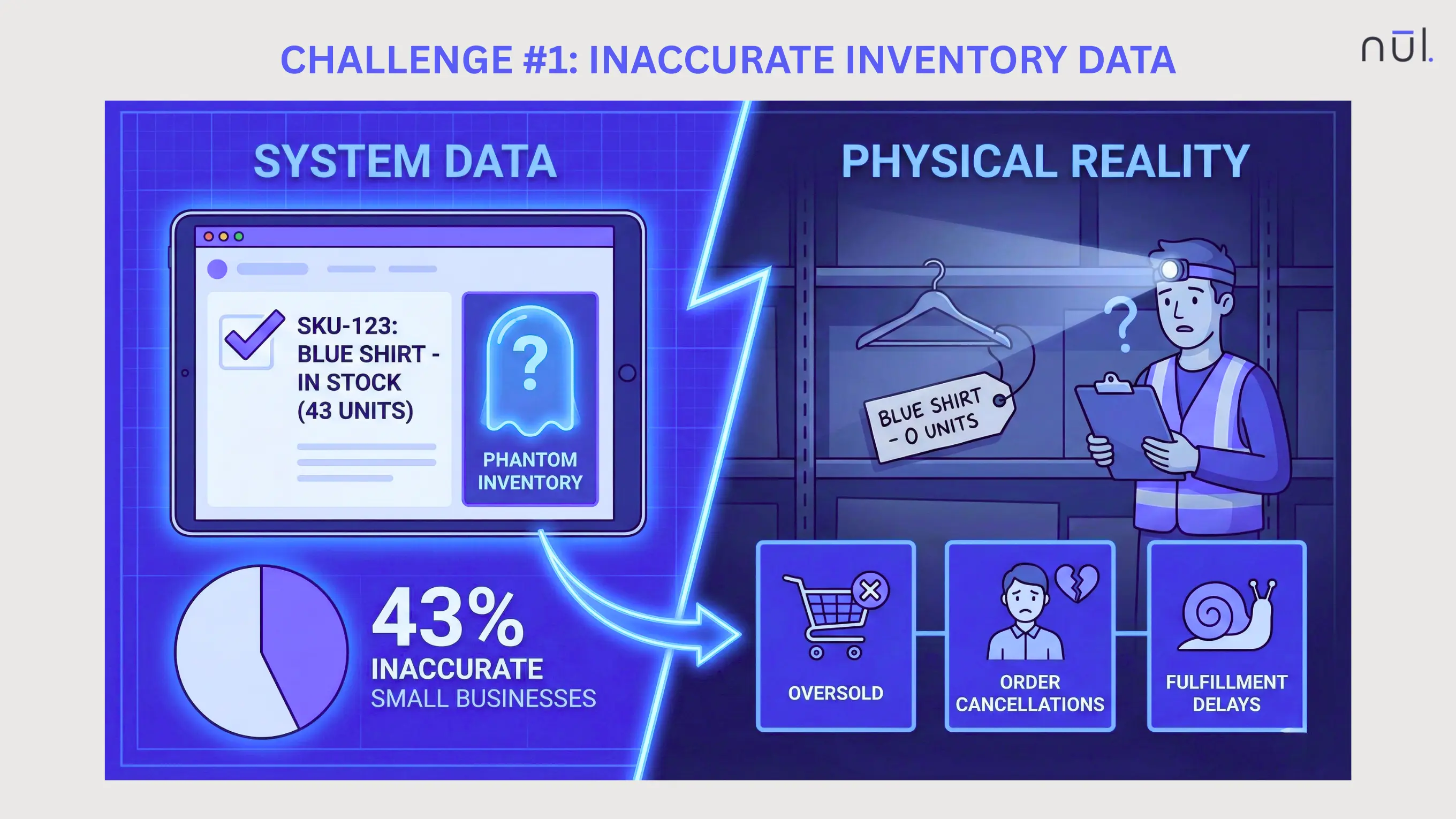

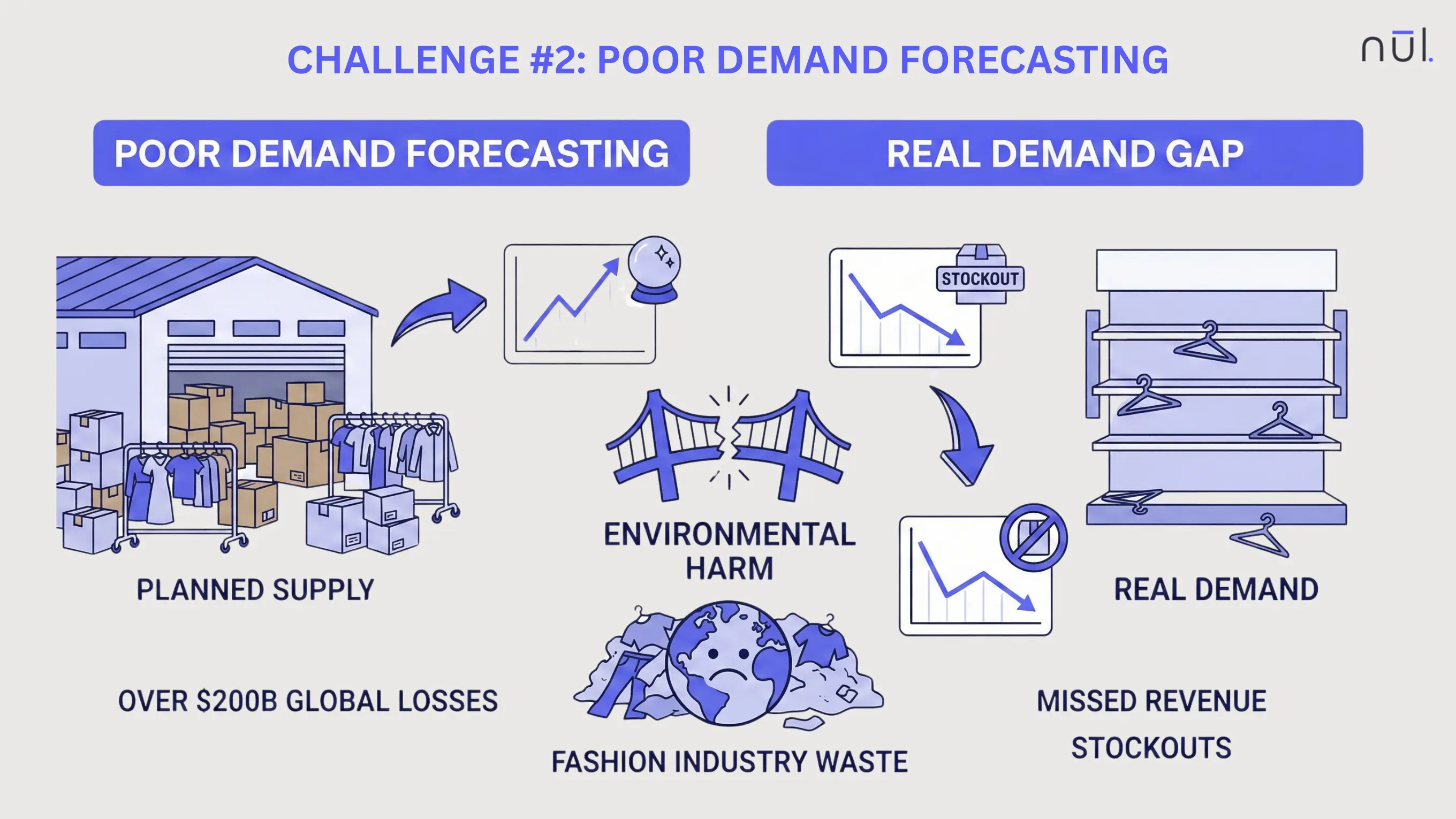

Poor demand forecasting is when a business cannot reliably predict what customers will buy, causing a gap between planned supply and real demand. Forecasting have to answer exactly what will be needed and when. You know, when this goes wrong, the supply chain turns into the reaction mode, creating waste from excess inventory or missed revenue from stockouts.

Inaccurate predictions contribute to over $200B in annual global retail losses due to the dual crisis of holding dead stock for slow sellers and facing stockouts for high-demand items. This is one of the biggest causes for waste in the fashion industry, harming the environment

Causes:

Relying only on last year’s sales or gut feeling without adjusting for promotions, price changes, or channel mix.

Ignoring seasonality, weather, and regional differences that shift demand timing and volume.

Not using external signals such as social media trends, events, or competitor activity.

Forecasting at a high level (category or total store) instead of at SKU × location.

Forecasts updated too rarely, so plans don’t react to new information or fast-moving trends.

A lack of collaborative planning (S&OP) between sales, marketing, and inventory teams leads to disconnected and conflicting forecasts.

Solutions:

|

|---|

>> Explore further:

14 Best Demand Forecasting Methods in Fashion Supply Chain

Poor Demand Forecasting

Limited Real-Time Visibility

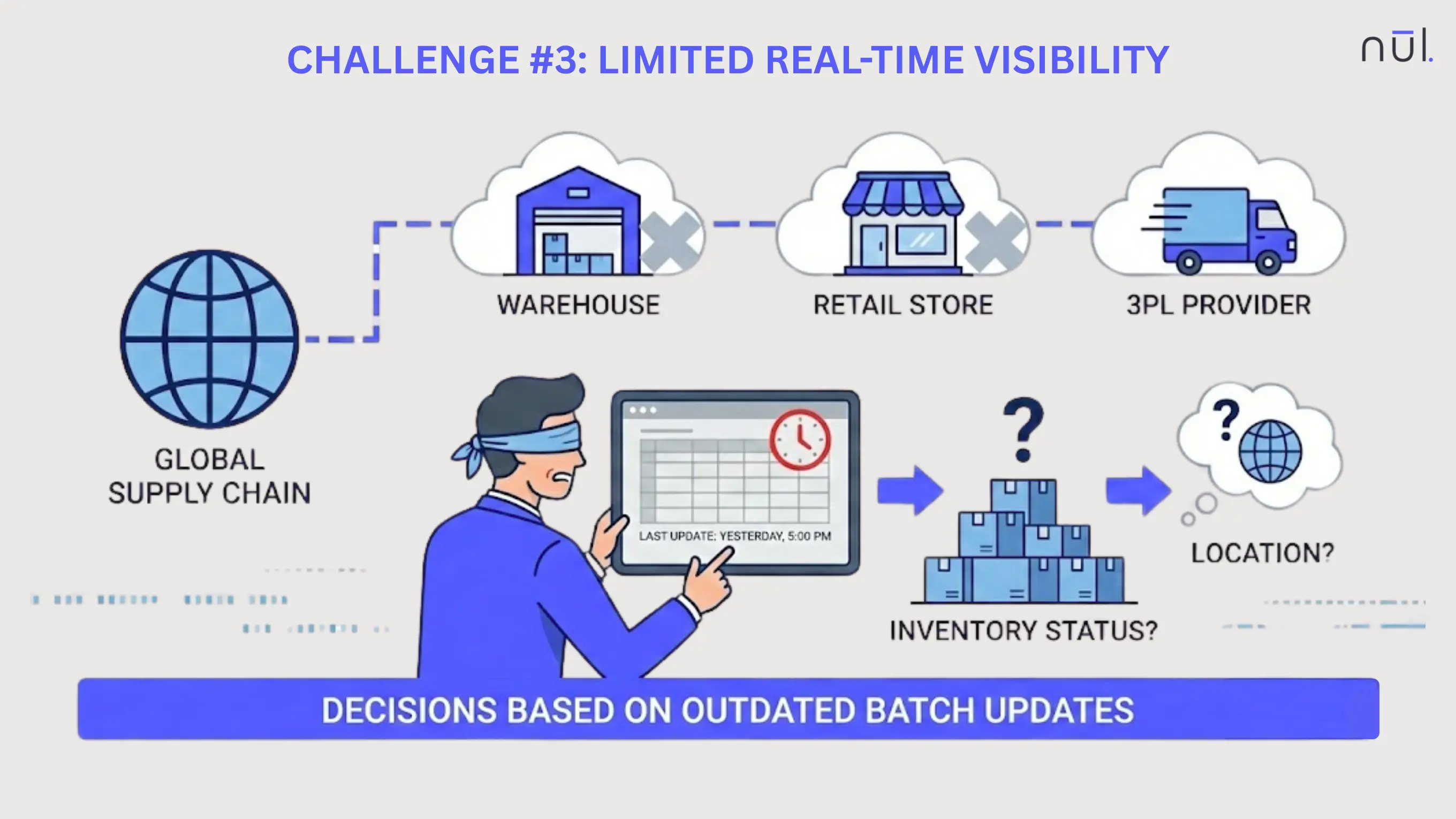

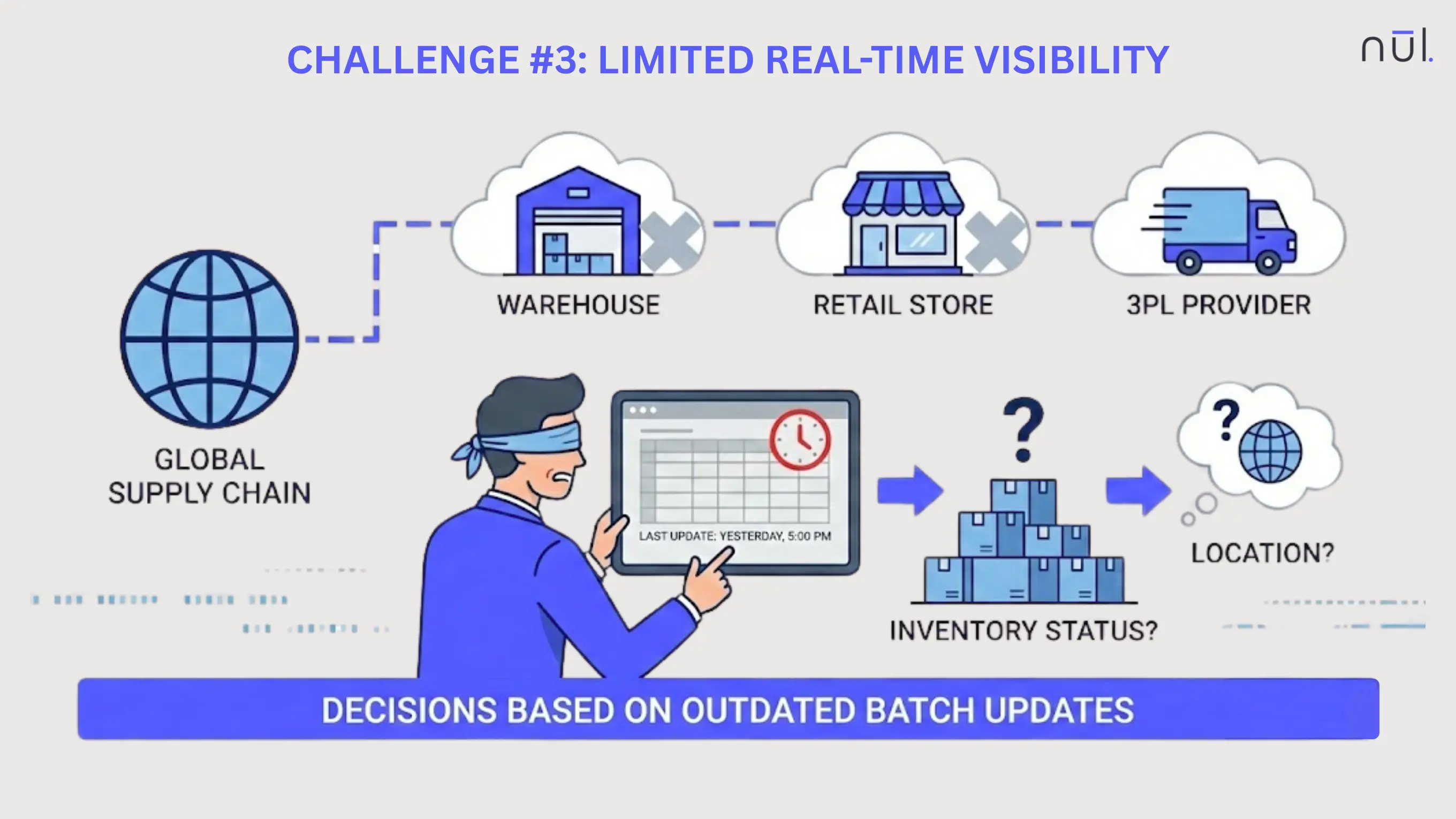

Another challenge is that you can't see exact stock levels, statuses, and locations across the entire supply chain in real-time. Without a live view of inventory distributed across multiple warehouses, retail stores, and third-party logistics (3PL) providers, managers are forced to make decisions based on outdated batch updates.

This transparency gap creates blind zones where inventory is physically present but digitally invisible to sales channels. The results are incorrect online availability and late inventory replenishment, which delays omnichannel fulfillment and leads to missed revenue opportunities.

Causes:

Older systems often update stock counts only every few hours or once daily, creating a big gap between physical sales and digital records.

Using separate software for e-commerce, in-store retail, and warehouse management prevents a unified, real-time view of stock.

Transfers, returns, and internal moves are recorded late or offline.

Solutions:

|

|---|

Limited Real-Time Visibility

Fragmented Data

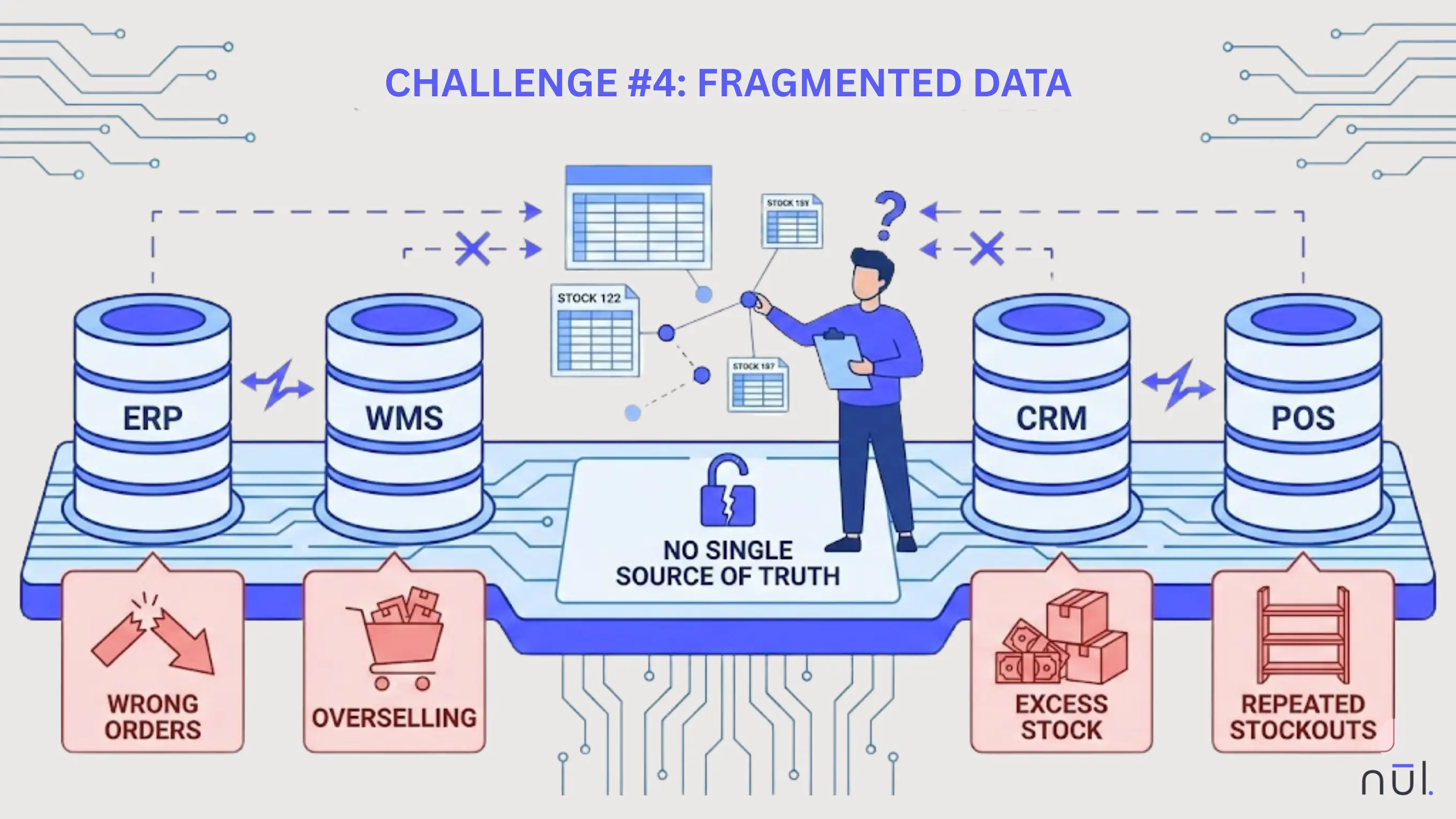

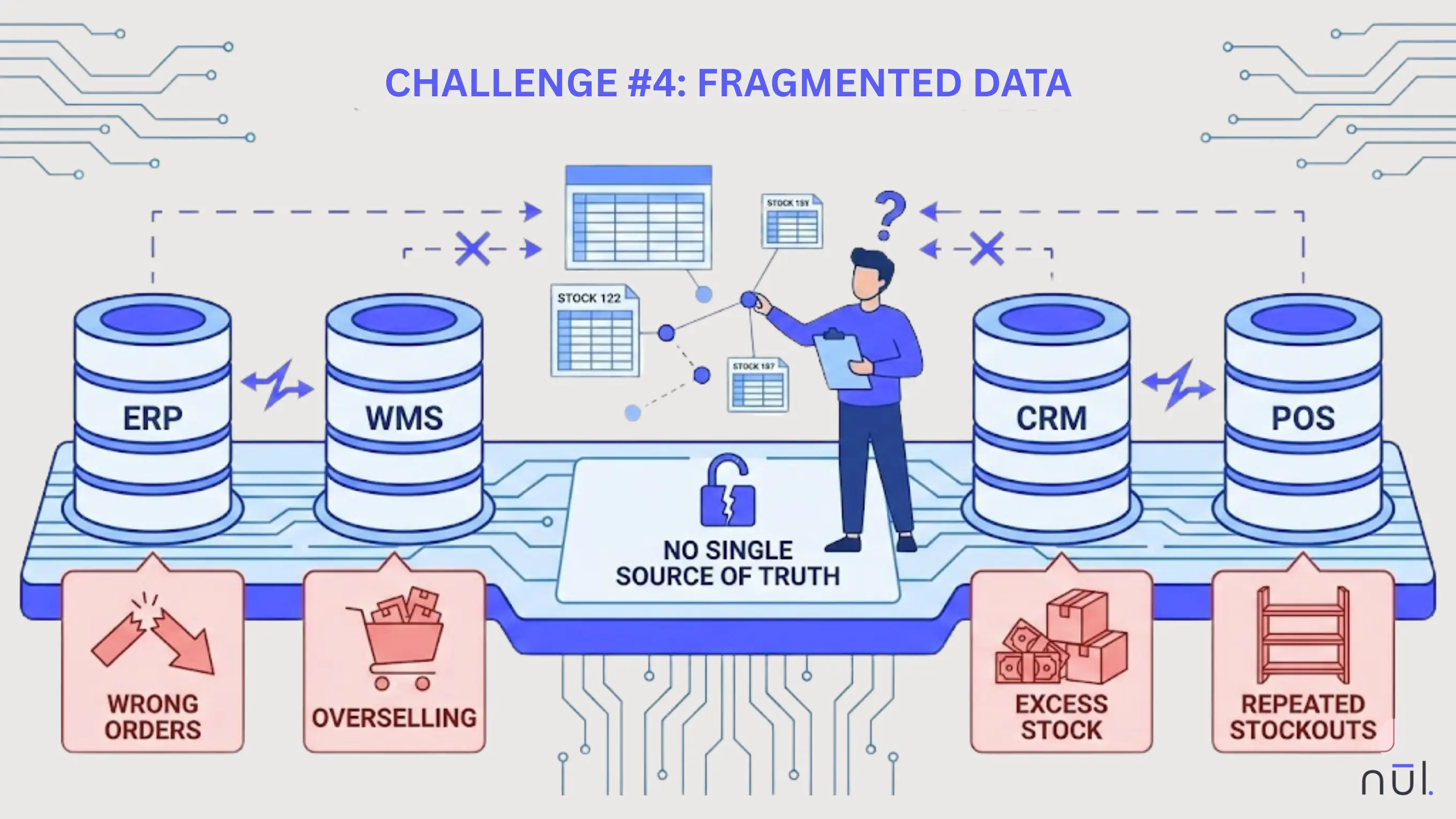

Fragmented data happens when ERP, WMS, CRM, POS, and other core systems sit in separate silos and don’t share information smoothly. There is no clear single source of truth, so different teams see different stock numbers for the same item.

To make sense of it, staff have to manually pull and combine data from multiple tools, which is slow and error-prone. Over time, this leads to wrong ordering decisions, overselling, excess stock that ties up cash, and repeated stockouts that lose sales.

Causes:

Using older, on-premise systems that were not built with modern integration or API capabilities.

Different departments using inconsistent naming conventions, SKU formats, or units of measure for the same products.

Avoiding the upfront cost of a unified suite in favor of cheaper, isolated point solutions that eventually fail to scale.

Solutions:

|

|---|

Fragmented Data

Manual Processes

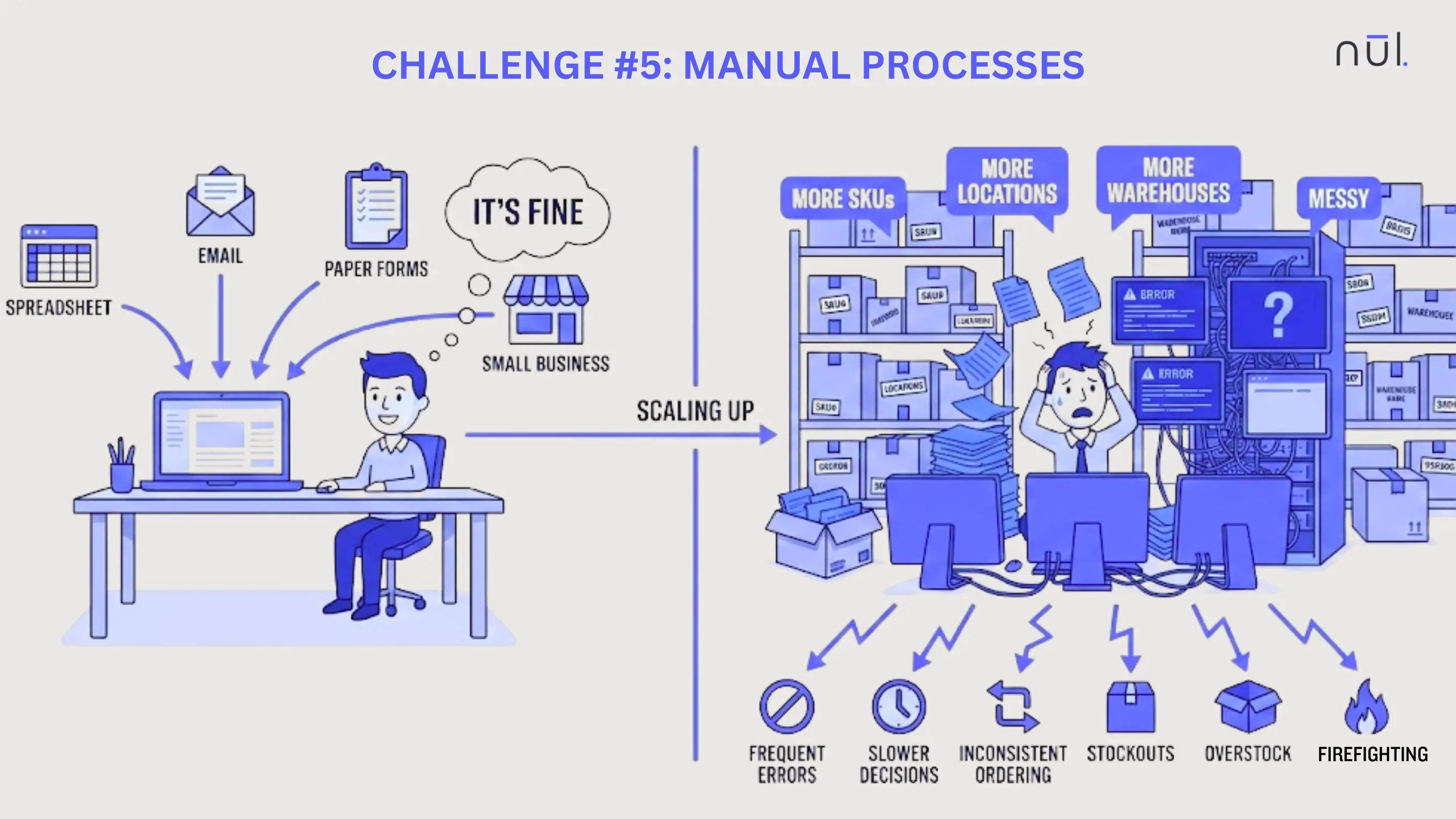

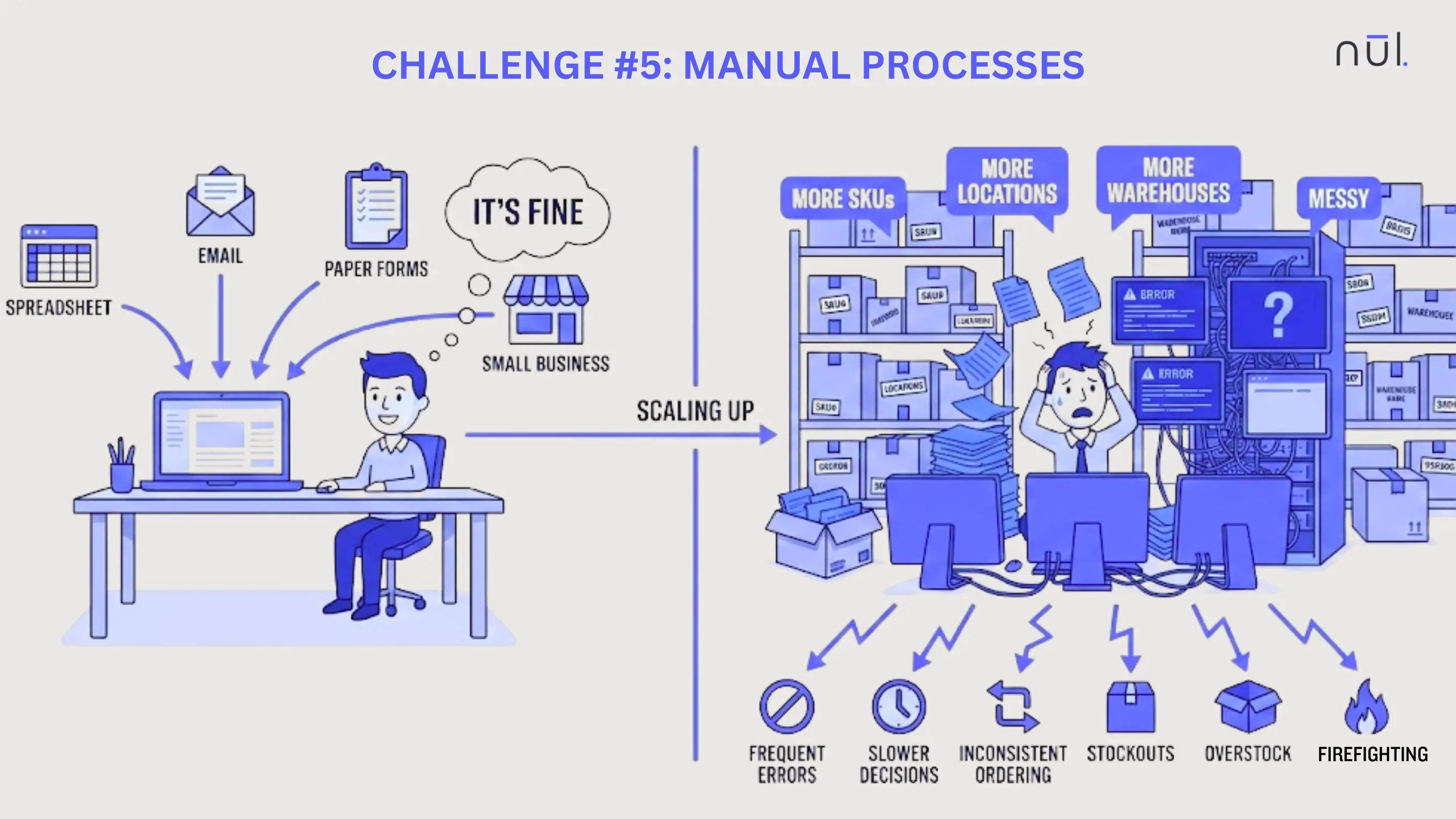

When your key inventory tasks like replenishment, purchase order creation, and stock adjustments rely on human intervention, it's difficult to scale efficiently and easy to cause errors. In fact, small businesses often handle those tasks with spreadsheets, emails, or paper forms to save investment costs on modern automation systems.

Actually, it's still fine, but once you add more SKUs, locations, and warehouses, everything becomes messy. Manual effort starts to create frequent errors, slower decisions, and inconsistent ordering patterns, which then ripple through the whole supply chain as stockouts, overstock, and constant firefighting.

Causes:

Many small or growing teams manage their entire inventory through Excel or Google Sheets, which require constant manual updates.

Warehouse staff often use printed sheets to find items, which wasting time and increasing errors in recorded stock levels.

Information from sales, returns, and shipments is often "keyed in" by hand, increasing the risk of typos and data discrepancies.

Purchase order creation often involves manual email chains or physical signatures, causing delays in the procurement cycle.

Solutions:

|

|---|

Manual Processes

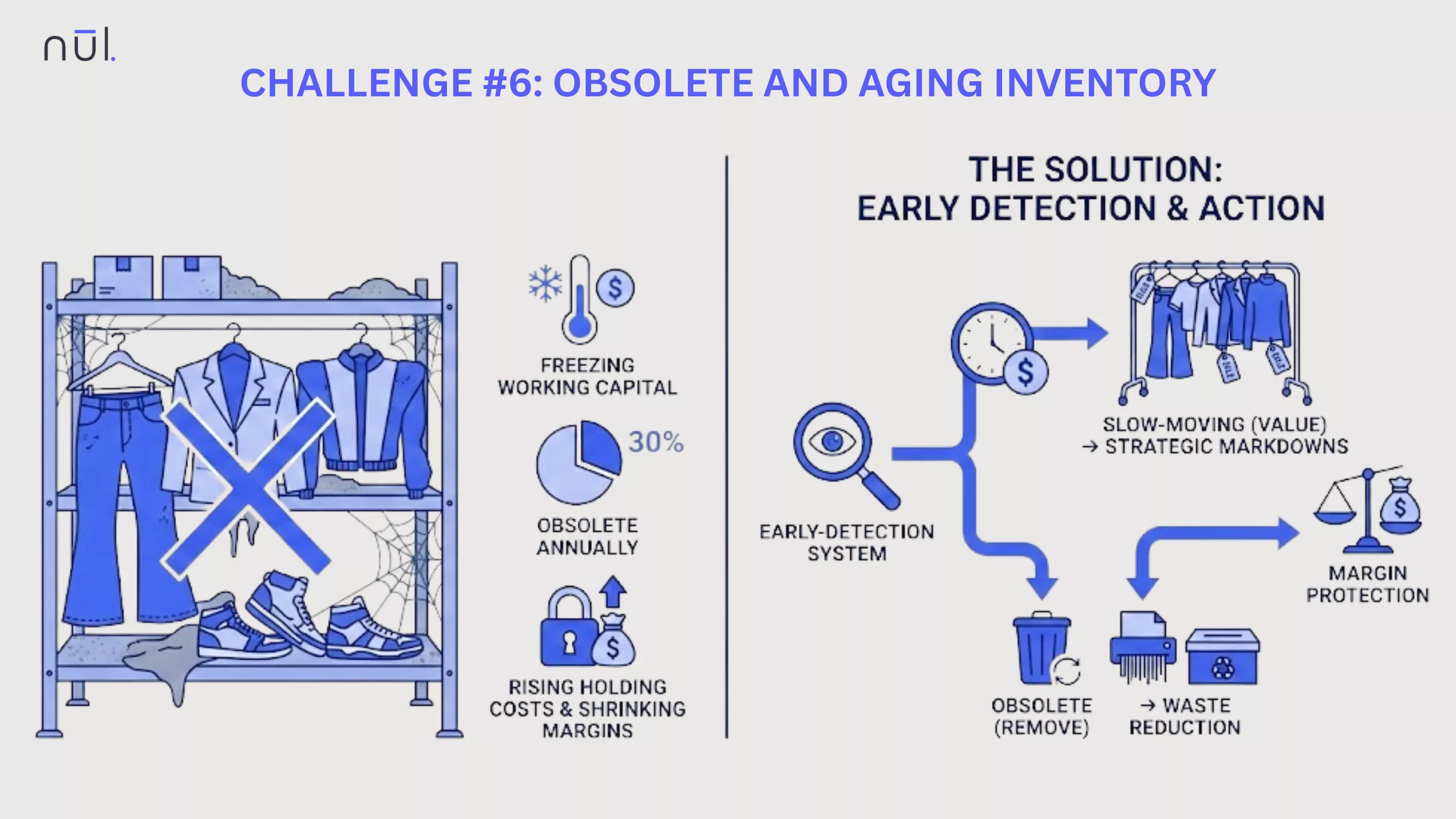

Obsolete and Aging Inventory

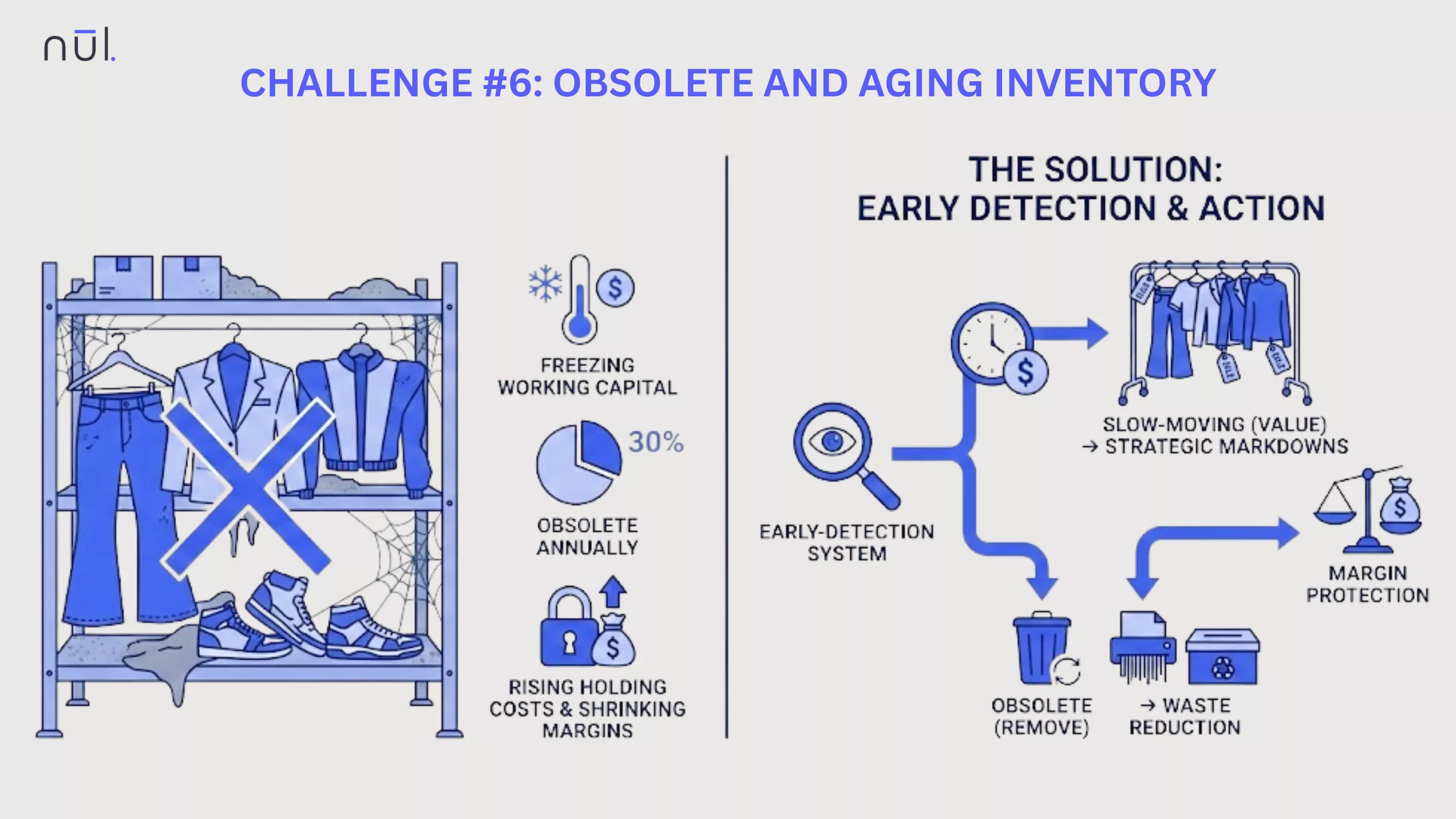

Stock that has reached the end of its functional lifecycle like expired goods, outdated product models, or items with zero remaining market demand can occupy valuable warehouse space and freeze working capital. Some researches suggest that up to 30% of fashion inventory becomes obsolete each year, turning poor inventory control into a major source of waste.

Managing this challenge requires an early-detection system to distinguish between slow-moving items that still possess value and truly obsolete items that should be removed entirely. If aging inventory is left unchecked, holding costs rise, heavy markdowns become unavoidable, and margins shrink.

Causes:

Slow-moving items are often not identified early enough to take corrective action, so they sit in the shelves in the long time.

Lack markdown strategies for low-velocity items, the business thus can't clear stock before it becomes obsolete.

Rely on flawed demand forecasts results in purchasing more units than the market needs.

Fail to implement inventory valuation methods (FIFO, FEFO), so products are buried behind newer shipments.

Solutions:

|

|---|

>> Learn more: What is Inventory Velocity? Formula, Example, & Best Practices

Obsolete and Aging Inventory

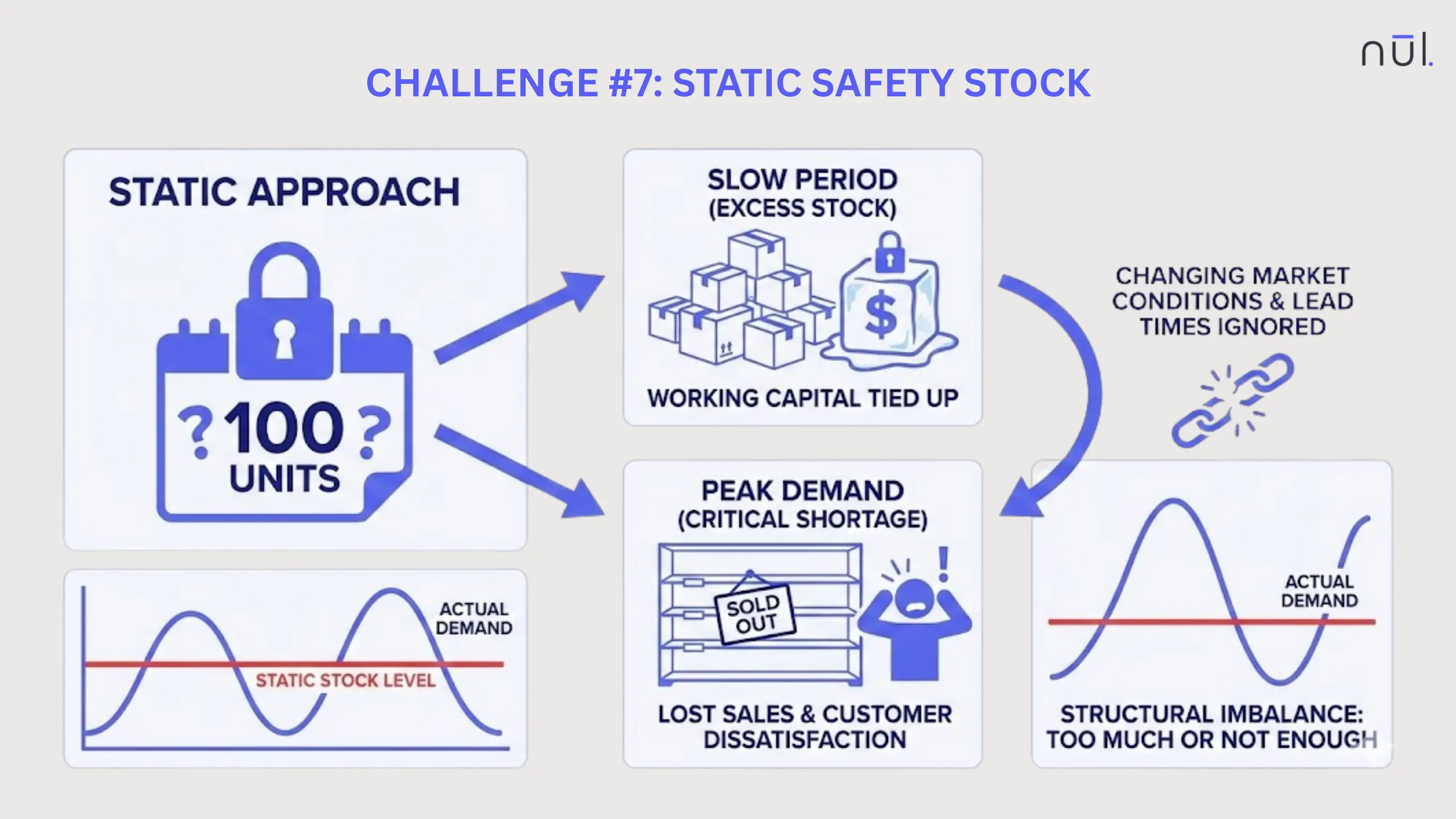

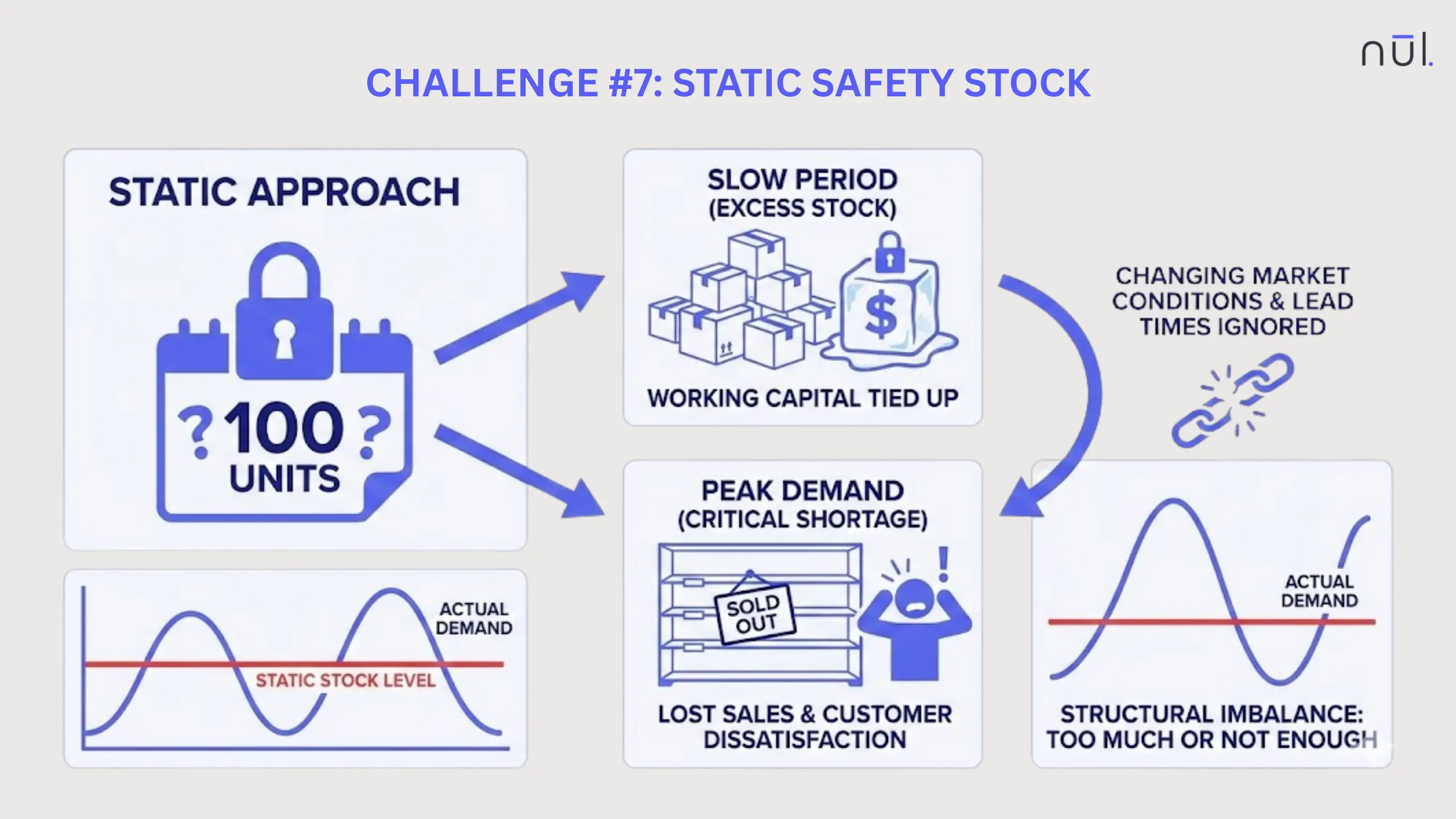

Static Safety Stock

Static safety stock is set once (often based on guesswork) and never updated for changes of external market conditions. It is supposed to protect against uncertainty, but a set-and-forget number ignores the fact that demand patterns and lead times are always changing.

Over time, this creates structural imbalances in stock: too much inventory during slow periods and not enough during peak demand. The result is higher working capital tied up in excess stock, plus critical shortages when items are most needed.

Causes:

Many brands set safety stock levels once and fail to adjust them for seasonality or market volatility.

Standard systems often do not link real-time demand fluctuations directly to safety stock targets.

Without automated rules, safety stock levels are only reviewed after a stockout occurs, rather than proactively adjusted.

Solutions:

|

|---|

Static Safety Stock

Supply Chain Complexity

It's not easy to managing and tracking inventory across a vast network of multiple suppliers, diverse global sourcing regions, and long transportation routes. As businesses scale, the number of "moving parts" increases, making it harder to know when and where stock will arrive.

Globalized networks are fragile, and minor disruptions in one region can affect inventory stability everywhere. Complexity leads to frequent shipping delays and unpredictable arrivals, making it nearly impossible to plan accurate replenishments without manual effort.

Causes:

Managing products that rely on components from various international vendors increases the risk of single-point failures.

Global sourcing often involves months of transit time, during which consumer demand can shift dramatically.

Disparate systems across different geographic regions prevent a unified view of the supply chain.

Solutions:

|

|---|

Supply Chain Complexity

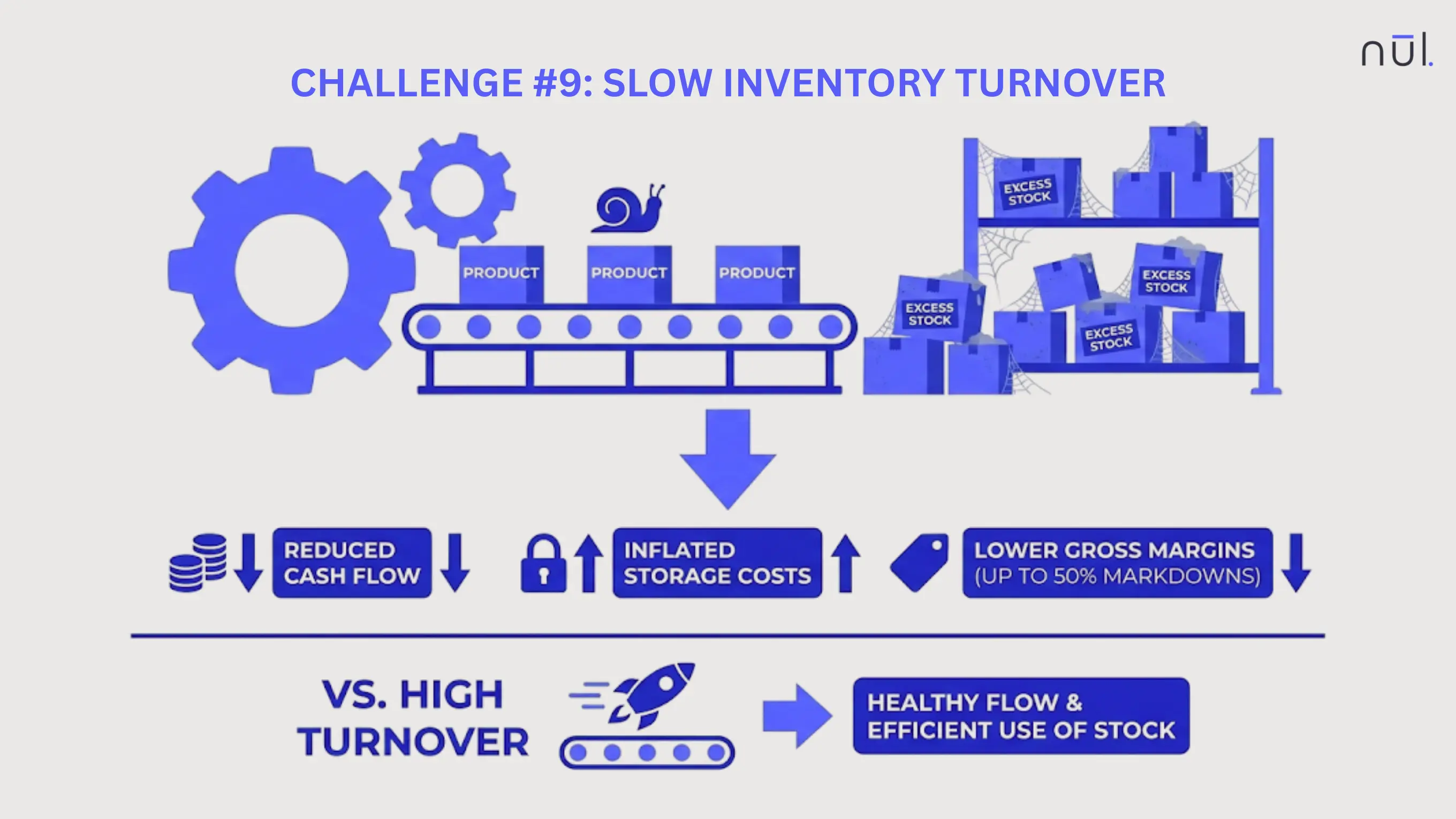

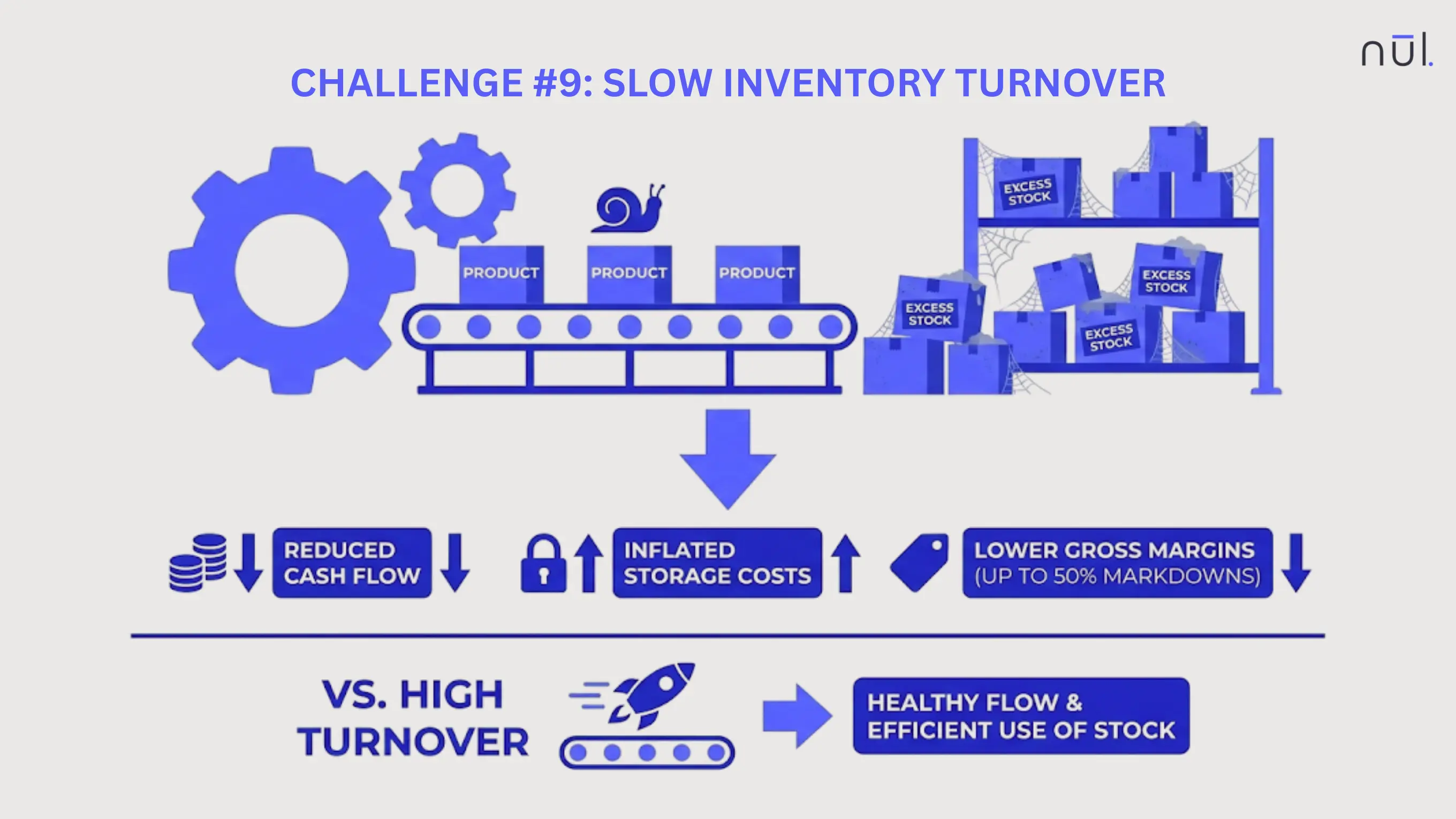

Slow Inventory Turnover

Slow inventory turnover occurs when products remain on the warehouse shelf for too long, indicating that stock is not moving as quickly as it was purchased. This shows a mismatch between procurement strategies and actual market demand.

High turnover is a sign of healthy flow and efficient use of stock. Whereas, slow turnover indicates that a business is mainly paying to store products that customers are not buying. This results in reducing cash flow and inflating storage costs. In some cases, it can reduce gross margins by up to 50% due to eventual markdowns.

Causes:

Buying the wrong mix of products or sizes that do not meet customer preferences.

Failure of marketing or sales efforts to move inventory at the expected velocity.

Purchasing excessive quantities of risky or unproven product categories based on flawed forecasts.

Solutions:

|

|---|

Slow Inventory Turnover

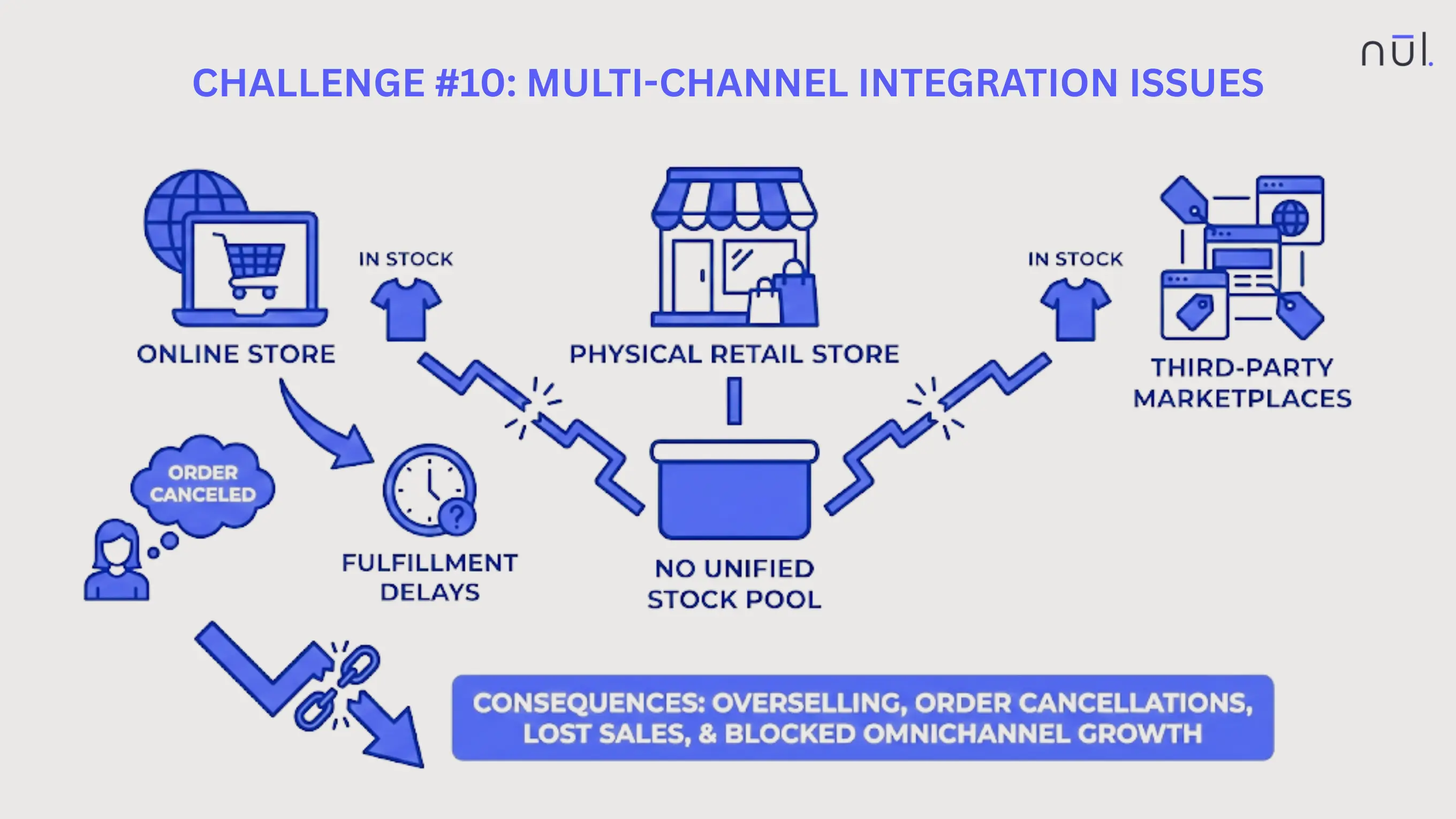

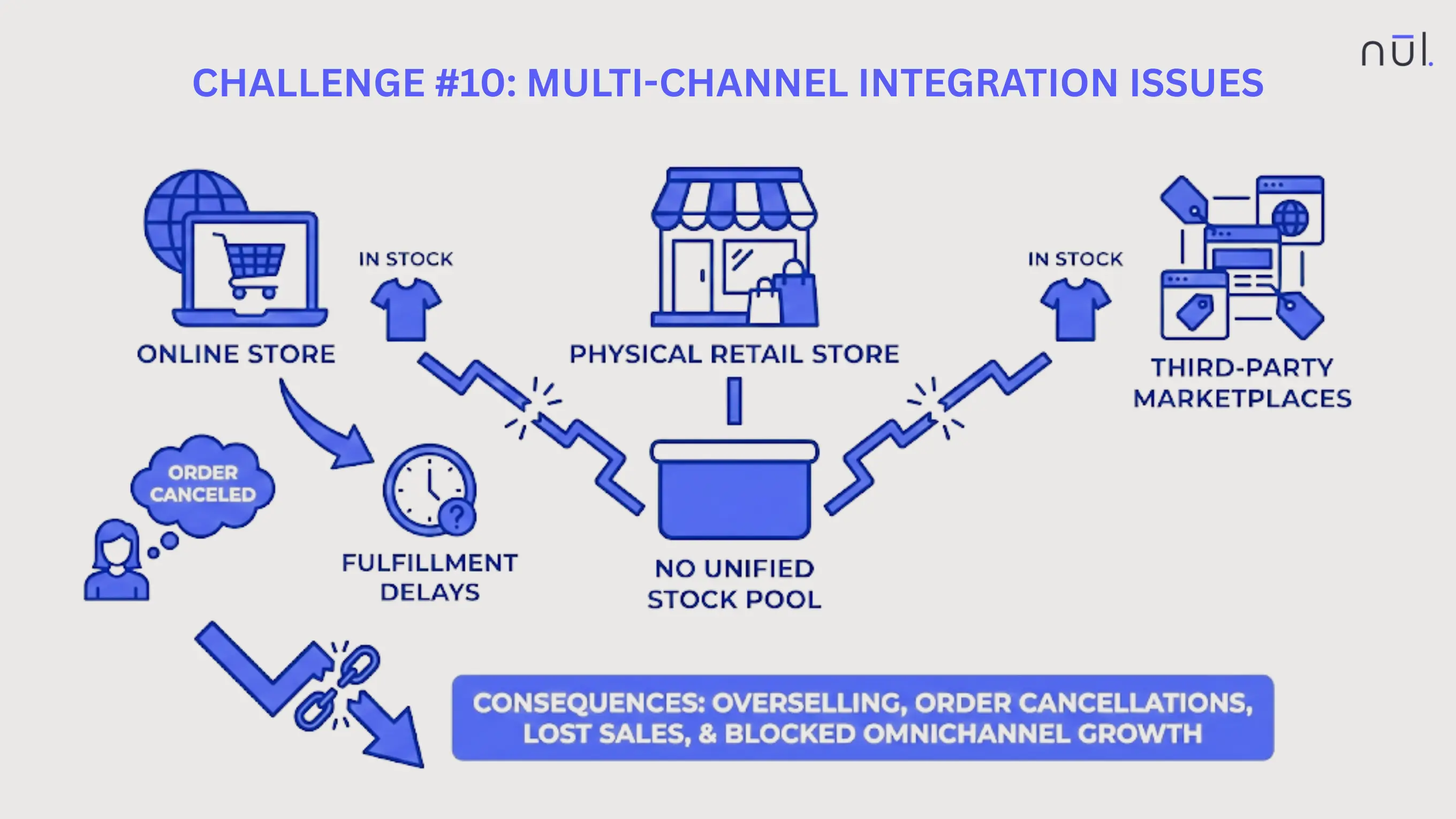

Multi-Channel Integration Issues

This challenge arises when a business sells across various platforms such as an online store, physical retail stores, and third-party marketplaces, but cannot keep inventory data in sync across them. Without a unified stock pool, one channel may report an item as "in stock" while it was actually sold on another channel seconds prior.

This breakdown in data flow makes it impossible to deliver a true “buy anywhere, fulfill anywhere” experience. Disconnected channels lead to overselling, order cancellations, and fulfillment delays, causing lost sales and blocking modern omnichannel growth.

Causes:

Using separate, non-communicating systems for e-commerce, physical POS, and warehouse management.

Relying on systems that only sync inventory counts every few hours instead of in real-time.

Maintaining separate piles of inventory for online versus in-store sales, which prevents efficient stock sharing.

Solutions:

|

|---|

Multi-Channel Integration Issues

Warehouse Inefficiencies

That the physical processes of receiving, storing, and picking inventory are slow, disorganized, or overly manual can prevent fast customer fulfillment. Even if inventory data is accurate, a poorly managed physical space wastes more time to find the needed items. Workers spend more time traveling through the warehouse than actually picking products.

This inefficiency results in slow order processing and high labor costs, while increasing the risk of mis-picks and expensive shipping errors.

Causes:

Storing high-demand items far from the packing station, leading to excessive travel time.

Relying on paper lists or human memory rather than digital barcode scanners for location and item validation.

Using non-optimized routes that force pickers to cross paths or double back through the same aisles multiple times.

Solutions:

|

|---|

Warehouse Inefficiencies

Inventory Shrinkage

Inventory shrinkage is the loss of stock that happens between buying it from the supplier and selling it to the customer. The business has already paid for these items but can never recover the cost through a sale, so every unit lost is a direct hit to profit. Because shrinkage is often only discovered during physical counts, it becomes a “silent killer” of margins.

Shrinkage not only causes lost revenue but also damages stock accuracy, creating misleading data that affects procurement and forecasting decisions. Globally, it is estimated to cost retailers over $112B each year, making it one of the most expensive and under-managed inventory challenges.

Causes:

Both internal employee theft and external shoplifting or warehouse diversion.

Products that are broken during handling or reach their expiration date before being sold.

Misplaced items or mistakes made during initial receiving that create a permanent discrepancy in the system.

Solutions:

|

|---|

Inventory Shrinkage

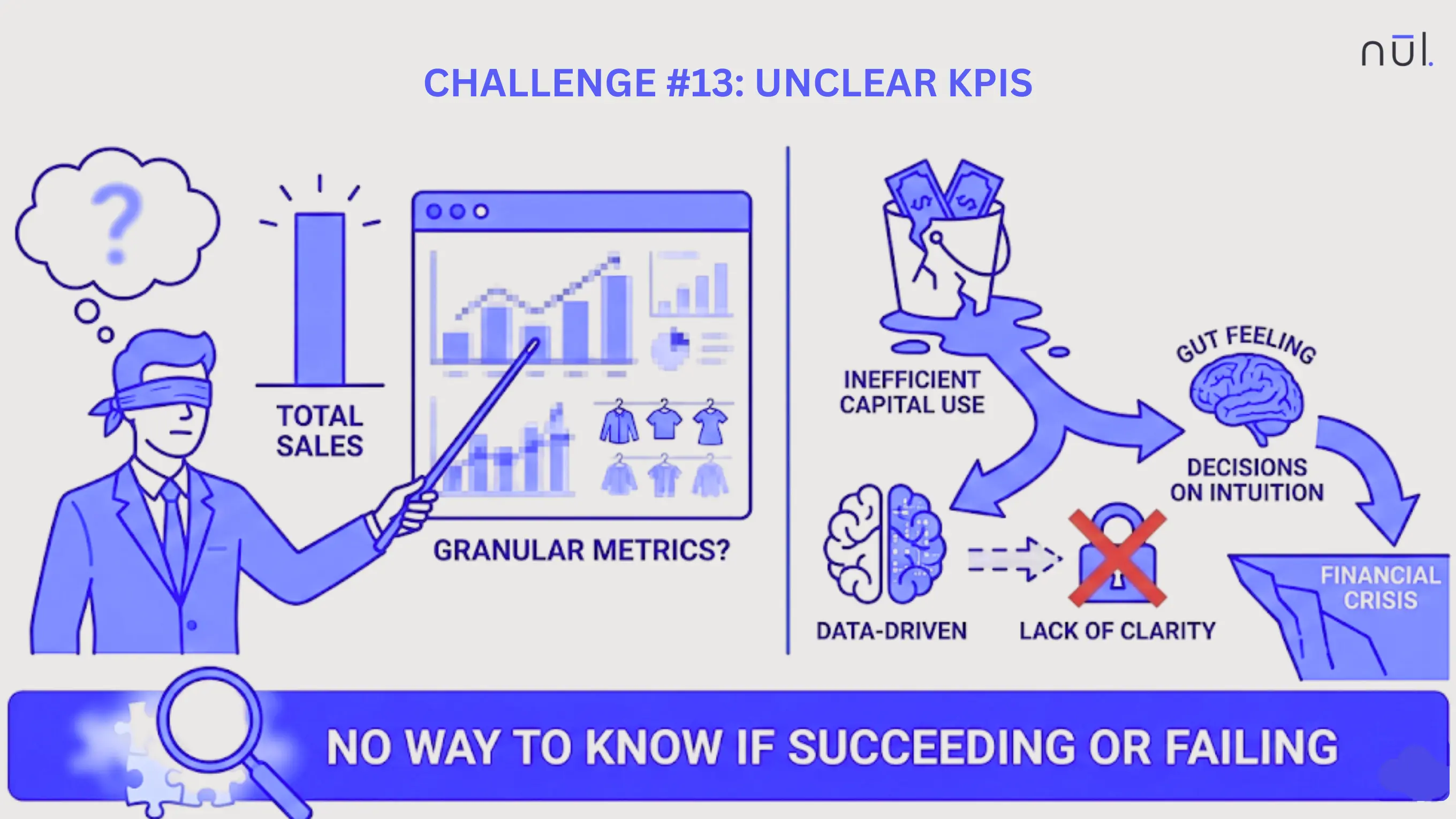

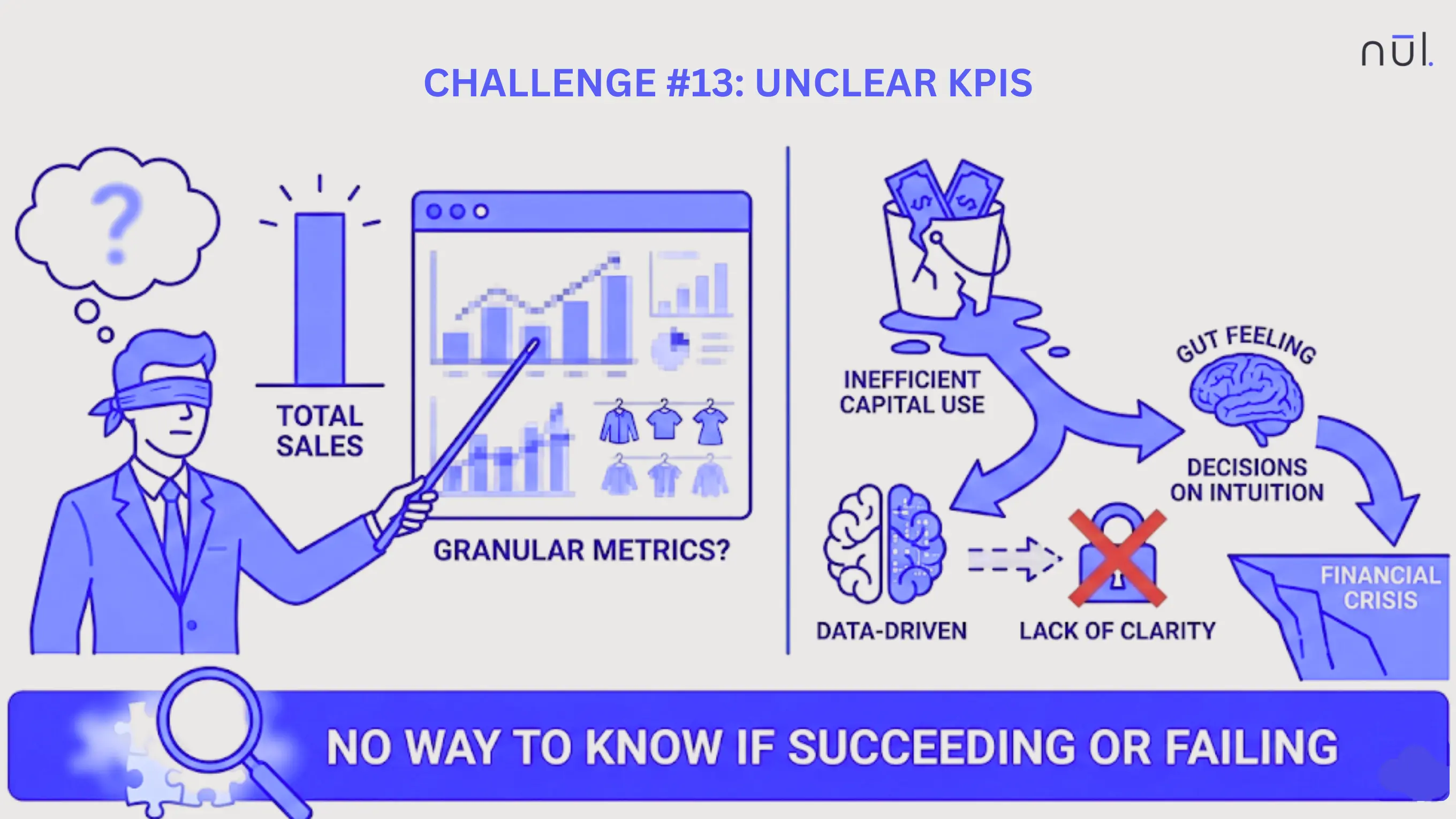

Unclear KPIs

Fashion brands often fail to define, track, or analyze the specific metrics that measure inventory health. Many businesses focus only on high-level "total sales," but without granular inventory metrics. So, they cannot see if their capital is being used efficiently.

Managing inventory without clear KPIs means having no way of knowing if they are succeeding or heading toward a financial crisis. This lack of clarity leads to decisions made based on intuition rather than data without knowing which parts of the business are failing.

Causes:

Collecting vast amounts of information but failing to distill it into actionable, high-level metrics.

Not knowing what "good" performance looks like for their specific product category.

Information needed to calculate KPIs (like cost of goods sold vs. storage costs) is trapped in different, un-synced platforms.

Solutions:

|

|---|

Unclear KPIs

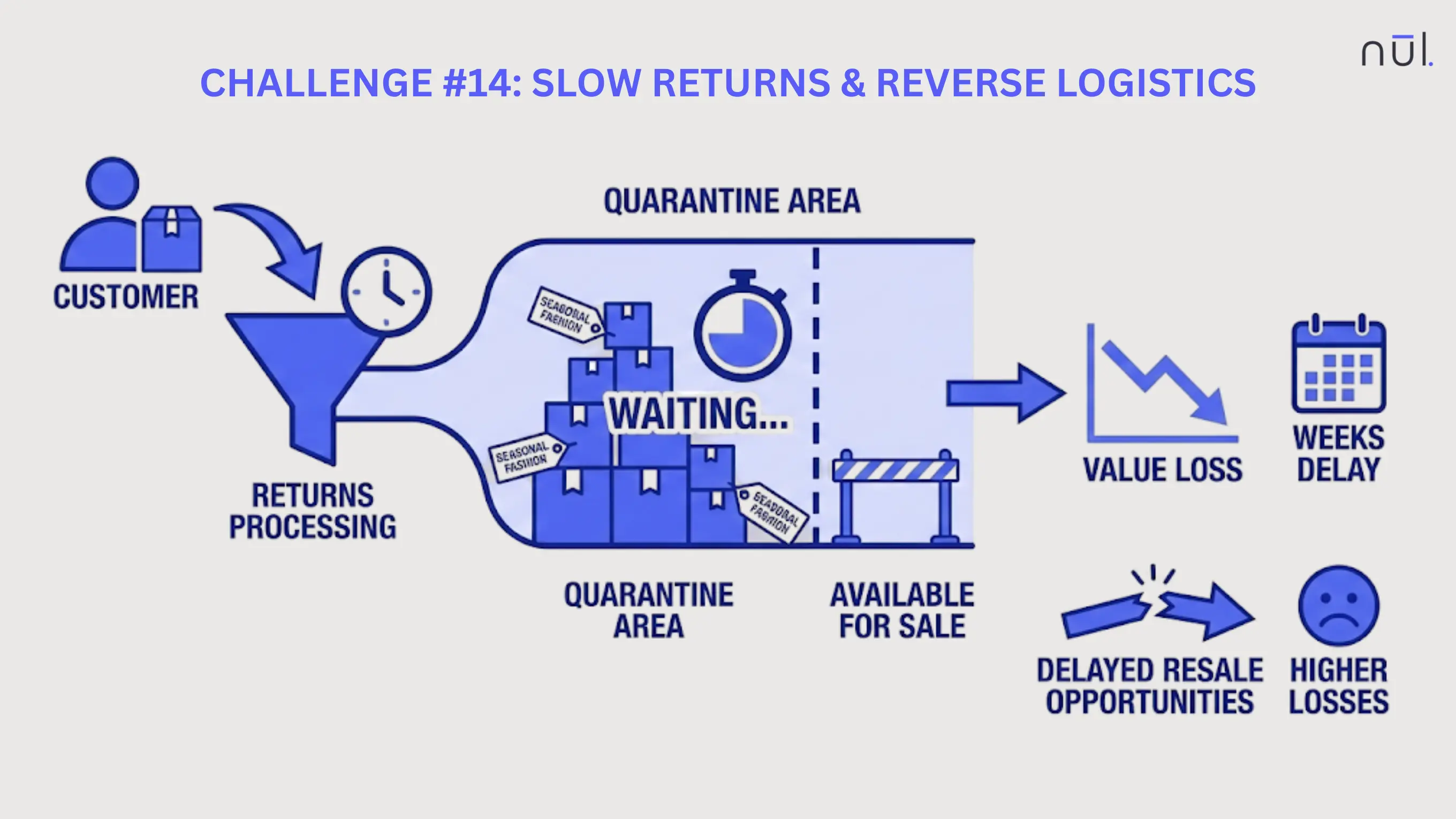

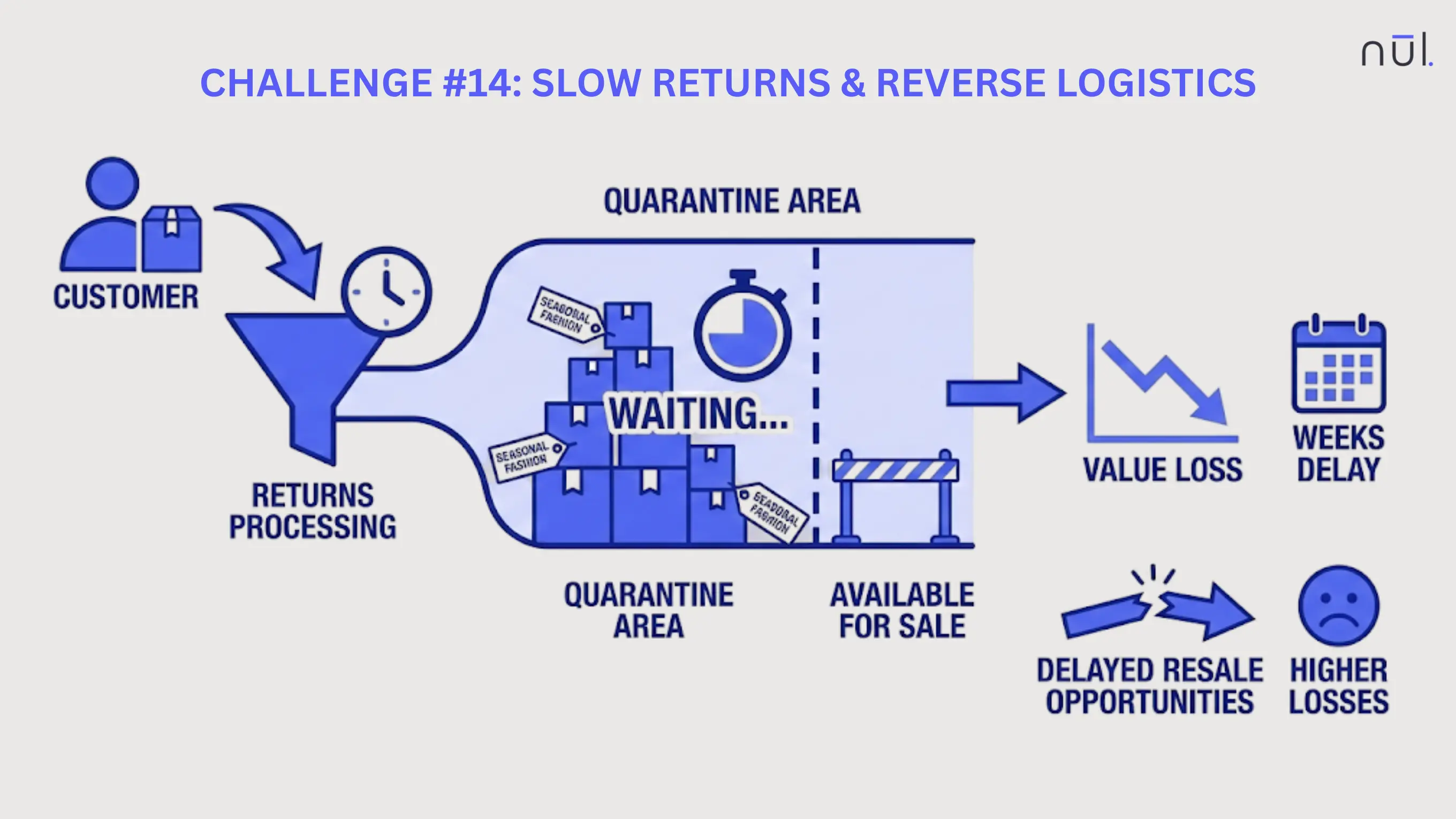

Slow Returns & Reverse Logistics

When customer returns are not processed, inspected, and restocked quickly, valuable stock gets stuck instead of going back on sale. In many businesses, returned items sit in a quarantine area for weeks, then disappearing from the available-for-sale inventory pool.

This is particularly critical for seasonal or high-fashion items, which lose significant value for every day they are not on the shelf. Inefficient reverse logistics ties up inventory in a useless queue, leading to delayed resale opportunities and higher losses on seasonal stock.

Causes:

Relying on paper-based forms and manual data entry to record returned items.

Treating returns as a "secondary" task that only gets handled when the warehouse is quiet.

Having unclear or subjective standards for determining if a returned item is "resaleable" or "damaged."

Impact:

Solutions:

|

|---|

Slow Returns & Reverse Logistics

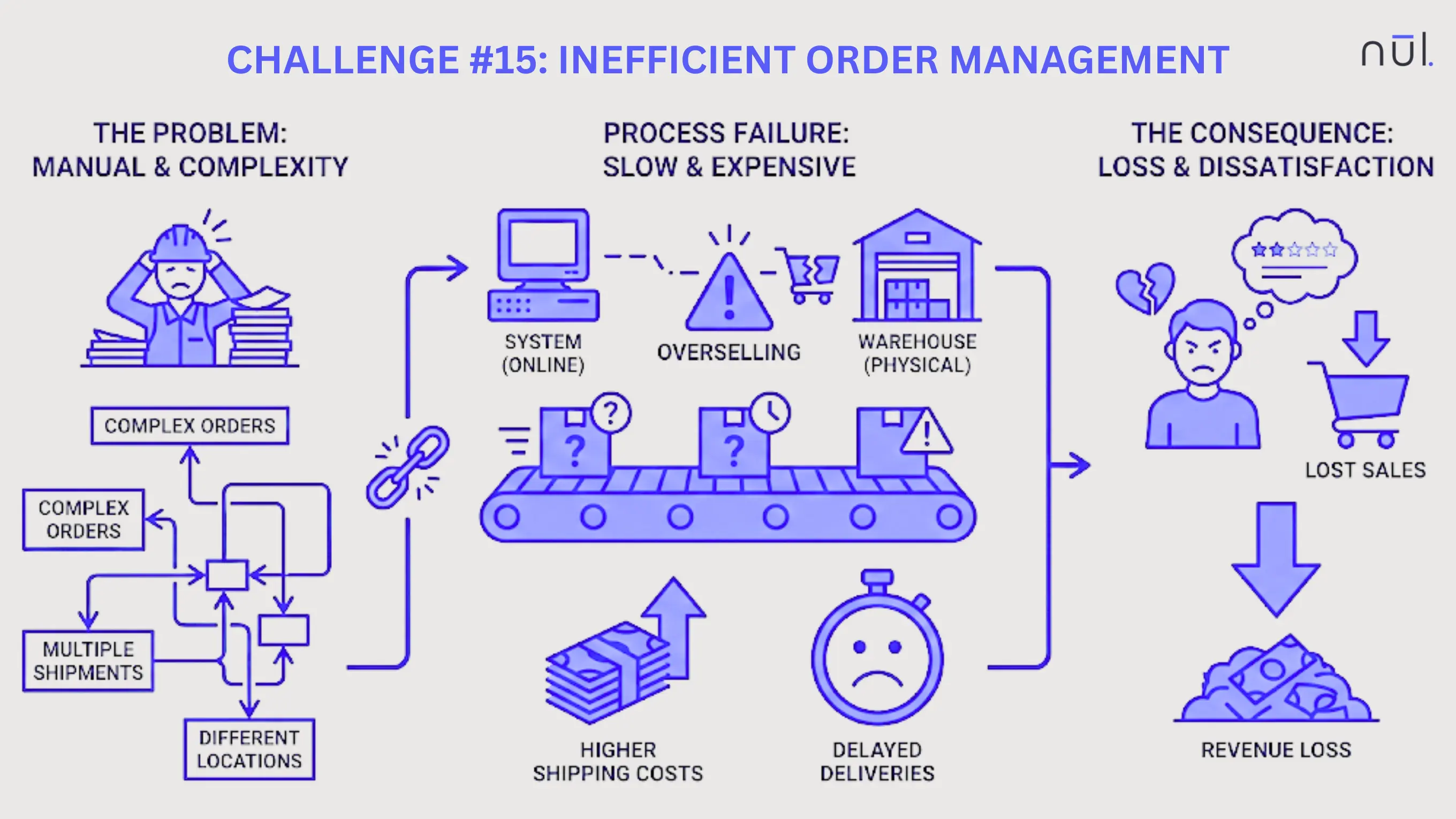

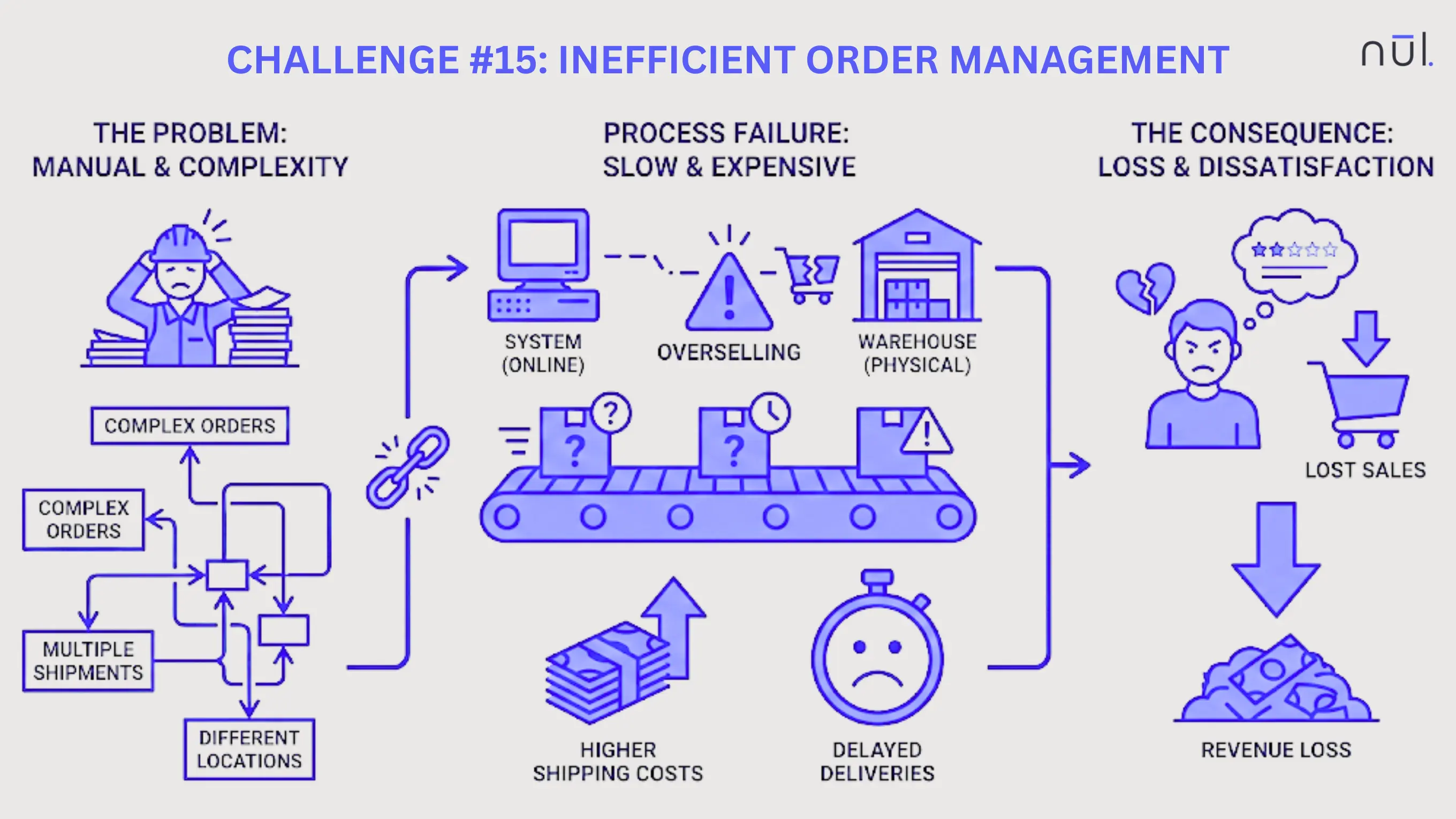

Inefficient Order Management

Inefficient order management means the process of routing, prioritizing, and fulfilling customer orders is manual or non-optimized. When a business lacks intelligent rules for how to handle complex orders such as those requiring multiple shipments or coming from different locations, fulfillment becomes slow and expensive.

This inefficiency often results in the system "overselling" an item because it cannot instantly communicate an order to the physical warehouse. Also, it leads to delayed deliveries and significantly higher shipping costs, causing customer dissatisfaction and lost sales.

Causes:

Staff manually deciding which warehouse should ship which order based on outdated spreadsheets.

Failing to group items together, resulting in multiple expensive shipments to the same customer.

The Order Management System (OMS) and the Inventory Management System (IMS) not sharing data in real-time.

Solutions:

|

|---|

Inefficient Order Management

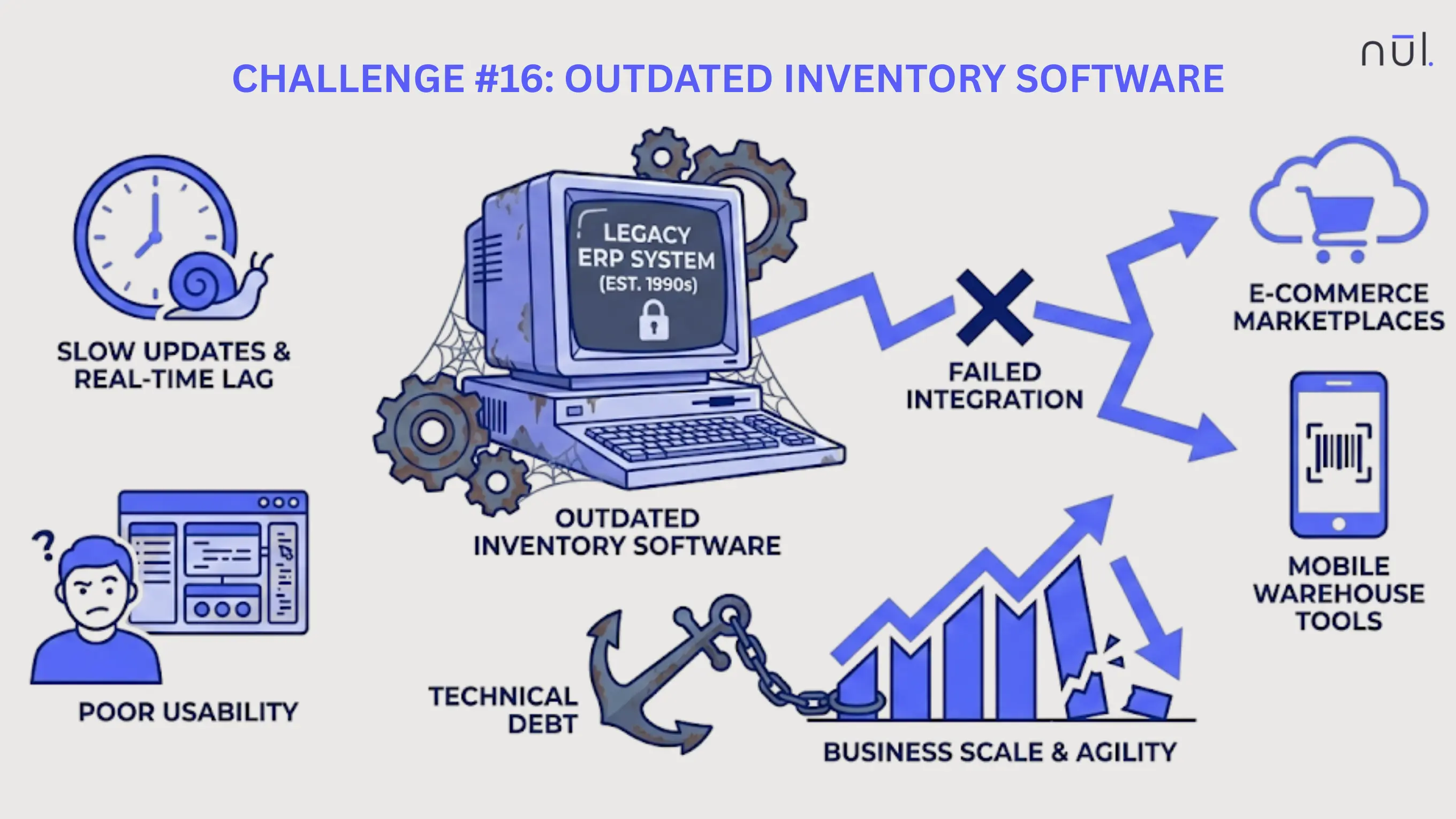

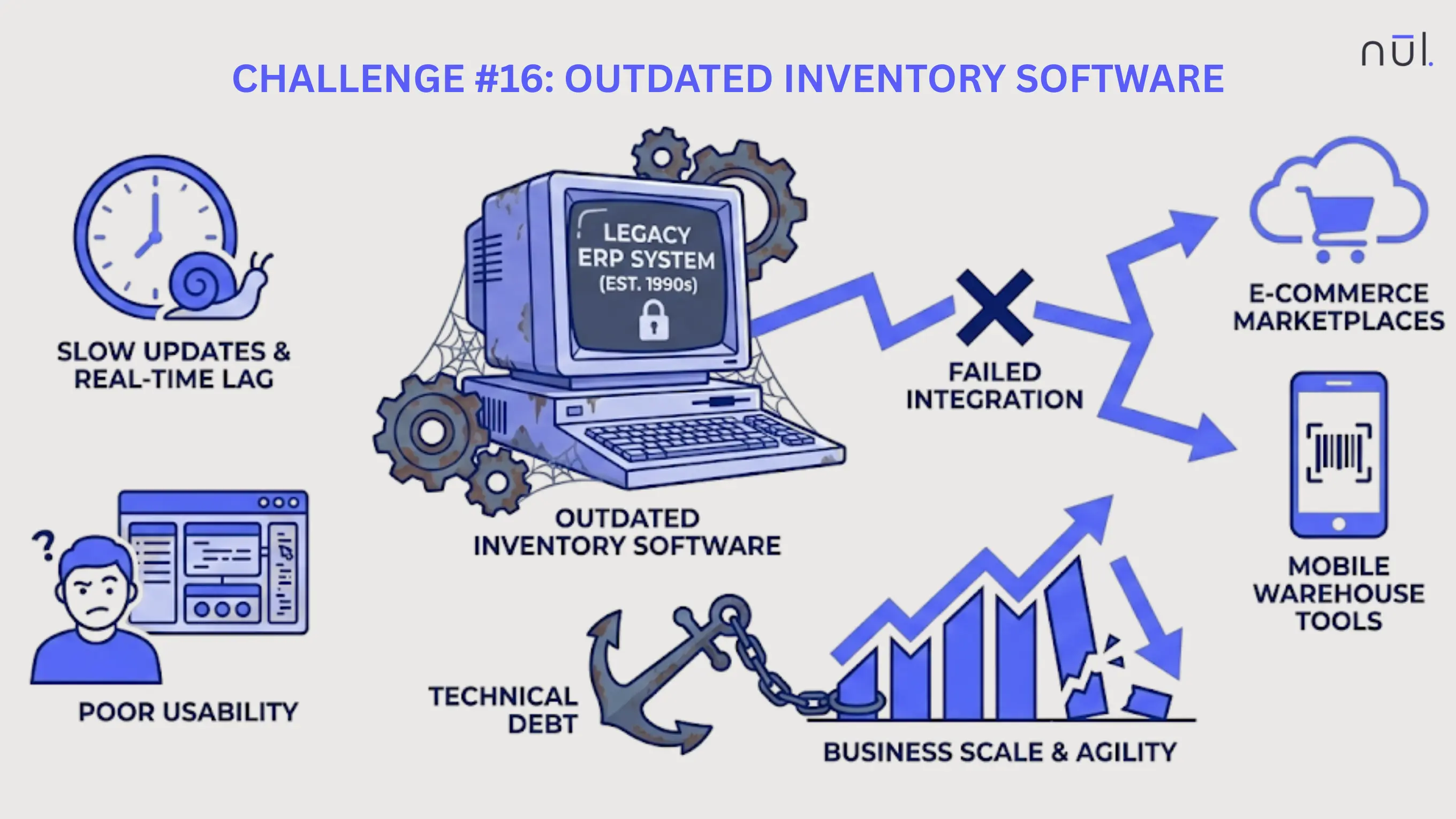

Outdated Inventory Software

Outdated inventory software refers to the continued reliance on legacy ERP or management systems that were built decades ago and lack modern connectivity. These systems often operate on "closed" architectures, making it difficult or impossible to integrate with modern e-commerce marketplaces or mobile warehouse tools.

Relying on outdated tech is a form of technical debt that prevents a business from scaling and reacting to real-time market shifts. Legacy software have poor usability and limited real-time capabilities, causing slow updates that hinder overall business agility.

Causes:

The high perceived upfront cost and organizational effort required to migrate to a new platform.

Failing to recognize that a functioning system can still be a competitive disadvantage if it is too slow or siloed.

Older systems that have been so heavily customized over time that they are now too complex to easily upgrade.

Solutions:

|

|---|

Outdated Inventory Software

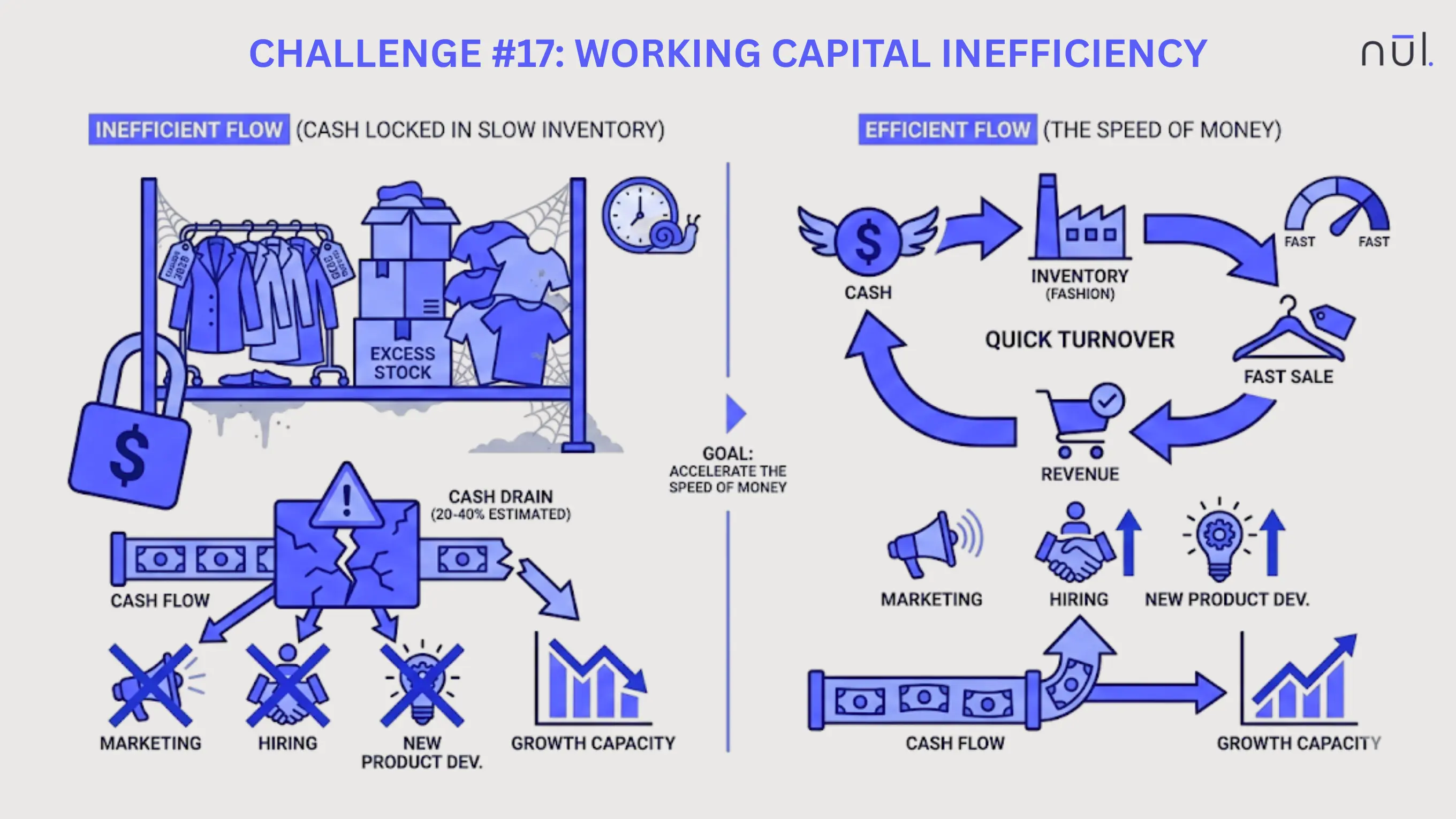

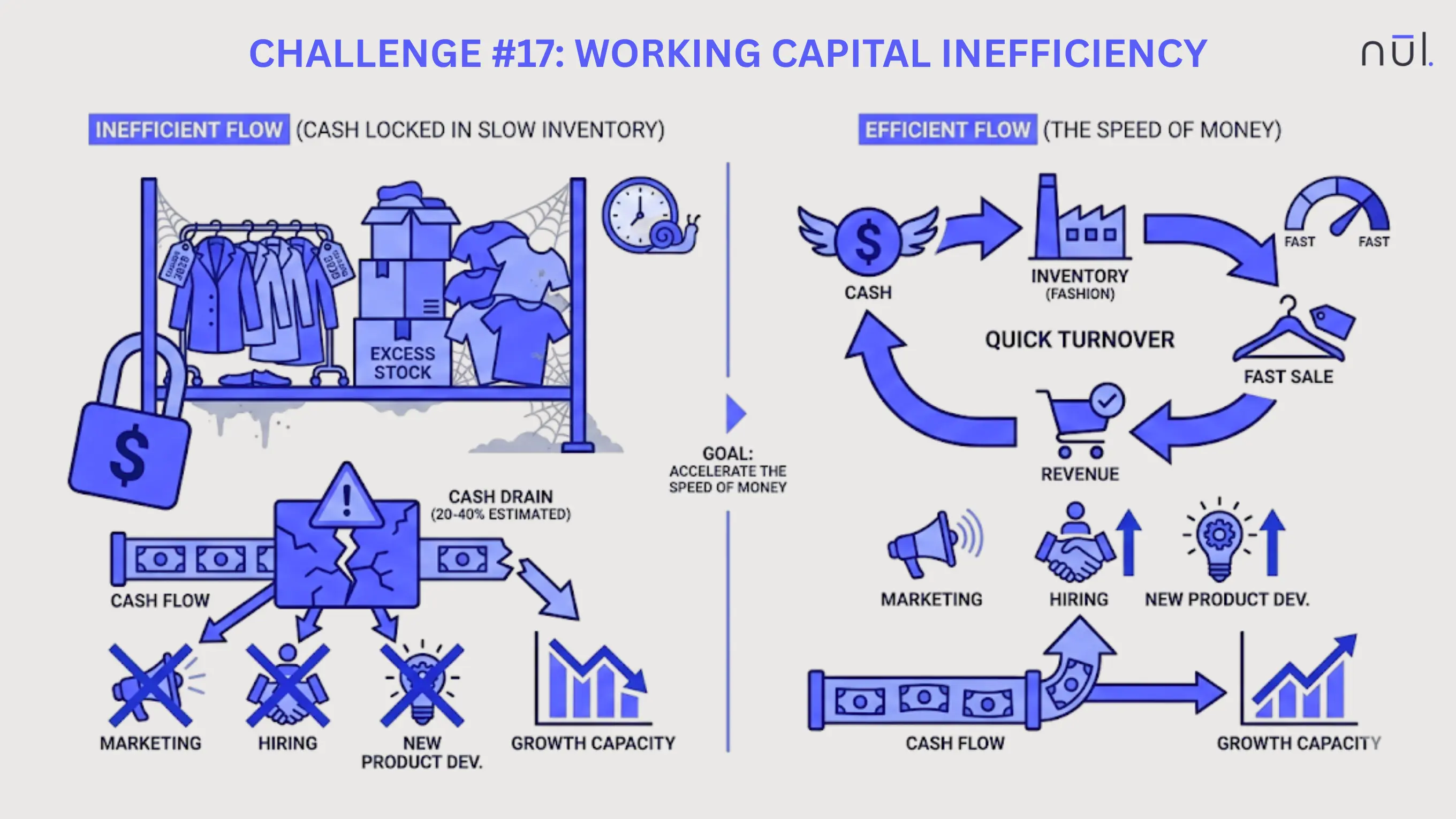

Working Capital Inefficiency

Working capital inefficiency in inventory management can see when too much of a company's cash is locked inside slow-moving or excess products. Cash is the lifeblood of any business, and when it is locked in warehouse shelves, it cannot be used for marketing, hiring, or developing new products.

The real goal is to manage the speed of money: turning cash into inventory and then back into cash as quickly as possible. When inventory moves too slowly, businesses face cash flow shortages and have less capacity to invest in growth. In fashion, for example, poor inventory management can drain an estimated 20–40% of available cash flow into unsold or poorly planned stock.

Causes:

Purchasing excessive stock based on overly optimistic sales forecasts.

Inefficient reverse logistics keeping items out of the saleable pool for too long.

Investing heavily in risky product categories that have low historical sell-through rates.

Solutions:

|

|---|

Working Capital Inefficiency

Supplier Reliability

Supplier reliability refers to the quality of service of your vendors, specifically their ability to deliver the correct items on time and in the right quantity. In a modern supply chain, your inventory accuracy is only as good as the data and shipments you receive from your suppliers.

In fact, many fashion brands struggle with late shipments, partial deliveries, wrong sizes or colors, and poor communication from suppliers, causing failed product launches and stockouts. The results? Brands have to pay for expensive air freight or last-minute production or hold extra safety stock just to protect against supplier failures.

Causes:

Receiving shipments with high defect rates that must be returned or scrapped.

Suppliers failing to notify the business of production delays or shortages until it is too late.

Having no alternative sourcing options when a primary supplier faces a major disruption.

Solutions:

|

|---|

Supplier Reliability

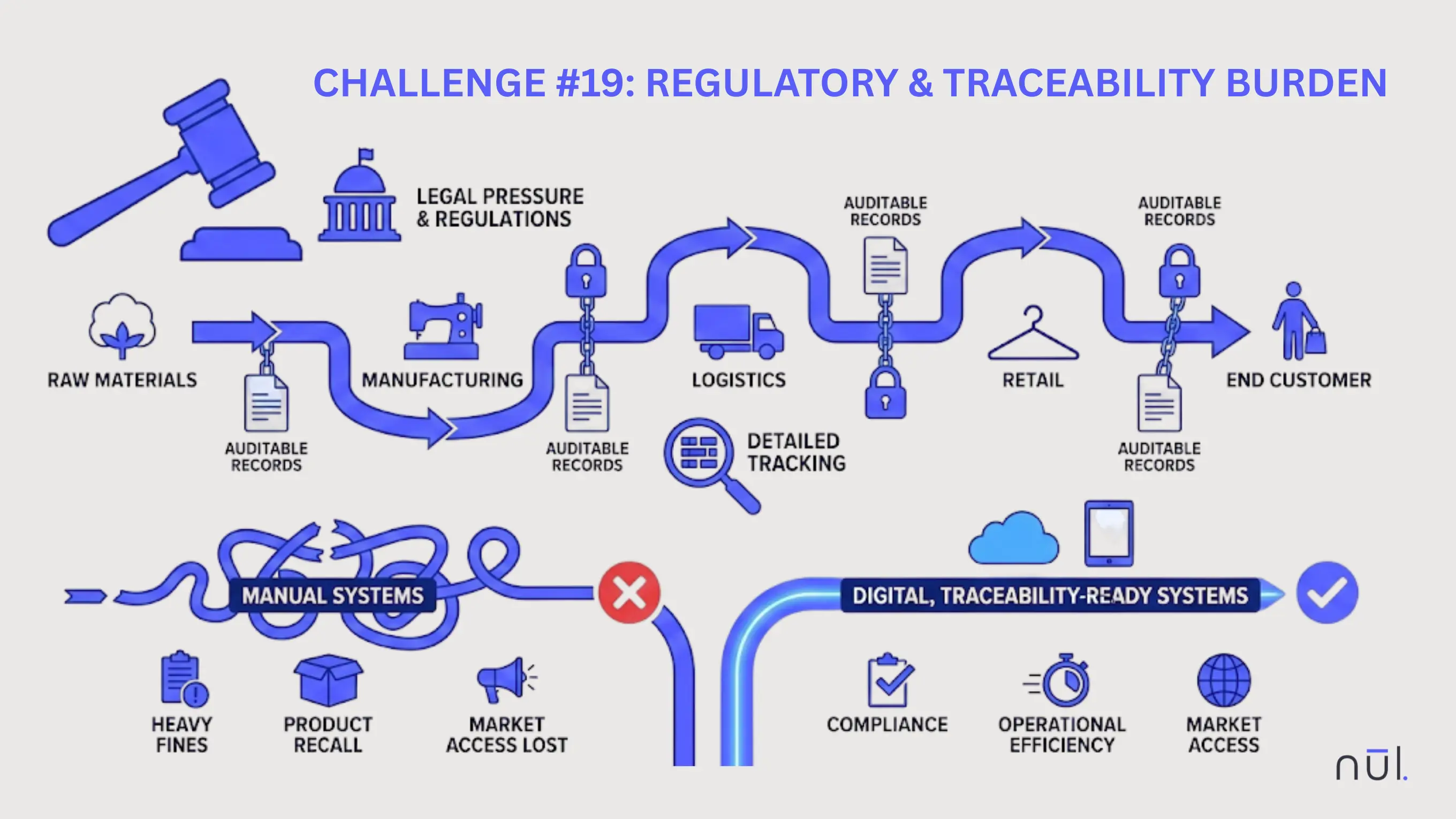

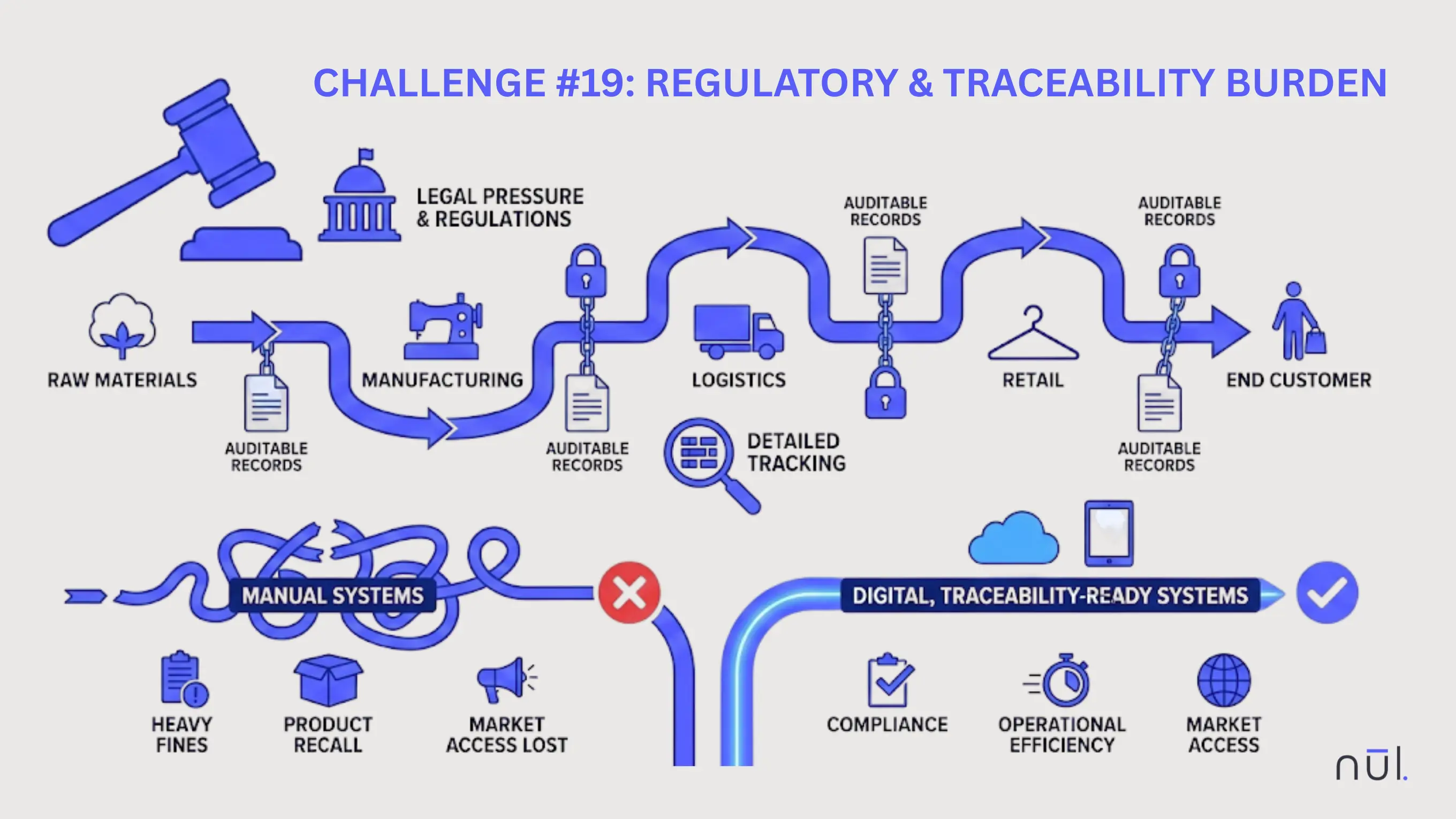

Regulatory & Traceability Burden

Fashion brands now face growing legal pressure to track every step of a product’s journey from raw materials to the end customer. Modern sustainability and safety regulations, especially in responsible apparel, require detailed, auditable records that manual inventory systems simply can’t handle.

Compliance is no longer optional, you know, failure to meet these standards can mean heavy fines, product recalls, or even losing access to key markets. At the same time, these rules need extra documentation and mandatory checks, which can slow down operations if brands don’t upgrade to digital, traceability-ready systems.

Causes:

New laws requiring "Digital Product Passports" to know where materials came from, how items were made, and how they can be recycled or reused.

Fashion brands must prove that raw materials and other inputs are sourced responsibly (no forced labor, safer chemicals, lower environmental impact)

Certain fashion segments (kidswear, footwear with chemical limits, skin-contact fabrics) need fast recall capability if a batch is unsafe.

Solutions:

|

|---|

Regulatory & Traceability Burden

>> You can consider more:

Top 7 Best Batch Production Software for Fashion Brands

How Nūl Helps You Solve Inventory Management Challenges?

Nūl’s agentic AI platform helps fashion brands tackle these challenges through:

✓ Accurate, real-time inventory visibility: Unified dashboards that sync all channels instantly.

✓ AI-driven forecasting & replenishment: Short-term and long-term forecasts updated daily, reducing stockouts & markdowns.

✓ Multi-location intelligence: Helps allocate, rebalance, and replenish across warehouses, stores, and online.

✓ Automated workflows: PO creation, replenishment, aging inventory alerts, and transfer suggestions.

✓ SKU-, store-, and channel-level granularity: No more spreadsheets. Every decision is data-driven.

✓ Explainable AI (XAI): Shows why inventory decisions change like weather, trends, events, velocity shifts.

✓ Integrated operations: Inventory, forecasting, materials, and pricing connected in one operating system.

Conclusion

Inventory management is one of the toughest operational challenges for retail and fashion brands, but it doesn’t need to be a constant struggle. With the right systems, automation, and data-driven decision-making, brands can reduce waste, optimize working capital, improve sell-through, and operate with far greater confidence.

Modern, AI-enabled tools like Nūl help brands transition from reactive inventory firefighting to proactive, intelligent inventory operations.

Article by

Nūl Content Team

An Experienced Research & Knowledge Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile

More From Blog

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

Co-Build With Us

We are so keen to get this right. If the problem statement resonates, please reach out and we’d love to co-build with you so fits right into your existing workflow.

More From Blog

19 Inventory Management Challenges and Their Solutions

Dec 30, 2025

Inaccurate inventory data, poor demand forecasting, limited real-time visibility, fragmented data, manual processes,... are common inventory management challenges.

Inventory is one of the most valuable and difficult to manage assets in retail and fashion. With shorter trend cycles, omnichannel fulfillment, and increasingly complex supply chains, brands face constant pressure to keep the right amount of stock, in the right place, at the right time.

Yet many retailers still struggle with inaccurate data, manual workflows, fragmented systems, and costly inefficiencies that lead to stockouts, overstocks, poor cash flow, and lost sales.

This guide breaks down the 19 biggest inventory management challenges, their real impacts, examples, and the practical solutions your brand can implement today.

Inaccurate Inventory Data

Inaccurate inventory data (or inventory discrepancy) happens when the numbers in your system don’t match what is physically on the shelf. A common case is phantom inventory where the system says an item is in stock, but it cannot be found in warehouse. Retail reports show up to 43% of small businesses don’t track inventory accurately.

When this gap grows, every decision needing stock data like procurement or customer fulfillment becomes less reliable. As a result, overselling, order cancellations, and significant fulfillment delays happen and damage customer trust.

Causes:

Manual Entry Errors: Paper forms and spreadsheet typing cause frequent mistakes and missed adjustments.

Disconnected Systems: POS, e-commerce, and warehouses don’t sync in real time, creating data blind spots.

No Scanning at Touchpoints: Items aren’t scanned at receiving, picking, or shipping, so movements aren’t recorded.

Rare Audits: Only doing one big annual count lets errors accumulate for months.

Mismatched SKUs: Inconsistent product codes and naming across channels confuse both systems and staff.

Solutions:

|

|---|

>> Read more: Perpetual vs Periodic Inventory System: What's the Difference?

Inaccurate Inventory Data

Poor Demand Forecasting

Poor demand forecasting is when a business cannot reliably predict what customers will buy, causing a gap between planned supply and real demand. Forecasting have to answer exactly what will be needed and when. You know, when this goes wrong, the supply chain turns into the reaction mode, creating waste from excess inventory or missed revenue from stockouts.

Inaccurate predictions contribute to over $200B in annual global retail losses due to the dual crisis of holding dead stock for slow sellers and facing stockouts for high-demand items. This is one of the biggest causes for waste in the fashion industry, harming the environment

Causes:

Relying only on last year’s sales or gut feeling without adjusting for promotions, price changes, or channel mix.

Ignoring seasonality, weather, and regional differences that shift demand timing and volume.

Not using external signals such as social media trends, events, or competitor activity.

Forecasting at a high level (category or total store) instead of at SKU × location.

Forecasts updated too rarely, so plans don’t react to new information or fast-moving trends.

A lack of collaborative planning (S&OP) between sales, marketing, and inventory teams leads to disconnected and conflicting forecasts.

Solutions:

|

|---|

>> Explore further:

14 Best Demand Forecasting Methods in Fashion Supply Chain

Poor Demand Forecasting

Limited Real-Time Visibility

Another challenge is that you can't see exact stock levels, statuses, and locations across the entire supply chain in real-time. Without a live view of inventory distributed across multiple warehouses, retail stores, and third-party logistics (3PL) providers, managers are forced to make decisions based on outdated batch updates.

This transparency gap creates blind zones where inventory is physically present but digitally invisible to sales channels. The results are incorrect online availability and late inventory replenishment, which delays omnichannel fulfillment and leads to missed revenue opportunities.

Causes:

Older systems often update stock counts only every few hours or once daily, creating a big gap between physical sales and digital records.

Using separate software for e-commerce, in-store retail, and warehouse management prevents a unified, real-time view of stock.

Transfers, returns, and internal moves are recorded late or offline.

Solutions:

|

|---|

Limited Real-Time Visibility

Fragmented Data

Fragmented data happens when ERP, WMS, CRM, POS, and other core systems sit in separate silos and don’t share information smoothly. There is no clear single source of truth, so different teams see different stock numbers for the same item.

To make sense of it, staff have to manually pull and combine data from multiple tools, which is slow and error-prone. Over time, this leads to wrong ordering decisions, overselling, excess stock that ties up cash, and repeated stockouts that lose sales.

Causes:

Using older, on-premise systems that were not built with modern integration or API capabilities.

Different departments using inconsistent naming conventions, SKU formats, or units of measure for the same products.

Avoiding the upfront cost of a unified suite in favor of cheaper, isolated point solutions that eventually fail to scale.

Solutions:

|

|---|

Fragmented Data

Manual Processes

When your key inventory tasks like replenishment, purchase order creation, and stock adjustments rely on human intervention, it's difficult to scale efficiently and easy to cause errors. In fact, small businesses often handle those tasks with spreadsheets, emails, or paper forms to save investment costs on modern automation systems.

Actually, it's still fine, but once you add more SKUs, locations, and warehouses, everything becomes messy. Manual effort starts to create frequent errors, slower decisions, and inconsistent ordering patterns, which then ripple through the whole supply chain as stockouts, overstock, and constant firefighting.

Causes:

Many small or growing teams manage their entire inventory through Excel or Google Sheets, which require constant manual updates.

Warehouse staff often use printed sheets to find items, which wasting time and increasing errors in recorded stock levels.

Information from sales, returns, and shipments is often "keyed in" by hand, increasing the risk of typos and data discrepancies.

Purchase order creation often involves manual email chains or physical signatures, causing delays in the procurement cycle.

Solutions:

|

|---|

Manual Processes

Obsolete and Aging Inventory

Stock that has reached the end of its functional lifecycle like expired goods, outdated product models, or items with zero remaining market demand can occupy valuable warehouse space and freeze working capital. Some researches suggest that up to 30% of fashion inventory becomes obsolete each year, turning poor inventory control into a major source of waste.

Managing this challenge requires an early-detection system to distinguish between slow-moving items that still possess value and truly obsolete items that should be removed entirely. If aging inventory is left unchecked, holding costs rise, heavy markdowns become unavoidable, and margins shrink.

Causes:

Slow-moving items are often not identified early enough to take corrective action, so they sit in the shelves in the long time.

Lack markdown strategies for low-velocity items, the business thus can't clear stock before it becomes obsolete.

Rely on flawed demand forecasts results in purchasing more units than the market needs.

Fail to implement inventory valuation methods (FIFO, FEFO), so products are buried behind newer shipments.

Solutions:

|

|---|

>> Learn more: What is Inventory Velocity? Formula, Example, & Best Practices

Obsolete and Aging Inventory

Static Safety Stock

Static safety stock is set once (often based on guesswork) and never updated for changes of external market conditions. It is supposed to protect against uncertainty, but a set-and-forget number ignores the fact that demand patterns and lead times are always changing.

Over time, this creates structural imbalances in stock: too much inventory during slow periods and not enough during peak demand. The result is higher working capital tied up in excess stock, plus critical shortages when items are most needed.

Causes:

Many brands set safety stock levels once and fail to adjust them for seasonality or market volatility.

Standard systems often do not link real-time demand fluctuations directly to safety stock targets.

Without automated rules, safety stock levels are only reviewed after a stockout occurs, rather than proactively adjusted.

Solutions:

|

|---|

Static Safety Stock

Supply Chain Complexity

It's not easy to managing and tracking inventory across a vast network of multiple suppliers, diverse global sourcing regions, and long transportation routes. As businesses scale, the number of "moving parts" increases, making it harder to know when and where stock will arrive.

Globalized networks are fragile, and minor disruptions in one region can affect inventory stability everywhere. Complexity leads to frequent shipping delays and unpredictable arrivals, making it nearly impossible to plan accurate replenishments without manual effort.

Causes:

Managing products that rely on components from various international vendors increases the risk of single-point failures.

Global sourcing often involves months of transit time, during which consumer demand can shift dramatically.

Disparate systems across different geographic regions prevent a unified view of the supply chain.

Solutions:

|

|---|

Supply Chain Complexity

Slow Inventory Turnover

Slow inventory turnover occurs when products remain on the warehouse shelf for too long, indicating that stock is not moving as quickly as it was purchased. This shows a mismatch between procurement strategies and actual market demand.

High turnover is a sign of healthy flow and efficient use of stock. Whereas, slow turnover indicates that a business is mainly paying to store products that customers are not buying. This results in reducing cash flow and inflating storage costs. In some cases, it can reduce gross margins by up to 50% due to eventual markdowns.

Causes:

Buying the wrong mix of products or sizes that do not meet customer preferences.

Failure of marketing or sales efforts to move inventory at the expected velocity.

Purchasing excessive quantities of risky or unproven product categories based on flawed forecasts.

Solutions:

|

|---|

Slow Inventory Turnover

Multi-Channel Integration Issues

This challenge arises when a business sells across various platforms such as an online store, physical retail stores, and third-party marketplaces, but cannot keep inventory data in sync across them. Without a unified stock pool, one channel may report an item as "in stock" while it was actually sold on another channel seconds prior.

This breakdown in data flow makes it impossible to deliver a true “buy anywhere, fulfill anywhere” experience. Disconnected channels lead to overselling, order cancellations, and fulfillment delays, causing lost sales and blocking modern omnichannel growth.

Causes:

Using separate, non-communicating systems for e-commerce, physical POS, and warehouse management.

Relying on systems that only sync inventory counts every few hours instead of in real-time.

Maintaining separate piles of inventory for online versus in-store sales, which prevents efficient stock sharing.

Solutions:

|

|---|

Multi-Channel Integration Issues

Warehouse Inefficiencies

That the physical processes of receiving, storing, and picking inventory are slow, disorganized, or overly manual can prevent fast customer fulfillment. Even if inventory data is accurate, a poorly managed physical space wastes more time to find the needed items. Workers spend more time traveling through the warehouse than actually picking products.

This inefficiency results in slow order processing and high labor costs, while increasing the risk of mis-picks and expensive shipping errors.

Causes:

Storing high-demand items far from the packing station, leading to excessive travel time.

Relying on paper lists or human memory rather than digital barcode scanners for location and item validation.

Using non-optimized routes that force pickers to cross paths or double back through the same aisles multiple times.

Solutions:

|

|---|

Warehouse Inefficiencies

Inventory Shrinkage

Inventory shrinkage is the loss of stock that happens between buying it from the supplier and selling it to the customer. The business has already paid for these items but can never recover the cost through a sale, so every unit lost is a direct hit to profit. Because shrinkage is often only discovered during physical counts, it becomes a “silent killer” of margins.

Shrinkage not only causes lost revenue but also damages stock accuracy, creating misleading data that affects procurement and forecasting decisions. Globally, it is estimated to cost retailers over $112B each year, making it one of the most expensive and under-managed inventory challenges.

Causes:

Both internal employee theft and external shoplifting or warehouse diversion.

Products that are broken during handling or reach their expiration date before being sold.

Misplaced items or mistakes made during initial receiving that create a permanent discrepancy in the system.

Solutions:

|

|---|

Inventory Shrinkage

Unclear KPIs

Fashion brands often fail to define, track, or analyze the specific metrics that measure inventory health. Many businesses focus only on high-level "total sales," but without granular inventory metrics. So, they cannot see if their capital is being used efficiently.

Managing inventory without clear KPIs means having no way of knowing if they are succeeding or heading toward a financial crisis. This lack of clarity leads to decisions made based on intuition rather than data without knowing which parts of the business are failing.

Causes:

Collecting vast amounts of information but failing to distill it into actionable, high-level metrics.

Not knowing what "good" performance looks like for their specific product category.

Information needed to calculate KPIs (like cost of goods sold vs. storage costs) is trapped in different, un-synced platforms.

Solutions:

|

|---|

Unclear KPIs

Slow Returns & Reverse Logistics

When customer returns are not processed, inspected, and restocked quickly, valuable stock gets stuck instead of going back on sale. In many businesses, returned items sit in a quarantine area for weeks, then disappearing from the available-for-sale inventory pool.

This is particularly critical for seasonal or high-fashion items, which lose significant value for every day they are not on the shelf. Inefficient reverse logistics ties up inventory in a useless queue, leading to delayed resale opportunities and higher losses on seasonal stock.

Causes:

Relying on paper-based forms and manual data entry to record returned items.

Treating returns as a "secondary" task that only gets handled when the warehouse is quiet.

Having unclear or subjective standards for determining if a returned item is "resaleable" or "damaged."

Impact:

Solutions:

|

|---|

Slow Returns & Reverse Logistics

Inefficient Order Management

Inefficient order management means the process of routing, prioritizing, and fulfilling customer orders is manual or non-optimized. When a business lacks intelligent rules for how to handle complex orders such as those requiring multiple shipments or coming from different locations, fulfillment becomes slow and expensive.

This inefficiency often results in the system "overselling" an item because it cannot instantly communicate an order to the physical warehouse. Also, it leads to delayed deliveries and significantly higher shipping costs, causing customer dissatisfaction and lost sales.

Causes:

Staff manually deciding which warehouse should ship which order based on outdated spreadsheets.

Failing to group items together, resulting in multiple expensive shipments to the same customer.

The Order Management System (OMS) and the Inventory Management System (IMS) not sharing data in real-time.

Solutions:

|

|---|

Inefficient Order Management

Outdated Inventory Software

Outdated inventory software refers to the continued reliance on legacy ERP or management systems that were built decades ago and lack modern connectivity. These systems often operate on "closed" architectures, making it difficult or impossible to integrate with modern e-commerce marketplaces or mobile warehouse tools.

Relying on outdated tech is a form of technical debt that prevents a business from scaling and reacting to real-time market shifts. Legacy software have poor usability and limited real-time capabilities, causing slow updates that hinder overall business agility.

Causes:

The high perceived upfront cost and organizational effort required to migrate to a new platform.

Failing to recognize that a functioning system can still be a competitive disadvantage if it is too slow or siloed.

Older systems that have been so heavily customized over time that they are now too complex to easily upgrade.

Solutions:

|

|---|

Outdated Inventory Software

Working Capital Inefficiency

Working capital inefficiency in inventory management can see when too much of a company's cash is locked inside slow-moving or excess products. Cash is the lifeblood of any business, and when it is locked in warehouse shelves, it cannot be used for marketing, hiring, or developing new products.

The real goal is to manage the speed of money: turning cash into inventory and then back into cash as quickly as possible. When inventory moves too slowly, businesses face cash flow shortages and have less capacity to invest in growth. In fashion, for example, poor inventory management can drain an estimated 20–40% of available cash flow into unsold or poorly planned stock.

Causes:

Purchasing excessive stock based on overly optimistic sales forecasts.

Inefficient reverse logistics keeping items out of the saleable pool for too long.

Investing heavily in risky product categories that have low historical sell-through rates.

Solutions:

|

|---|

Working Capital Inefficiency

Supplier Reliability

Supplier reliability refers to the quality of service of your vendors, specifically their ability to deliver the correct items on time and in the right quantity. In a modern supply chain, your inventory accuracy is only as good as the data and shipments you receive from your suppliers.

In fact, many fashion brands struggle with late shipments, partial deliveries, wrong sizes or colors, and poor communication from suppliers, causing failed product launches and stockouts. The results? Brands have to pay for expensive air freight or last-minute production or hold extra safety stock just to protect against supplier failures.

Causes:

Receiving shipments with high defect rates that must be returned or scrapped.

Suppliers failing to notify the business of production delays or shortages until it is too late.

Having no alternative sourcing options when a primary supplier faces a major disruption.

Solutions:

|

|---|

Supplier Reliability

Regulatory & Traceability Burden

Fashion brands now face growing legal pressure to track every step of a product’s journey from raw materials to the end customer. Modern sustainability and safety regulations, especially in responsible apparel, require detailed, auditable records that manual inventory systems simply can’t handle.

Compliance is no longer optional, you know, failure to meet these standards can mean heavy fines, product recalls, or even losing access to key markets. At the same time, these rules need extra documentation and mandatory checks, which can slow down operations if brands don’t upgrade to digital, traceability-ready systems.

Causes:

New laws requiring "Digital Product Passports" to know where materials came from, how items were made, and how they can be recycled or reused.

Fashion brands must prove that raw materials and other inputs are sourced responsibly (no forced labor, safer chemicals, lower environmental impact)

Certain fashion segments (kidswear, footwear with chemical limits, skin-contact fabrics) need fast recall capability if a batch is unsafe.

Solutions:

|

|---|

Regulatory & Traceability Burden

>> You can consider more:

Top 7 Best Batch Production Software for Fashion Brands

How Nūl Helps You Solve Inventory Management Challenges?

Nūl’s agentic AI platform helps fashion brands tackle these challenges through:

✓ Accurate, real-time inventory visibility: Unified dashboards that sync all channels instantly.

✓ AI-driven forecasting & replenishment: Short-term and long-term forecasts updated daily, reducing stockouts & markdowns.

✓ Multi-location intelligence: Helps allocate, rebalance, and replenish across warehouses, stores, and online.

✓ Automated workflows: PO creation, replenishment, aging inventory alerts, and transfer suggestions.

✓ SKU-, store-, and channel-level granularity: No more spreadsheets. Every decision is data-driven.

✓ Explainable AI (XAI): Shows why inventory decisions change like weather, trends, events, velocity shifts.

✓ Integrated operations: Inventory, forecasting, materials, and pricing connected in one operating system.

Conclusion

Inventory management is one of the toughest operational challenges for retail and fashion brands, but it doesn’t need to be a constant struggle. With the right systems, automation, and data-driven decision-making, brands can reduce waste, optimize working capital, improve sell-through, and operate with far greater confidence.

Modern, AI-enabled tools like Nūl help brands transition from reactive inventory firefighting to proactive, intelligent inventory operations.

Article by

Nūl Content Team

An Experienced Research & Knowledge Team

An Experienced Research & Knowledge Team

The Nūl Content Team combines expertise in technology, fashion, and supply chain management to deliver clear, practical insights. Guided by Nūl’s mission to end overproduction, we create content that helps brands forecast demand more accurately, optimize inventory, and build sustainable operations. Every piece we publish is grounded in real-world experience, ensuring it’s both credible and actionable.

LinkedIn Profile